-

×

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Complete Trading System with Segma Singh

1 × $6.00

Complete Trading System with Segma Singh

1 × $6.00 -

×

Lepus Proprietary Trading with Richard Jackson

1 × $6.00

Lepus Proprietary Trading with Richard Jackson

1 × $6.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Forex Trader Package 2010

1 × $15.00

Forex Trader Package 2010

1 × $15.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

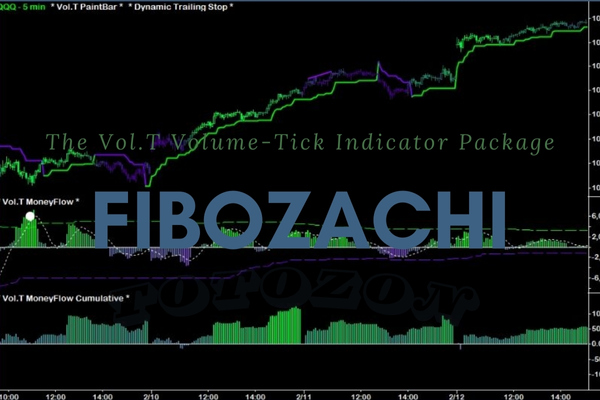

The Vol.T Volume-Tick Indicator Package

$999.00 Original price was: $999.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Unlocking Market Potential with the Vol.T Volume-Tick Indicator Package

Introduction: Why the Vol.T Matters in Trading

In today’s fast-paced trading environment, having the right tools can mean the difference between success and failure. One such essential tool is the Vol.T Volume-Tick Indicator Package. This innovative trading tool provides traders with unique insights into market dynamics, allowing for more informed decision-making.

Understanding the Vol.T Indicator

What is the Vol.T Indicator?

The Vol.T Volume-Tick Indicator is a specialized tool designed to analyze market volume and tick movements in real-time. By blending these two critical data points, the indicator offers traders a deeper understanding of market liquidity and price action.

How Does the Vol.T Indicator Work?

- Volume Analysis: Measures the total number of shares or contracts traded.

- Tick Analysis: Counts the number of price changes within a trading session.

- Combined Insight: Provides a composite view of market sentiment and potential price movements.

Benefits of Using the Vol.T Indicator

Enhanced Market Insight

With the Vol.T Indicator, traders gain an unparalleled view of the undercurrents of market activity, often hidden from standard analysis tools.

Improved Trading Decisions

By understanding volume and tick fluctuations, traders can better predict short-term price movements and adjust their strategies accordingly.

Real-Time Data Utilization

The Vol.T operates in real-time, giving traders up-to-the-minute information to capitalize on market movements swiftly.

Integrating the Vol.T into Your Trading Strategy

Step-by-Step Integration

- Installation: Set up the Vol.T Indicator on your trading platform.

- Configuration: Adjust the settings to match your trading style and preferences.

- Analysis: Regularly review the data provided to understand market trends.

Tips for Maximizing Effectiveness

- Combine with Other Indicators: Use the Vol.T in conjunction with other analytical tools for a well-rounded trading approach.

- Continuous Learning: Stay updated on new features and best practices for using the Vol.T.

Real-Life Success Stories

Traders across the globe have reported enhanced decision-making capabilities and improved trading outcomes by incorporating the Vol.T into their strategies.

Who Should Use the Vol.T?

Ideal Users of the Vol.T

- Day Traders: Benefit from real-time data to make quick, informed decisions.

- Long-Term Investors: Use aggregated data for deeper market understanding.

- Forex Traders: Apply tick analysis to the highly liquid forex market.

The Future of Trading with the Vol.T

As markets evolve, tools like the Vol.T will become increasingly indispensable for traders aiming to maintain a competitive edge.

Conclusion: Your Trading Edge with Vol.T

Embracing the Vol.T Volume-Tick Indicator can significantly enhance your trading strategy, providing you with the insights needed to navigate the complexities of modern markets confidently.

FAQs

1. How quickly can I see results with the Vol.T?

Results can be observed as soon as you start applying the insights from the Vol.T in your trading activities.

2. Is the Vol.T suitable for beginners?

Yes, it’s designed to be user-friendly for both beginners and experienced traders.

3. Can the Vol.T be used for all types of markets?

Absolutely! Whether it’s stocks, forex, or commodities, the Vol.T is versatile.

4. What makes the Vol.T different from other market indicators?

It uniquely combines volume and tick data, offering a more comprehensive market analysis.

5. How do I get started with the Vol.T?

You can typically download it directly from your trading platform and integrate it with a few simple steps.

Be the first to review “The Vol.T Volume-Tick Indicator Package” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.