-

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Opening Range Success Formula with Geoff Bysshe

1 × $4.00

Opening Range Success Formula with Geoff Bysshe

1 × $4.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Coin FX Academy

1 × $6.00

The Coin FX Academy

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00 -

×

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Forex Freedom Course

1 × $54.00

Forex Freedom Course

1 × $54.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00 -

×

Professional Strategies For Trading The DAX

1 × $6.00

Professional Strategies For Trading The DAX

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Day Trade to Win E-Course with John Paul

1 × $6.00

Day Trade to Win E-Course with John Paul

1 × $6.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

Low Timeframe Supply & Demand with RROP

1 × $5.00

Low Timeframe Supply & Demand with RROP

1 × $5.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

International Assignments with Linda K.Stroh

1 × $6.00

International Assignments with Linda K.Stroh

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00 -

×

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00 -

×

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

Trading Triggers – The Secrets to Profitable Trading with John Person

$289.00 Original price was: $289.00.$6.00Current price is: $6.00.

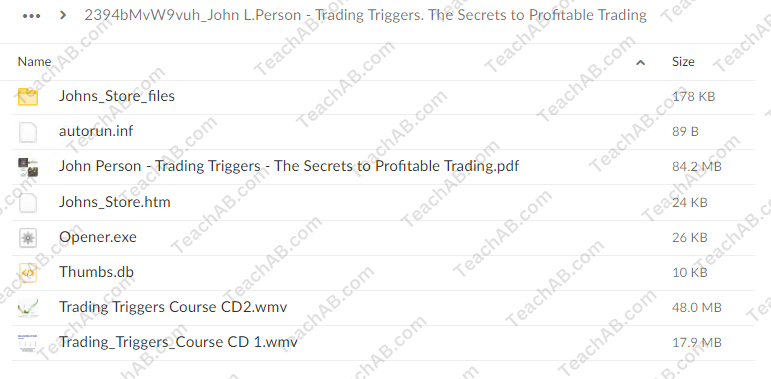

File Size: 150.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Triggers – The Secrets to Profitable Trading with John Person” below:

Trading Triggers – The Secrets to Profitable Trading with John Person

Introduction

Welcome to the world of profitable trading with John Person’s Trading Triggers. This comprehensive guide will unravel the secrets to effective trading, leveraging John Person’s renowned strategies. Whether you’re a novice or an experienced trader, this article will provide valuable insights into maximizing your trading potential.

Who is John Person?

Background and Expertise

John Person is a seasoned trader, author, and educator with over 30 years of experience in the financial markets. He is widely recognized for his innovative trading systems and has authored several books on trading strategies.

Contributions to Trading

- Innovative Strategies: Developed unique trading methods that have become industry standards.

- Educational Influence: A prominent figure in trader education through books, seminars, and webinars.

What are Trading Triggers?

Definition and Overview

Trading triggers are specific conditions or signals that prompt a trader to enter or exit a trade. These triggers are based on technical analysis, market patterns, and other indicators.

Importance of Trading Triggers

- Precision: Help in making precise entry and exit decisions.

- Consistency: Ensure consistent application of trading strategies.

- Risk Management: Aid in managing and minimizing risk.

Core Concepts of John Person’s Trading Triggers

Pivot Points

Understanding Pivot Points

Pivot points are significant levels calculated using the high, low, and close prices of a previous period. They help identify potential support and resistance levels.

Using Pivot Points in Trading

- Entry Points: Enter trades near support or resistance levels identified by pivot points.

- Exit Points: Use pivot points to determine optimal exit levels.

Candlestick Patterns

Importance of Candlestick Patterns

Candlestick patterns provide visual insights into market sentiment and potential price reversals.

Key Candlestick Patterns

- Doji: Indicates market indecision and potential reversal.

- Hammer: Suggests a bullish reversal after a downtrend.

- Engulfing Patterns: Signal strong reversals when a smaller candle is followed by a larger one that engulfs it.

Technical Indicators

Relative Strength Index (RSI)

RSI measures the speed and change of price movements, helping identify overbought or oversold conditions.

Moving Averages

Moving averages smooth out price data to identify trends and potential reversal points.

Developing a Trading Plan with Trading Triggers

Setting Clear Objectives

Defining Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals for your trading activities.

Risk Tolerance

Determine your risk tolerance and adjust your trading strategies accordingly.

Identifying Trading Triggers

Combining Indicators

Use a combination of pivot points, candlestick patterns, and technical indicators to identify reliable trading triggers.

Entry and Exit Rules

Establish clear entry and exit rules based on your identified triggers to maintain consistency.

Executing Trades

Implementing Your Trading Plan

Order Types

- Market Orders: Execute trades immediately at the current market price.

- Limit Orders: Set specific prices at which you want to buy or sell an asset.

Position Sizing

Determine the size of your trade positions to manage risk effectively.

Monitoring and Adjusting

Trade Monitoring

Keep a close watch on your trades and market conditions to make necessary adjustments.

Adjusting Strategies

Be prepared to adjust your strategies based on market changes and new information.

Risk Management with Trading Triggers

Stop-Loss Orders

Setting Stop-Loss Levels

Use stop-loss orders to limit potential losses by exiting trades at predetermined price levels.

Trailing Stops

Implement trailing stops to protect profits by moving the stop-loss level as the market price moves in your favor.

Position Sizing

Calculating Position Size

Use position sizing techniques to determine the appropriate amount of capital to risk on each trade.

Diversification

Diversify your trades across different assets to spread risk.

Advanced Strategies with Trading Triggers

Backtesting Strategies

Historical Data Analysis

Test your trading strategies using historical data to evaluate their effectiveness.

Refining Strategies

Continuously refine your strategies based on backtesting results and market feedback.

Automating Trading

Trading Bots

Implement trading bots to automate your strategies and execute trades based on predefined triggers.

Algorithmic Trading

Develop algorithms to trade based on complex strategies and multiple indicators.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to trade too frequently. Focus on quality trades rather than quantity.

Ignoring Risk Management

Always implement risk management techniques to protect your capital.

Lack of Discipline

Stick to your trading plan and avoid making impulsive decisions based on emotions.

Benefits of Using Trading Triggers

Consistency

Ensure consistent application of your trading strategies by relying on specific triggers.

Improved Decision-Making

Enhance your decision-making process with clear entry and exit signals.

Reduced Emotional Trading

Minimize emotional trading by following predefined triggers and strategies.

Conclusion

Trading triggers, as taught by John Person, offer a structured and effective approach to trading. By understanding and implementing these triggers, you can enhance your trading performance, manage risks effectively, and achieve consistent profits. Start incorporating trading triggers into your strategy today and unlock the secrets to profitable trading.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trading Triggers – The Secrets to Profitable Trading with John Person” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.