-

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

TIMfundamentals with Timothy Sykes

1 × $5.00

TIMfundamentals with Timothy Sykes

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Channel Surfing Video Course

1 × $23.00

Channel Surfing Video Course

1 × $23.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Radioactive Trading Mastery Course

1 × $6.00

Radioactive Trading Mastery Course

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00 -

×

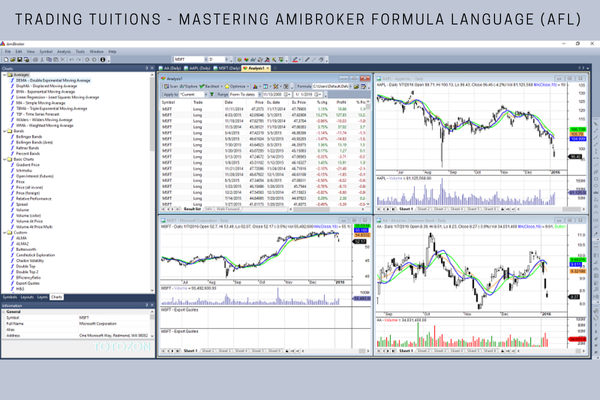

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading the Elliott Waves with Robert Prechter

1 × $15.00

Trading the Elliott Waves with Robert Prechter

1 × $15.00 -

×

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

The Superstock Investor with Charles LaLoggia

1 × $6.00

The Superstock Investor with Charles LaLoggia

1 × $6.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

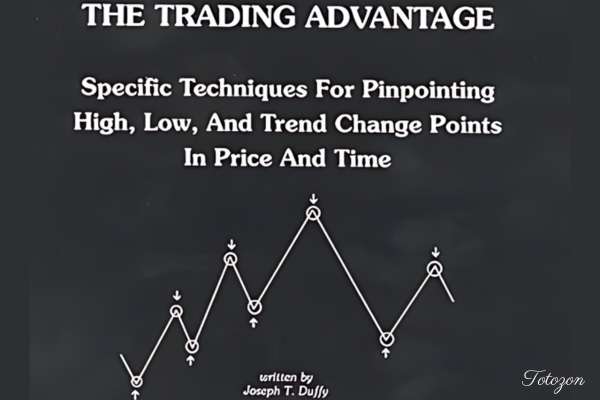

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

Low Timeframe Supply & Demand with RROP

1 × $5.00

Low Timeframe Supply & Demand with RROP

1 × $5.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00 -

×

Triple Squeeze Indicator TOS

1 × $6.00

Triple Squeeze Indicator TOS

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Options Income Generating Blueprint

1 × $31.00

Options Income Generating Blueprint

1 × $31.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray” below:

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

Valuing a stock accurately is crucial for making informed investment decisions. The “Streetsmart Guide to Valuing a Stock (2nd Ed.)” by Gary Gray provides comprehensive strategies and methodologies to help investors determine the true worth of a stock. In this article, we’ll delve into the key concepts and techniques outlined in Gray’s guide, offering practical insights to enhance your stock valuation skills.

Introduction to Stock Valuation

Why Valuation Matters

Stock valuation is essential for identifying investment opportunities and making informed decisions. It helps investors understand whether a stock is overvalued, undervalued, or fairly priced.

Who is Gary Gray?

Gary Gray is a seasoned financial analyst and author with extensive experience in stock valuation. His expertise has helped many investors achieve their financial goals through strategic stock analysis.

Fundamental Concepts of Stock Valuation

1. Intrinsic Value

Definition

Intrinsic value refers to the actual worth of a stock based on its fundamentals, including earnings, dividends, and growth potential.

Importance

Understanding intrinsic value helps investors make decisions based on a stock’s true worth rather than market speculation.

2. Market Value

Definition

Market value is the current price at which a stock is trading on the market.

Comparison with Intrinsic Value

Comparing market value to intrinsic value helps determine whether a stock is overvalued, undervalued, or fairly priced.

