-

×

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading System Building Blocks with John Hill

1 × $6.00

Trading System Building Blocks with John Hill

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

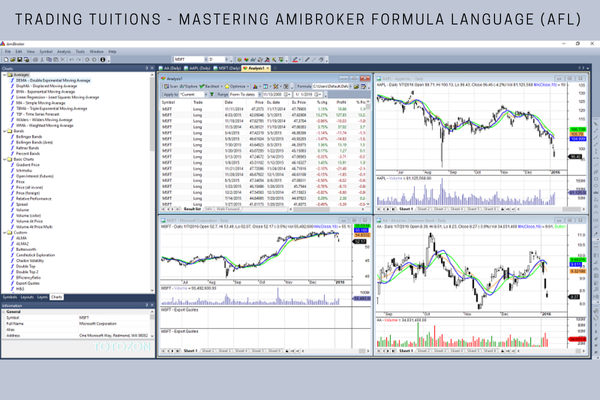

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00 -

×

Pinpoint Profit Method Class

1 × $31.00

Pinpoint Profit Method Class

1 × $31.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00 -

×

The GBP USD Trading System with A.Heuscher

1 × $6.00

The GBP USD Trading System with A.Heuscher

1 × $6.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Andrew Keene's Most Confident Trade Yet

1 × $54.00

Andrew Keene's Most Confident Trade Yet

1 × $54.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

The Whale Order with The Forex Scalpers

1 × $5.00

The Whale Order with The Forex Scalpers

1 × $5.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

TotalTheo 12 Month Mentorship

1 × $54.00

TotalTheo 12 Month Mentorship

1 × $54.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

Stop Loss Secrets

1 × $6.00

Stop Loss Secrets

1 × $6.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

The Double Thurst Stock Trading System

1 × $15.00

The Double Thurst Stock Trading System

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

RadioActive Trading Home Study Kit with Power Options

1 × $31.00

RadioActive Trading Home Study Kit with Power Options

1 × $31.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

Trading Signals And Training 100

1 × $6.00

Trading Signals And Training 100

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

The New Multi-10x on Steroids Pro Package

1 × $78.00

The New Multi-10x on Steroids Pro Package

1 × $78.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray” below:

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

Valuing a stock accurately is crucial for making informed investment decisions. The “Streetsmart Guide to Valuing a Stock (2nd Ed.)” by Gary Gray provides comprehensive strategies and methodologies to help investors determine the true worth of a stock. In this article, we’ll delve into the key concepts and techniques outlined in Gray’s guide, offering practical insights to enhance your stock valuation skills.

Introduction to Stock Valuation

Why Valuation Matters

Stock valuation is essential for identifying investment opportunities and making informed decisions. It helps investors understand whether a stock is overvalued, undervalued, or fairly priced.

Who is Gary Gray?

Gary Gray is a seasoned financial analyst and author with extensive experience in stock valuation. His expertise has helped many investors achieve their financial goals through strategic stock analysis.

Fundamental Concepts of Stock Valuation

1. Intrinsic Value

Definition

Intrinsic value refers to the actual worth of a stock based on its fundamentals, including earnings, dividends, and growth potential.

Importance

Understanding intrinsic value helps investors make decisions based on a stock’s true worth rather than market speculation.

2. Market Value

Definition

Market value is the current price at which a stock is trading on the market.

Comparison with Intrinsic Value

Comparing market value to intrinsic value helps determine whether a stock is overvalued, undervalued, or fairly priced.

Valuation Methods

1. Discounted Cash Flow (DCF) Analysis

Overview

DCF analysis estimates the value of a stock based on its expected future cash flows, discounted back to their present value.

Steps Involved

- Project Future Cash Flows

- Determine the Discount Rate

- Calculate Present Value

2. Price-to-Earnings (P/E) Ratio

Overview

The P/E ratio compares a company’s current share price to its per-share earnings.

Usage

A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest it is undervalued.

3. Price-to-Book (P/B) Ratio

Overview

The P/B ratio compares a stock’s market value to its book value.

Usage

A lower P/B ratio may indicate a stock is undervalued, while a higher ratio could suggest overvaluation.

4. Dividend Discount Model (DDM)

Overview

DDM values a stock based on the present value of its expected future dividends.

Steps Involved

- Estimate Future Dividends

- Determine the Discount Rate

- Calculate Present Value

Applying Valuation Techniques

Step-by-Step Guide

Step 1: Gather Financial Data

Collect relevant financial data, including earnings reports, cash flow statements, and balance sheets.

Step 2: Choose Appropriate Valuation Method

Select the valuation method that best suits the stock and industry.

Step 3: Perform Calculations

Perform the necessary calculations to determine the intrinsic value of the stock.

Step 4: Compare with Market Value

Compare the intrinsic value with the current market value to assess whether the stock is overvalued, undervalued, or fairly priced.

Practical Examples

Example 1: DCF Analysis

Scenario

Applying DCF analysis to a technology company with high growth potential.

Process

- Project future cash flows based on past performance and growth forecasts.

- Determine an appropriate discount rate.

- Calculate the present value of future cash flows.

Example 2: P/E Ratio

Scenario

Evaluating a consumer goods company using the P/E ratio.

Process

- Obtain the current share price and earnings per share (EPS).

- Calculate the P/E ratio and compare it to industry averages.

Common Mistakes in Stock Valuation

1. Over-Reliance on a Single Method

Issue

Relying solely on one valuation method can lead to inaccurate assessments.

Solution

Use multiple valuation methods to get a comprehensive view of a stock’s value.

2. Ignoring Market Conditions

Issue

Market conditions can significantly impact stock prices and valuation accuracy.

Solution

Consider current market trends and economic factors when performing valuations.

3. Inaccurate Financial Projections

Issue

Incorrect financial projections can skew valuation results.

Solution

Use conservative estimates and validate projections with historical data.

Advanced Valuation Techniques

1. Earnings Yield

Overview

Earnings yield compares a company’s earnings to its market value, providing an alternative to the P/E ratio.

2. Economic Value Added (EVA)

Overview

EVA measures a company’s financial performance based on residual wealth, calculated by deducting the cost of capital from operating profit.

Implementing Valuation in Your Investment Strategy

Building a Valuation Model

Software and Tools

Use financial software and tools to build detailed valuation models.

Regular Updates

Continuous Monitoring

Regularly update your valuation models with the latest financial data and market trends.

Conclusion

Valuing a stock accurately is a crucial skill for successful investing. The “Streetsmart Guide to Valuing a Stock (2nd Ed.)” by Gary Gray provides a thorough framework for understanding and applying various valuation methods. By mastering these techniques, you can make informed investment decisions and achieve your financial goals.

FAQs

1. What is the intrinsic value of a stock?

Intrinsic value is the actual worth of a stock based on its fundamentals, such as earnings, dividends, and growth potential.

2. How does the P/E ratio help in valuing a stock?

The P/E ratio compares a company’s current share price to its per-share earnings, helping determine if a stock is overvalued or undervalued.

3. What is the purpose of DCF analysis?

DCF analysis estimates the value of a stock based on its expected future cash flows, discounted back to their present value.

4. Why is diversification important in stock valuation?

Diversification helps manage risk by spreading investments across various asset classes, reducing the impact of poor-performing stocks.

5. How can I improve my stock valuation skills?

Continuous learning, using multiple valuation methods, and staying informed about market trends and economic factors can enhance your stock valuation skills.

Be the first to review “Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.