-

×

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

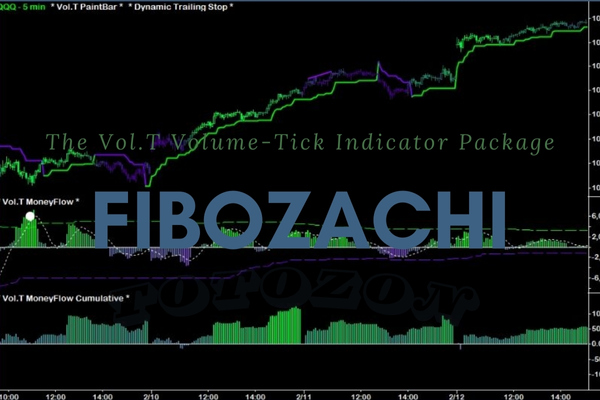

The Vol.T Volume-Tick Indicator Package

$999.00 Original price was: $999.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Unlocking Market Potential with the Vol.T Volume-Tick Indicator Package

Introduction: Why the Vol.T Matters in Trading

In today’s fast-paced trading environment, having the right tools can mean the difference between success and failure. One such essential tool is the Vol.T Volume-Tick Indicator Package. This innovative trading tool provides traders with unique insights into market dynamics, allowing for more informed decision-making.

Understanding the Vol.T Indicator

What is the Vol.T Indicator?

The Vol.T Volume-Tick Indicator is a specialized tool designed to analyze market volume and tick movements in real-time. By blending these two critical data points, the indicator offers traders a deeper understanding of market liquidity and price action.

How Does the Vol.T Indicator Work?

- Volume Analysis: Measures the total number of shares or contracts traded.

- Tick Analysis: Counts the number of price changes within a trading session.

- Combined Insight: Provides a composite view of market sentiment and potential price movements.

Benefits of Using the Vol.T Indicator

Enhanced Market Insight

With the Vol.T Indicator, traders gain an unparalleled view of the undercurrents of market activity, often hidden from standard analysis tools.

Improved Trading Decisions

By understanding volume and tick fluctuations, traders can better predict short-term price movements and adjust their strategies accordingly.

Real-Time Data Utilization

The Vol.T operates in real-time, giving traders up-to-the-minute information to capitalize on market movements swiftly.

Integrating the Vol.T into Your Trading Strategy

Step-by-Step Integration

- Installation: Set up the Vol.T Indicator on your trading platform.

- Configuration: Adjust the settings to match your trading style and preferences.

- Analysis: Regularly review the data provided to understand market trends.

Tips for Maximizing Effectiveness

- Combine with Other Indicators: Use the Vol.T in conjunction with other analytical tools for a well-rounded trading approach.

- Continuous Learning: Stay updated on new features and best practices for using the Vol.T.

Real-Life Success Stories

Traders across the globe have reported enhanced decision-making capabilities and improved trading outcomes by incorporating the Vol.T into their strategies.

Who Should Use the Vol.T?

Ideal Users of the Vol.T

- Day Traders: Benefit from real-time data to make quick, informed decisions.

- Long-Term Investors: Use aggregated data for deeper market understanding.

- Forex Traders: Apply tick analysis to the highly liquid forex market.

The Future of Trading with the Vol.T

As markets evolve, tools like the Vol.T will become increasingly indispensable for traders aiming to maintain a competitive edge.

Conclusion: Your Trading Edge with Vol.T

Embracing the Vol.T Volume-Tick Indicator can significantly enhance your trading strategy, providing you with the insights needed to navigate the complexities of modern markets confidently.

FAQs

1. How quickly can I see results with the Vol.T?

Results can be observed as soon as you start applying the insights from the Vol.T in your trading activities.

2. Is the Vol.T suitable for beginners?

Yes, it’s designed to be user-friendly for both beginners and experienced traders.

3. Can the Vol.T be used for all types of markets?

Absolutely! Whether it’s stocks, forex, or commodities, the Vol.T is versatile.

4. What makes the Vol.T different from other market indicators?

It uniquely combines volume and tick data, offering a more comprehensive market analysis.

5. How do I get started with the Vol.T?

You can typically download it directly from your trading platform and integrate it with a few simple steps.

Be the first to review “The Vol.T Volume-Tick Indicator Package” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.