-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

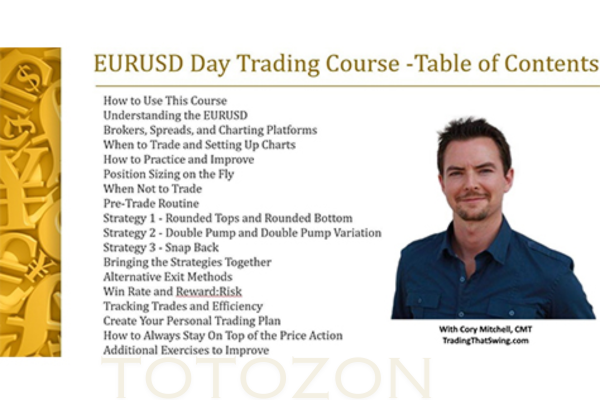

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Double Thurst Stock Trading System

1 × $15.00

The Double Thurst Stock Trading System

1 × $15.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

The Volatility Surface with Jim Gatheral

1 × $6.00

The Volatility Surface with Jim Gatheral

1 × $6.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Valuing Employee Stock Options with Johnathan Mun

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Valuing Employee Stock Options with Johnathan Mun” below:

Valuing Employee Stock Options with Johnathan Mun

Introduction

Employee stock options (ESOs) are a popular form of compensation used by companies to attract and retain talent. However, valuing these options can be complex and requires a deep understanding of financial modeling and valuation techniques. Johnathan Mun, an expert in financial engineering, offers valuable insights into the methodologies for accurately valuing ESOs. In this article, we explore these techniques and their applications.

Understanding Employee Stock Options

What are Employee Stock Options?

Employee stock options are contracts that give employees the right to purchase company stock at a predetermined price, known as the exercise or strike price, after a certain period.

Importance of ESOs

ESOs are crucial for aligning the interests of employees with those of shareholders. They provide employees with a financial incentive to contribute to the company’s success, potentially leading to increased productivity and loyalty.

Key Components of ESOs

Grant Date

The grant date is when the company issues the stock options to the employee. This date is critical for valuation purposes.

Vesting Period

The vesting period is the time an employee must wait before they can exercise their options. This period can range from a few months to several years.

Exercise Price

The exercise price is the fixed price at which the employee can purchase the company stock. It is usually set at the market price of the stock on the grant date.

Expiration Date

The expiration date is the last date on which the options can be exercised. After this date, the options become worthless.

Valuation Methods for ESOs

Black-Scholes Model

The Black-Scholes model is a widely used method for valuing options. It considers factors such as stock price, strike price, time to expiration, volatility, and the risk-free interest rate.

Binomial Model

The binomial model uses a discrete-time framework to model the possible price paths of the underlying stock. It provides more flexibility than the Black-Scholes model by allowing for changing variables over time.

Monte Carlo Simulation

Monte Carlo simulations use random sampling to model the uncertainty and variability in the stock price. This method is useful for valuing complex ESOs with multiple conditions and features.

Lattice Models

Lattice models, such as the binomial or trinomial lattice, create a tree of possible stock prices and option values at each node. These models are particularly useful for capturing the early exercise features of ESOs.

Factors Influencing ESO Valuation

Stock Price Volatility

Volatility measures the degree of variation in the stock price. Higher volatility increases the potential for the stock price to rise significantly, thereby increasing the value of the options.

Interest Rates

The risk-free interest rate is used to discount the expected payoff of the options. Changes in interest rates can impact the present value of the ESOs.

Dividend Yield

If the company pays dividends, the value of the ESOs can be affected. Higher dividend yields typically reduce the value of call options.

Employee Behavior

The likelihood of employees exercising their options early or leaving the company can impact the valuation. Modeling these behaviors accurately is essential for precise valuation.

Practical Steps in Valuing ESOs

Gather Necessary Data

Collect data on the stock price, strike price, grant date, vesting period, expiration date, volatility, interest rates, and dividend yield.

Choose an Appropriate Model

Select the valuation model that best fits the characteristics of the ESOs and the available data. Each model has its strengths and weaknesses depending on the complexity of the options.

Run the Valuation Model

Input the gathered data into the chosen model to calculate the value of the ESOs. This step may involve running simulations or constructing price lattices.

Interpret the Results

Analyze the output of the valuation model to understand the fair value of the ESOs. This information can be used for financial reporting, compensation planning, and decision-making.

Challenges in ESO Valuation

Complexity of Models

The mathematical and computational complexity of the models can be a barrier for some organizations. Expertise in financial modeling is required to implement these models correctly.

Data Accuracy

Accurate and reliable data is crucial for precise valuation. Inaccurate data can lead to significant errors in the valuation results.

Regulatory Requirements

Compliance with accounting standards such as IFRS 2 or ASC 718 requires rigorous valuation processes and documentation.

Benefits of Accurate ESO Valuation

Financial Transparency

Accurate valuation provides transparency in financial reporting, helping stakeholders understand the cost and impact of ESOs.

Informed Decision-Making

Understanding the true value of ESOs enables better decision-making regarding compensation packages and strategic planning.

Employee Motivation

Fair valuation ensures that ESOs remain an attractive and motivating form of compensation for employees.

Conclusion

Valuing Employee Stock Options with insights from Johnathan Mun provides a comprehensive framework for accurately assessing the value of ESOs. By understanding the key components, valuation methods, and influencing factors, companies can enhance their financial transparency, make informed decisions, and effectively motivate their employees. Accurate ESO valuation is not just a regulatory requirement but a strategic tool for organizational success.

FAQs

1. What is the Black-Scholes model?

The Black-Scholes model is a mathematical model used to value options by considering factors such as stock price, strike price, time to expiration, volatility, and risk-free interest rates.

2. How does stock price volatility affect ESO valuation?

Higher volatility increases the potential for significant price changes, which can raise the value of stock options.

3. Why are Monte Carlo simulations used in ESO valuation?

Monte Carlo simulations are used to model the uncertainty and variability in stock prices, making them useful for valuing complex ESOs with multiple conditions.

4. What is the significance of the vesting period in ESOs?

The vesting period is the time an employee must wait before they can exercise their options, impacting the timing and valuation of the options.

5. How can accurate ESO valuation benefit a company?

Accurate ESO valuation enhances financial transparency, informs decision-making, and ensures ESOs remain a motivating compensation tool for employees.

Be the first to review “Valuing Employee Stock Options with Johnathan Mun” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.