-

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

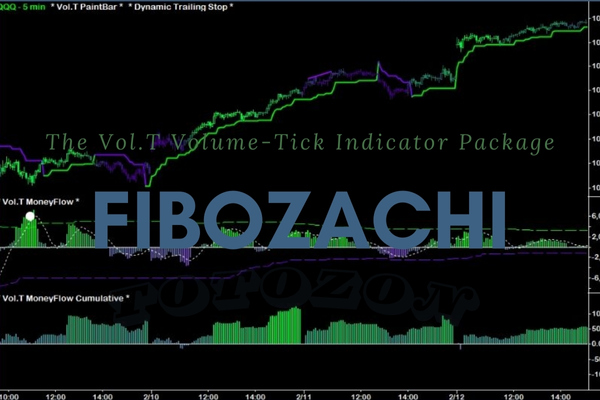

The Vol.T Volume-Tick Indicator Package

$999.00 Original price was: $999.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Unlocking Market Potential with the Vol.T Volume-Tick Indicator Package

Introduction: Why the Vol.T Matters in Trading

In today’s fast-paced trading environment, having the right tools can mean the difference between success and failure. One such essential tool is the Vol.T Volume-Tick Indicator Package. This innovative trading tool provides traders with unique insights into market dynamics, allowing for more informed decision-making.

Understanding the Vol.T Indicator

What is the Vol.T Indicator?

The Vol.T Volume-Tick Indicator is a specialized tool designed to analyze market volume and tick movements in real-time. By blending these two critical data points, the indicator offers traders a deeper understanding of market liquidity and price action.

How Does the Vol.T Indicator Work?

- Volume Analysis: Measures the total number of shares or contracts traded.

- Tick Analysis: Counts the number of price changes within a trading session.

- Combined Insight: Provides a composite view of market sentiment and potential price movements.

Benefits of Using the Vol.T Indicator

Enhanced Market Insight

With the Vol.T Indicator, traders gain an unparalleled view of the undercurrents of market activity, often hidden from standard analysis tools.

Improved Trading Decisions

By understanding volume and tick fluctuations, traders can better predict short-term price movements and adjust their strategies accordingly.

Real-Time Data Utilization

The Vol.T operates in real-time, giving traders up-to-the-minute information to capitalize on market movements swiftly.

Integrating the Vol.T into Your Trading Strategy

Step-by-Step Integration

- Installation: Set up the Vol.T Indicator on your trading platform.

- Configuration: Adjust the settings to match your trading style and preferences.

- Analysis: Regularly review the data provided to understand market trends.

Tips for Maximizing Effectiveness

- Combine with Other Indicators: Use the Vol.T in conjunction with other analytical tools for a well-rounded trading approach.

- Continuous Learning: Stay updated on new features and best practices for using the Vol.T.

Real-Life Success Stories

Traders across the globe have reported enhanced decision-making capabilities and improved trading outcomes by incorporating the Vol.T into their strategies.

Who Should Use the Vol.T?

Ideal Users of the Vol.T

- Day Traders: Benefit from real-time data to make quick, informed decisions.

- Long-Term Investors: Use aggregated data for deeper market understanding.

- Forex Traders: Apply tick analysis to the highly liquid forex market.

The Future of Trading with the Vol.T

As markets evolve, tools like the Vol.T will become increasingly indispensable for traders aiming to maintain a competitive edge.

Conclusion: Your Trading Edge with Vol.T

Embracing the Vol.T Volume-Tick Indicator can significantly enhance your trading strategy, providing you with the insights needed to navigate the complexities of modern markets confidently.

FAQs

1. How quickly can I see results with the Vol.T?

Results can be observed as soon as you start applying the insights from the Vol.T in your trading activities.

2. Is the Vol.T suitable for beginners?

Yes, it’s designed to be user-friendly for both beginners and experienced traders.

3. Can the Vol.T be used for all types of markets?

Absolutely! Whether it’s stocks, forex, or commodities, the Vol.T is versatile.

4. What makes the Vol.T different from other market indicators?

It uniquely combines volume and tick data, offering a more comprehensive market analysis.

5. How do I get started with the Vol.T?

You can typically download it directly from your trading platform and integrate it with a few simple steps.

Be the first to review “The Vol.T Volume-Tick Indicator Package” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.