-

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

The Superstock Investor with Charles LaLoggia

1 × $6.00

The Superstock Investor with Charles LaLoggia

1 × $6.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Art of Yen Course (Feb 2014)

1 × $23.00

Art of Yen Course (Feb 2014)

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

$195.00 Original price was: $195.00.$6.00Current price is: $6.00.

File Size: 3.19 GB

Delivery Time: 1–12 hours

Media Type: Online Course

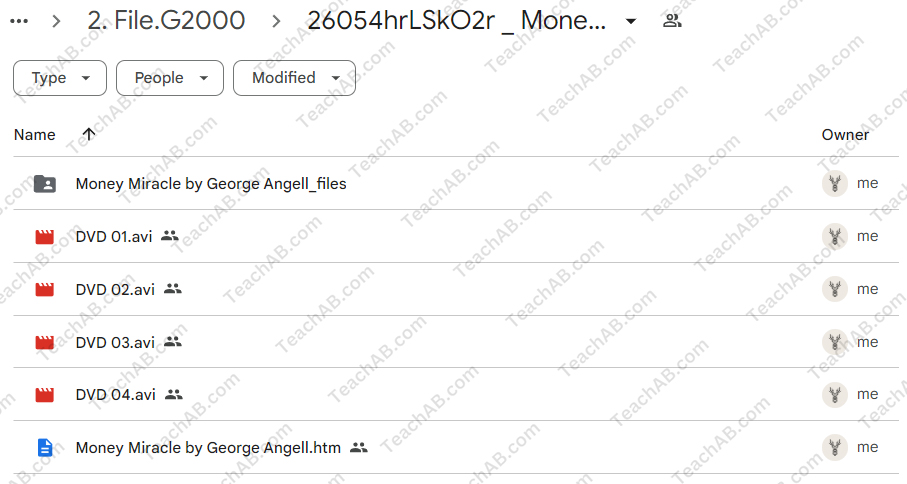

Content Proof: Watch Here!

You may check content proof of “Money Miracle: Use Other Peoples Money to Make You Rich with George Angell ” below:

Money Miracle: Use Other People’s Money to Make You Rich with George Angell

In the world of finance, leveraging other people’s money (OPM) can be a game-changer. George Angell’s insights into this strategy, as detailed in his work “Money Miracle: Use Other People’s Money to Make You Rich,” provide a roadmap for turning this concept into a profitable reality. Let’s explore how you can harness the power of OPM to build wealth and achieve financial success.

Introduction to Other People’s Money (OPM)

Using OPM involves borrowing money or utilizing other resources to invest and generate returns. This method can magnify your financial gains while minimizing your personal risk.

Who is George Angell?

George Angell is a financial expert with decades of experience. He has authored numerous books and courses, guiding individuals on how to effectively navigate the complexities of financial markets and investment strategies.

Understanding the Concept of OPM

1. The Basics of OPM

- Leveraging borrowed funds for investment

- Reducing personal capital exposure

- Increasing potential returns through strategic investments

2. Historical Success with OPM

Many successful entrepreneurs and investors have utilized OPM to amass significant wealth. Understanding their strategies can offer valuable lessons.

Benefits of Using OPM

1. Enhanced Investment Opportunities

By using other people’s money, you can access larger investment opportunities that might be out of reach with your capital alone.

2. Risk Mitigation

OPM allows you to spread your risk across multiple investments without heavily relying on your resources.

3. Increased Return on Investment

Properly managed, OPM can significantly boost your return on investment, amplifying your gains.

Strategies for Using OPM Effectively

1. Real Estate Investments

One of the most common ways to use OPM is through real estate investments. Borrowing to buy property can lead to substantial returns.

1.1 Mortgage Financing

- Leveraging mortgages to purchase properties

- Generating rental income to cover mortgage payments

1.2 Real Estate Partnerships

- Partnering with investors to pool resources

- Sharing profits and minimizing individual risk

2. Business Ventures

Starting or expanding a business using OPM can accelerate growth and profitability.

2.1 Angel Investors and Venture Capitalists

- Securing funding from investors in exchange for equity

- Utilizing funds for business expansion and development

2.2 Business Loans

- Taking out loans to finance business operations

- Ensuring the business generates enough revenue to repay loans

3. Stock Market Investments

Investing in the stock market using borrowed funds can be lucrative if managed wisely.

3.1 Margin Trading

- Borrowing money from a broker to trade stocks

- Amplifying potential returns while managing risk

3.2 Leveraged ETFs

- Using exchange-traded funds that use leverage to boost returns

- Understanding the risks associated with leveraged investments

Key Considerations When Using OPM

1. Interest Rates

The cost of borrowing can impact your overall returns. It’s essential to secure loans with favorable interest rates.

2. Repayment Terms

Understanding the repayment terms and conditions is crucial to ensure you can meet your obligations without financial strain.

3. Risk Management

Using OPM comes with inherent risks. Developing a robust risk management strategy is essential to protect your investments and financial health.

Psychological Aspects of Using OPM

1. Confidence in Your Strategy

Believing in your investment strategy is crucial when using OPM. Confidence can help you make informed decisions and stay the course during market fluctuations.

2. Managing Stress

Borrowing money for investments can be stressful. Learning to manage this stress is vital for long-term success.

George Angell’s Tips for Success

1. Thorough Research

Conduct extensive research before making any investment using OPM. Understanding the market and potential returns is crucial.

2. Diversification

Diversifying your investments can help spread risk and increase the likelihood of returns.

3. Continuous Learning

The financial market is ever-evolving. Staying updated with the latest trends and strategies can give you a competitive edge.

Conclusion

Utilizing other people’s money to make you rich is a powerful strategy when executed correctly. George Angell’s “Money Miracle” provides a comprehensive guide to mastering this approach. By understanding the basics, leveraging strategic opportunities, and managing risks, you can achieve financial success and build substantial wealth.

FAQs

1. What is the main benefit of using other people’s money for investments?

The main benefit is the ability to access larger investment opportunities and potentially increase returns without heavily relying on your capital.

2. What are the risks associated with using OPM?

The primary risks include high-interest rates, stringent repayment terms, and the potential for financial loss if investments do not perform as expected.

3. How can I start using OPM for real estate investments?

You can start by exploring mortgage financing options or partnering with other investors to pool resources for property purchases.

4. What should I consider before using OPM for stock market investments?

Consider the risks of margin trading and leveraged ETFs, and ensure you have a solid understanding of market trends and investment strategies.

5. How can I manage stress when using borrowed funds for investments?

Develop a robust risk management strategy, stay informed about your investments, and maintain a confident yet cautious approach to your investment decisions.

Be the first to review “Money Miracle: Use Other Peoples Money to Make You Rich with George Angell” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.