-

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

Power Charting - Robert’s Indicator Webinar

1 × $6.00

Power Charting - Robert’s Indicator Webinar

1 × $6.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Quality FX Academy

1 × $5.00

Quality FX Academy

1 × $5.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Restore Soul Fragments (Advanced) by Spirituality Zone

1 × $15.40

Restore Soul Fragments (Advanced) by Spirituality Zone

1 × $15.40 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

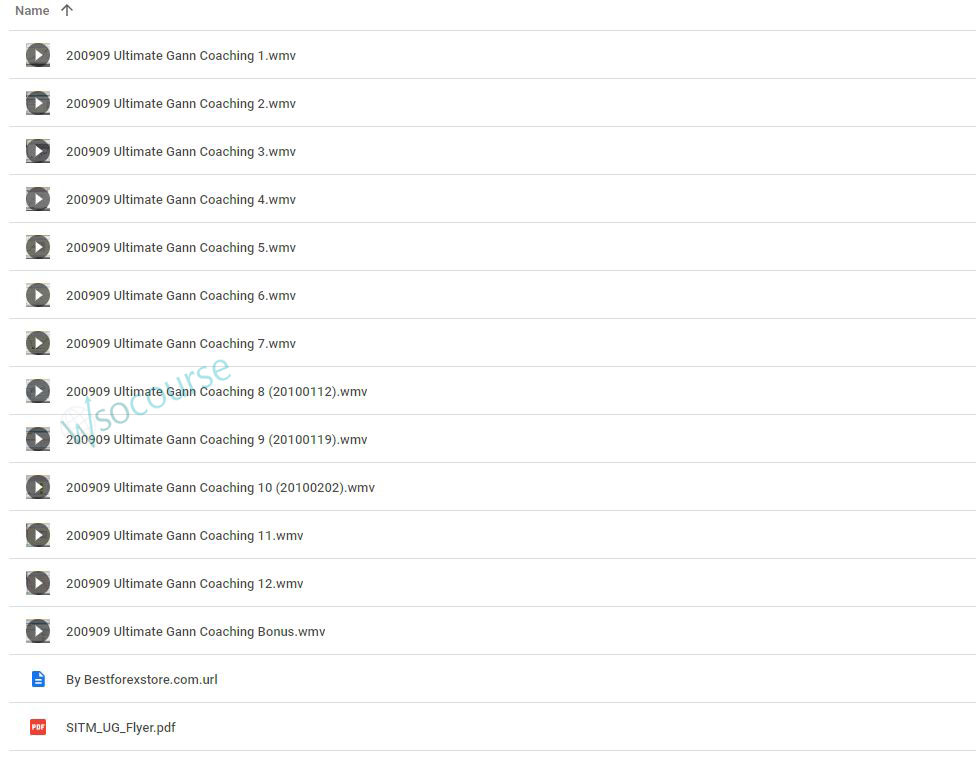

Content Proof: Watch Here!

You may check content proof of “Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch” below:

Ultimate Gann Course Coaching: Safety in The Market COMPLETE 12 Modules with Aaron Lynch

Introduction to the Ultimate Gann Course

The Ultimate Gann Course, coached by Aaron Lynch, is a comprehensive training program designed to equip traders with advanced techniques and strategies based on the principles of W.D. Gann. This course spans 12 modules, each meticulously crafted to ensure traders achieve safety and profitability in the market.

Who is Aaron Lynch?

Aaron Lynch is a seasoned trader and respected educator in the field of technical analysis and Gann theory. His expertise and practical approach make him an ideal mentor for those looking to master Gann’s methodologies.

Overview of the Ultimate Gann Course

Purpose of the Course

- Educational Resource: To provide an in-depth understanding of Gann’s trading techniques.

- Skill Enhancement: To improve traders’ abilities to analyze and predict market movements.

- Safety in Trading: To ensure traders can navigate the market safely and profitably.

