-

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Winning on the Stock Market with Brian J.Millard

1 × $6.00

Winning on the Stock Market with Brian J.Millard

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00

Ultimate and Options Trading MasterClass Bundle with FX Evolution

1 × $54.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

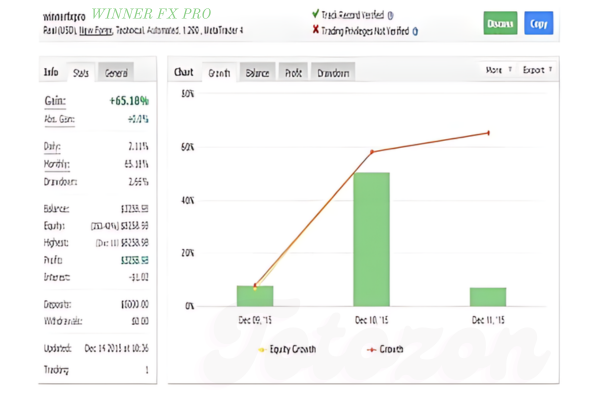

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “TrimTabs Investing with Charles Biderman & David Santschi” below:

TrimTabs Investing with Charles Biderman & David Santschi

TrimTabs Investing is a unique approach to the financial markets that uses liquidity theory to predict stock market movements. Developed by Charles Biderman, founder of TrimTabs Investment Research, along with key contributions from David Santschi, this methodology offers insights into how the flow of money in and out of the market can be a powerful predictor of future market performance.

Introduction to TrimTabs Investing

TrimTabs Investing focuses on the analysis of stock market liquidity and how it influences stock prices. Charles Biderman, a pioneer in this field, along with David Santschi, have utilized this strategy to provide actionable investment advice based on real-time economic and stock market data.

Understanding Liquidity Analysis

Liquidity analysis involves studying the supply and demand of stocks in the market. Biderman and Santschi argue that the best time to buy stocks is when there is a high level of liquidity—meaning there’s more money flowing into the market than flowing out.

The Role of Money Flows

- Money Flowing In: Indicates potential stock price increases.

- Money Flowing Out: Suggests possible price declines.

- Balanced Flow: Points to stable market conditions.

Core Principles of TrimTabs Investing

At its core, TrimTabs Investing relies on a set of fundamental principles that guide investors in their decision-making process.

Principle 1: Follow the Money

The basic tenet of TrimTabs is that stock prices are driven by liquidity more than any other factor. By tracking where the money is flowing, investors can anticipate market movements more effectively.

Principle 2: Market Efficiency

TrimTabs Investing posits that markets are efficient in the sense that they react quickly to changes in liquidity. This responsiveness can be leveraged to predict short-term market trends.

Strategies for Implementing TrimTabs Investing

Implementing TrimTabs Investing involves a disciplined approach to monitoring money flows and interpreting their impact on stock prices.

Strategy 1: Use Real-Time Data

- Daily Tracking: Monitor the daily flows of money to catch early signs of market shifts.

- Liquidity Indicators: Use specific indicators that reflect the current state of market liquidity.

Strategy 2: Focus on Market Sentiment

- Sentiment Analysis: Gauge investor sentiment through the analysis of money flows.

- Behavioral Economics: Incorporate principles of behavioral economics to understand how investor behavior affects liquidity.

Challenges in TrimTabs Investing

While TrimTabs Investing provides a compelling framework for investment, it comes with its own set of challenges.

Handling Market Anomalies

Sometimes, liquidity data can be misleading due to market anomalies or external economic shocks. Investors need to be cautious and consider other factors in conjunction with liquidity analysis.

Adapting to New Market Realities

- Technological Changes: Rapid technological advancements can alter money flow dynamics.

- Regulatory Impact: Changes in financial regulations can affect liquidity patterns.

The Future of TrimTabs Investing

As financial markets evolve, the methodologies and strategies of TrimTabs Investing continue to adapt. The insights provided by Biderman and Santschi remain relevant as they refine their techniques to handle new market conditions.

Innovations in Liquidity Analysis

- Advanced Analytics: Leveraging machine learning and big data to enhance liquidity analysis.

- Global Expansion: Applying TrimTabs principles to global markets to identify investment opportunities.

Conclusion

TrimTabs Investing, as developed by Charles Biderman and enhanced by David Santschi, provides a unique perspective on market analysis through the lens of liquidity. By understanding and utilizing the dynamics of money flows, investors can gain a significant edge in predicting market movements.

Frequently Asked Questions:

- What is the primary focus of TrimTabs Investing?

- The primary focus is on analyzing liquidity—money flows in and out of the market—to predict stock movements.

- How does liquidity affect stock prices according to TrimTabs?

- High liquidity typically leads to rising stock prices, while low liquidity can cause prices to fall.

- What are some key strategies of TrimTabs Investing?

- Key strategies include monitoring real-time data and focusing on market sentiment through liquidity.

- What challenges do TrimTabs investors face?

- Challenges include navigating market anomalies and adapting to new technological and regulatory changes.

- How is TrimTabs Investing adapting to modern financial markets?

- It is incorporating advanced analytics and expanding its application to global markets.

Be the first to review “TrimTabs Investing with Charles Biderman & David Santschi” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.