-

×

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Complete Course (Lectures 1-6) - Selling Options for Profits with Rodrigo Santano - Top Trader Academy

1 × $23.00

Complete Course (Lectures 1-6) - Selling Options for Profits with Rodrigo Santano - Top Trader Academy

1 × $23.00 -

×

Breakout Trading Systems with Chris Tate

1 × $6.00

Breakout Trading Systems with Chris Tate

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Dan Sheridan Volatility Class

1 × $6.00

Dan Sheridan Volatility Class

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00 -

×

Math for the Trades with LearningExpress

1 × $6.00

Math for the Trades with LearningExpress

1 × $6.00 -

×

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00 -

×

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

The WallStreet Waltz with Ken Fisher

1 × $6.00

The WallStreet Waltz with Ken Fisher

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00

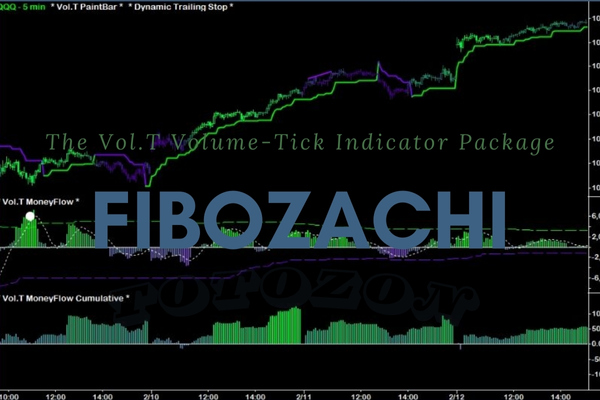

The Vol.T Volume-Tick Indicator Package

$999.00 Original price was: $999.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Unlocking Market Potential with the Vol.T Volume-Tick Indicator Package

Introduction: Why the Vol.T Matters in Trading

In today’s fast-paced trading environment, having the right tools can mean the difference between success and failure. One such essential tool is the Vol.T Volume-Tick Indicator Package. This innovative trading tool provides traders with unique insights into market dynamics, allowing for more informed decision-making.

Understanding the Vol.T Indicator

What is the Vol.T Indicator?

The Vol.T Volume-Tick Indicator is a specialized tool designed to analyze market volume and tick movements in real-time. By blending these two critical data points, the indicator offers traders a deeper understanding of market liquidity and price action.

How Does the Vol.T Indicator Work?

- Volume Analysis: Measures the total number of shares or contracts traded.

- Tick Analysis: Counts the number of price changes within a trading session.

- Combined Insight: Provides a composite view of market sentiment and potential price movements.

Benefits of Using the Vol.T Indicator

Enhanced Market Insight

With the Vol.T Indicator, traders gain an unparalleled view of the undercurrents of market activity, often hidden from standard analysis tools.

Improved Trading Decisions

By understanding volume and tick fluctuations, traders can better predict short-term price movements and adjust their strategies accordingly.

Real-Time Data Utilization

The Vol.T operates in real-time, giving traders up-to-the-minute information to capitalize on market movements swiftly.

Integrating the Vol.T into Your Trading Strategy

Step-by-Step Integration

- Installation: Set up the Vol.T Indicator on your trading platform.

- Configuration: Adjust the settings to match your trading style and preferences.

- Analysis: Regularly review the data provided to understand market trends.

Tips for Maximizing Effectiveness

- Combine with Other Indicators: Use the Vol.T in conjunction with other analytical tools for a well-rounded trading approach.

- Continuous Learning: Stay updated on new features and best practices for using the Vol.T.

Real-Life Success Stories

Traders across the globe have reported enhanced decision-making capabilities and improved trading outcomes by incorporating the Vol.T into their strategies.

Who Should Use the Vol.T?

Ideal Users of the Vol.T

- Day Traders: Benefit from real-time data to make quick, informed decisions.

- Long-Term Investors: Use aggregated data for deeper market understanding.

- Forex Traders: Apply tick analysis to the highly liquid forex market.

The Future of Trading with the Vol.T

As markets evolve, tools like the Vol.T will become increasingly indispensable for traders aiming to maintain a competitive edge.

Conclusion: Your Trading Edge with Vol.T

Embracing the Vol.T Volume-Tick Indicator can significantly enhance your trading strategy, providing you with the insights needed to navigate the complexities of modern markets confidently.

FAQs

1. How quickly can I see results with the Vol.T?

Results can be observed as soon as you start applying the insights from the Vol.T in your trading activities.

2. Is the Vol.T suitable for beginners?

Yes, it’s designed to be user-friendly for both beginners and experienced traders.

3. Can the Vol.T be used for all types of markets?

Absolutely! Whether it’s stocks, forex, or commodities, the Vol.T is versatile.

4. What makes the Vol.T different from other market indicators?

It uniquely combines volume and tick data, offering a more comprehensive market analysis.

5. How do I get started with the Vol.T?

You can typically download it directly from your trading platform and integrate it with a few simple steps.

Be the first to review “The Vol.T Volume-Tick Indicator Package” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.