Valuation Methods

1. Discounted Cash Flow (DCF) Analysis

Overview

DCF analysis estimates the value of a stock based on its expected future cash flows, discounted back to their present value.

Steps Involved

- Project Future Cash Flows

- Determine the Discount Rate

- Calculate Present Value

2. Price-to-Earnings (P/E) Ratio

Overview

The P/E ratio compares a company’s current share price to its per-share earnings.

Usage

A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest it is undervalued.

3. Price-to-Book (P/B) Ratio

Overview

The P/B ratio compares a stock’s market value to its book value.

Usage

A lower P/B ratio may indicate a stock is undervalued, while a higher ratio could suggest overvaluation.

4. Dividend Discount Model (DDM)

Overview

DDM values a stock based on the present value of its expected future dividends.

Steps Involved

- Estimate Future Dividends

- Determine the Discount Rate

- Calculate Present Value

Applying Valuation Techniques

Step-by-Step Guide

Step 1: Gather Financial Data

Collect relevant financial data, including earnings reports, cash flow statements, and balance sheets.

Step 2: Choose Appropriate Valuation Method

Select the valuation method that best suits the stock and industry.

Step 3: Perform Calculations

Perform the necessary calculations to determine the intrinsic value of the stock.

Step 4: Compare with Market Value

Compare the intrinsic value with the current market value to assess whether the stock is overvalued, undervalued, or fairly priced.

Practical Examples

Example 1: DCF Analysis

Scenario

Applying DCF analysis to a technology company with high growth potential.

Process

- Project future cash flows based on past performance and growth forecasts.

- Determine an appropriate discount rate.

- Calculate the present value of future cash flows.

Example 2: P/E Ratio

Scenario

Evaluating a consumer goods company using the P/E ratio.

Process

- Obtain the current share price and earnings per share (EPS).

- Calculate the P/E ratio and compare it to industry averages.

Common Mistakes in Stock Valuation

1. Over-Reliance on a Single Method

Issue

Relying solely on one valuation method can lead to inaccurate assessments.

Solution

Use multiple valuation methods to get a comprehensive view of a stock’s value.

2. Ignoring Market Conditions

Issue

Market conditions can significantly impact stock prices and valuation accuracy.

Solution

Consider current market trends and economic factors when performing valuations.

3. Inaccurate Financial Projections

Issue

Incorrect financial projections can skew valuation results.

Solution

Use conservative estimates and validate projections with historical data.

Advanced Valuation Techniques

1. Earnings Yield

Overview

Earnings yield compares a company’s earnings to its market value, providing an alternative to the P/E ratio.

2. Economic Value Added (EVA)

Overview

EVA measures a company’s financial performance based on residual wealth, calculated by deducting the cost of capital from operating profit.

Implementing Valuation in Your Investment Strategy

Building a Valuation Model

Software and Tools

Use financial software and tools to build detailed valuation models.

Regular Updates

Continuous Monitoring

Regularly update your valuation models with the latest financial data and market trends.

Conclusion

Valuing a stock accurately is a crucial skill for successful investing. The “Streetsmart Guide to Valuing a Stock (2nd Ed.)” by Gary Gray provides a thorough framework for understanding and applying various valuation methods. By mastering these techniques, you can make informed investment decisions and achieve your financial goals.

FAQs

1. What is the intrinsic value of a stock?

Intrinsic value is the actual worth of a stock based on its fundamentals, such as earnings, dividends, and growth potential.

2. How does the P/E ratio help in valuing a stock?

The P/E ratio compares a company’s current share price to its per-share earnings, helping determine if a stock is overvalued or undervalued.

3. What is the purpose of DCF analysis?

DCF analysis estimates the value of a stock based on its expected future cash flows, discounted back to their present value.

4. Why is diversification important in stock valuation?

Diversification helps manage risk by spreading investments across various asset classes, reducing the impact of poor-performing stocks.

5. How can I improve my stock valuation skills?

Continuous learning, using multiple valuation methods, and staying informed about market trends and economic factors can enhance your stock valuation skills.

Be the first to review “Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.