-

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Raghee’s Winners Circle Course

1 × $6.00

Raghee’s Winners Circle Course

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Lifetime Membership

1 × $840.00

Lifetime Membership

1 × $840.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Latent Curve Models with Kenneth Bollen

1 × $6.00

Latent Curve Models with Kenneth Bollen

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Stock Market 101 with Sabrina Peterson

1 × $4.00

Stock Market 101 with Sabrina Peterson

1 × $4.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

Create A Forex Trading Cash Money Machine

1 × $54.00

Create A Forex Trading Cash Money Machine

1 × $54.00 -

×

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Technical Analysis Package with Martin Pring

1 × $4.00

Technical Analysis Package with Martin Pring

1 × $4.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Crypto and Blockchain with MasterClass

1 × $6.00

Crypto and Blockchain with MasterClass

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Scalp Trading Mini Course with Jayson Casper

1 × $23.00

Scalp Trading Mini Course with Jayson Casper

1 × $23.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

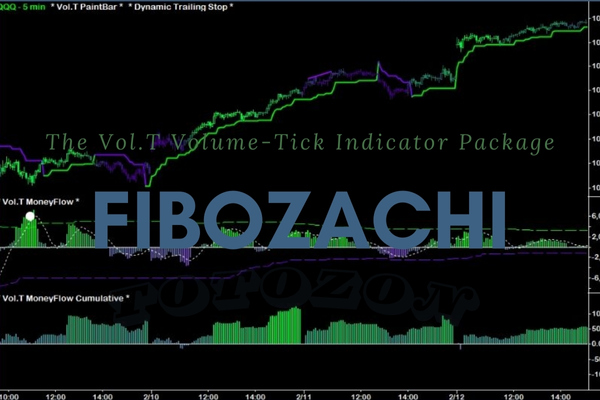

The Vol.T Volume-Tick Indicator Package

$999.00 Original price was: $999.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Unlocking Market Potential with the Vol.T Volume-Tick Indicator Package

Introduction: Why the Vol.T Matters in Trading

In today’s fast-paced trading environment, having the right tools can mean the difference between success and failure. One such essential tool is the Vol.T Volume-Tick Indicator Package. This innovative trading tool provides traders with unique insights into market dynamics, allowing for more informed decision-making.

Understanding the Vol.T Indicator

What is the Vol.T Indicator?

The Vol.T Volume-Tick Indicator is a specialized tool designed to analyze market volume and tick movements in real-time. By blending these two critical data points, the indicator offers traders a deeper understanding of market liquidity and price action.

How Does the Vol.T Indicator Work?

- Volume Analysis: Measures the total number of shares or contracts traded.

- Tick Analysis: Counts the number of price changes within a trading session.

- Combined Insight: Provides a composite view of market sentiment and potential price movements.

Benefits of Using the Vol.T Indicator

Enhanced Market Insight

With the Vol.T Indicator, traders gain an unparalleled view of the undercurrents of market activity, often hidden from standard analysis tools.

Improved Trading Decisions

By understanding volume and tick fluctuations, traders can better predict short-term price movements and adjust their strategies accordingly.

Real-Time Data Utilization

The Vol.T operates in real-time, giving traders up-to-the-minute information to capitalize on market movements swiftly.

Integrating the Vol.T into Your Trading Strategy

Step-by-Step Integration

- Installation: Set up the Vol.T Indicator on your trading platform.

- Configuration: Adjust the settings to match your trading style and preferences.

- Analysis: Regularly review the data provided to understand market trends.

Tips for Maximizing Effectiveness

- Combine with Other Indicators: Use the Vol.T in conjunction with other analytical tools for a well-rounded trading approach.

- Continuous Learning: Stay updated on new features and best practices for using the Vol.T.

Real-Life Success Stories

Traders across the globe have reported enhanced decision-making capabilities and improved trading outcomes by incorporating the Vol.T into their strategies.

Who Should Use the Vol.T?

Ideal Users of the Vol.T

- Day Traders: Benefit from real-time data to make quick, informed decisions.

- Long-Term Investors: Use aggregated data for deeper market understanding.

- Forex Traders: Apply tick analysis to the highly liquid forex market.

The Future of Trading with the Vol.T

As markets evolve, tools like the Vol.T will become increasingly indispensable for traders aiming to maintain a competitive edge.

Conclusion: Your Trading Edge with Vol.T

Embracing the Vol.T Volume-Tick Indicator can significantly enhance your trading strategy, providing you with the insights needed to navigate the complexities of modern markets confidently.

FAQs

1. How quickly can I see results with the Vol.T?

Results can be observed as soon as you start applying the insights from the Vol.T in your trading activities.

2. Is the Vol.T suitable for beginners?

Yes, it’s designed to be user-friendly for both beginners and experienced traders.

3. Can the Vol.T be used for all types of markets?

Absolutely! Whether it’s stocks, forex, or commodities, the Vol.T is versatile.

4. What makes the Vol.T different from other market indicators?

It uniquely combines volume and tick data, offering a more comprehensive market analysis.

5. How do I get started with the Vol.T?

You can typically download it directly from your trading platform and integrate it with a few simple steps.

Be the first to review “The Vol.T Volume-Tick Indicator Package” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.