Contents of the Course

- Module 1: Introduction to Gann Theory

- Module 2: Charting Techniques

- Module 3: Time Cycles

- Module 4: Price Patterns

- Module 5: Trading Strategies

- Module 6: Risk Management

- Module 7: Market Analysis

- Module 8: Advanced Techniques

- Module 9: Real-World Applications

- Module 10: Continuous Learning

- Module 11: Case Studies

- Module 12: Course Summary and Next Steps

Module 1: Introduction to Gann Theory

What is Gann Theory?

W.D. Gann’s theory revolves around the idea that market movements are cyclical and can be predicted through geometric, mathematical, and astrological tools.

Historical Context

Understanding the historical background of Gann theory and its development over time.

Module 2: Charting Techniques

Basic Chart Types

- Line Charts: Simple representation of price movements.

- Bar Charts: Detailed view of price action.

- Candlestick Charts: Visual patterns to identify market trends.

Gann Angles

Learning to draw and interpret Gann angles for predicting support and resistance levels.

Module 3: Time Cycles

Importance of Time Cycles

How time cycles help in forecasting market turns and trends.

Gann’s Time Cycles

Identifying and using Gann’s time cycles to predict market behavior.

Module 4: Price Patterns

Key Price Patterns

Recognizing and interpreting important price patterns such as triangles, wedges, and rectangles.

Gann’s Price Patterns

Applying Gann’s unique price pattern techniques to trading.

Module 5: Trading Strategies

Developing a Strategy

- Setting Goals: Defining clear trading objectives.

- Strategy Selection: Choosing the right strategy based on market conditions.

Gann Trading Strategies

Implementing Gann’s strategies to enhance trading performance.

Module 6: Risk Management

Importance of Risk Management

Understanding why managing risk is crucial for long-term success.

Techniques for Risk Management

- Stop-Loss Orders: Protecting your capital.

- Position Sizing: Determining the appropriate size for each trade.

Module 7: Market Analysis

Technical Analysis

Using technical analysis tools to evaluate market conditions.

Fundamental Analysis

Incorporating fundamental analysis to complement technical insights.

Module 8: Advanced Techniques

Advanced Gann Techniques

Exploring more complex Gann methods such as planetary cycles and square of nine.

Integrating Techniques

Combining different techniques to develop a robust trading approach.

Module 9: Real-World Applications

Applying Gann Theory

Practical application of Gann’s principles in real trading scenarios.

Trading Examples

Analyzing historical trades using Gann’s methods.

Module 10: Continuous Learning

Importance of Continuous Learning

Staying updated with the latest market trends and trading techniques.

Resources for Learning

Recommended books, courses, and online resources for further study.

Module 11: Case Studies

Successful Trades

Detailed case studies of successful trades using Gann’s techniques.

Learning from Mistakes

Analyzing mistakes to improve future trading performance.

Module 12: Course Summary and Next Steps

Recap of Key Learnings

Reviewing the main concepts and strategies covered in the course.

Next Steps for Traders

Guidance on how to continue developing as a trader and applying what has been learned.

Conclusion

The Ultimate Gann Course, coached by Aaron Lynch, offers a thorough education in Gann theory and its application in trading. By completing this 12-module course, traders will be well-equipped to navigate the financial markets with confidence and precision.

Frequently Asked Questions

1. What is the Ultimate Gann Course?

The Ultimate Gann Course is a 12-module training program designed to teach traders the principles and techniques of W.D. Gann.

2. Who can benefit from this course?

Both beginners and experienced traders looking to enhance their technical analysis skills and apply Gann’s methods can benefit from this course.

3. How is the course structured?

The course is divided into 12 modules, each focusing on different aspects of Gann theory and trading techniques.

4. What resources are included in the course?

The course includes video tutorials, written materials, practical exercises, and case studies.

5. How can I enroll in the Ultimate Gann Course?

You can enroll in the course through the Ablesys website or contact their support team for more information.

Be the first to review “Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.