-

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Volatility Position Risk Management with Cynthia Kase

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

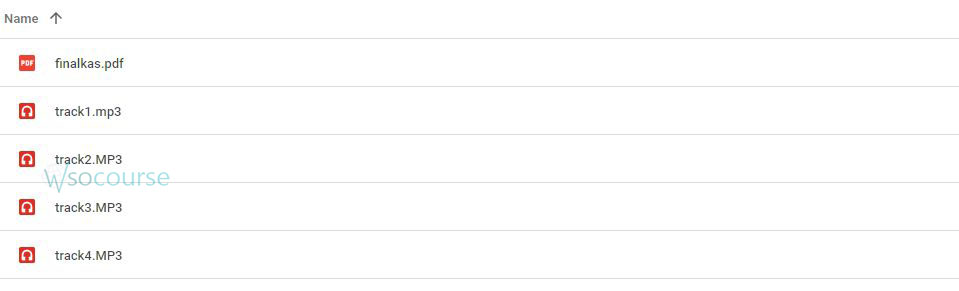

Content Proof: Watch Here!

You may check content proof of “Volatility Position Risk Management with Cynthia Kase” below:

Volatility Position Risk Management by Cynthia Kase

Navigating the volatile waters of financial markets requires robust risk management strategies. Cynthia Kase, a renowned expert in trading and technical analysis, has developed comprehensive approaches to volatility position risk management. This article delves into her methodologies, offering insights and actionable strategies for traders and investors to mitigate risks effectively.

Introduction

Who is Cynthia Kase?

Cynthia Kase is a highly respected trader and technical analyst known for her expertise in market volatility and risk management. Her innovative techniques and tools have been widely adopted by traders seeking to improve their market performance.

Why Focus on Volatility Position Risk Management?

Volatility can significantly impact trading outcomes. Proper risk management strategies are essential to protect investments and ensure long-term profitability, especially in unpredictable market conditions.

Understanding Market Volatility

What is Market Volatility?

Market volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means significant price movements, while low volatility indicates stable prices.

Types of Volatility

Historical Volatility

Historical volatility measures past market fluctuations over a specific period. It provides insights into how much the price of a security has varied historically.

Implied Volatility

Implied volatility is derived from the market price of a financial instrument, reflecting the market’s expectations of future volatility.

Key Concepts in Volatility Risk Management

Risk Assessment

Volatility Indexes

Indexes like the VIX (Volatility Index) provide a measure of market risk and investor sentiment, helping traders gauge market conditions.

Standard Deviation

Standard deviation quantifies the amount of variation in a set of data points, indicating the volatility of an asset.

Position Sizing

Why Position Sizing Matters

Position sizing involves determining the number of units to trade based on account size and risk tolerance. It helps manage potential losses and maintain portfolio stability.

Methods of Position Sizing

- Fixed Fractional Method: Risk a fixed percentage of your account on each trade.

- Volatility-Based Position Sizing: Adjust position size based on the asset’s volatility, trading smaller positions in more volatile markets.

Cynthia Kase’s Volatility Risk Management Strategies

Kase StatWare Indicators

Kase DevStops

Kase DevStops use standard deviations to set dynamic stop-loss levels, adjusting to market volatility and protecting against significant losses.

Kase PeakOscillator

This oscillator helps identify market turning points and gauge the strength of price movements, providing valuable insights for risk management.

Kase Permission Stochastic

How it Works

Kase Permission Stochastic filters out false signals in volatile markets, ensuring trades are only taken in favorable conditions.

Benefits

This tool helps maintain discipline by preventing trades during unfavorable market conditions, reducing the risk of losses.

Implementing Volatility Risk Management

Setting Stop-Loss and Take-Profit Levels

Dynamic Stop-Loss Orders

Use dynamic stop-loss orders that adjust based on market volatility, providing better protection against adverse price movements.

Take-Profit Strategies

Set take-profit levels based on realistic targets and market conditions, locking in profits while minimizing risk.

Diversification

Importance of Diversification

Diversification spreads risk across various assets, reducing the impact of volatility on the overall portfolio.

How to Diversify

Invest in a mix of asset classes, sectors, and geographies to balance risk and potential returns.

Hedging Strategies

Using Options

Options can hedge against potential losses in volatile markets, providing insurance for your positions.

Inverse ETFs

Inverse ETFs gain value when the underlying asset declines, offering protection during market downturns.

Monitoring and Adjusting Your Strategy

Regular Performance Reviews

Monthly and Quarterly Reviews

Conduct regular reviews of your trading performance to identify strengths and weaknesses, allowing for continuous improvement.

Adjusting Strategies

Adapt your risk management strategies based on market conditions and performance reviews to stay aligned with your financial goals.

Staying Informed

Market News and Analysis

Stay updated with market news and analysis to anticipate volatility and adjust your strategies accordingly.

Continuous Learning

Invest in ongoing education to enhance your understanding of volatility and risk management techniques.

Conclusion

Why Cynthia Kase’s Strategies Matter

Cynthia Kase’s volatility position risk management strategies offer a robust framework for navigating the complexities of the financial markets. By incorporating her tools and methodologies, traders can effectively manage risk, protect their investments, and achieve long-term success.

FAQs

1. What is market volatility?

Market volatility refers to the rate at which the price of a security increases or decreases, indicating the level of price fluctuations.

2. How does Cynthia Kase’s Kase StatWare help in risk management?

Kase StatWare includes indicators like Kase DevStops and Kase PeakOscillator, which provide dynamic stop-loss levels and identify market turning points, aiding in risk management.

3. Why is position sizing important in volatility risk management?

Position sizing helps manage potential losses and maintain portfolio stability by determining the number of units to trade based on account size and risk tolerance.

4. How can diversification reduce risk?

Diversification spreads risk across various assets, sectors, and geographies, reducing the impact of volatility on the overall portfolio.

5. What are dynamic stop-loss orders?

Dynamic stop-loss orders adjust based on market volatility, providing better protection against adverse price movements compared to static stop-loss orders.

Be the first to review “Volatility Position Risk Management with Cynthia Kase” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.