-

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Sacredscience - Raphael – Book of Fate

1 × $6.00

Sacredscience - Raphael – Book of Fate

1 × $6.00 -

×

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

AstuceFX Mentorship 2023

1 × $27.00

AstuceFX Mentorship 2023

1 × $27.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

Steidlmayer On Markets. A New Approach to Trading with J.Peter Steidlmayer

1 × $6.00

Steidlmayer On Markets. A New Approach to Trading with J.Peter Steidlmayer

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

Pristine - Trading the Pristine Method 2

1 × $6.00

Pristine - Trading the Pristine Method 2

1 × $6.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Trading Full Circle with Jea Yu

1 × $6.00

Trading Full Circle with Jea Yu

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Trading in the Bluff with John Templeton

1 × $6.00

Trading in the Bluff with John Templeton

1 × $6.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Trading Triggers – The Secrets to Profitable Trading with John Person

$289.00 Original price was: $289.00.$6.00Current price is: $6.00.

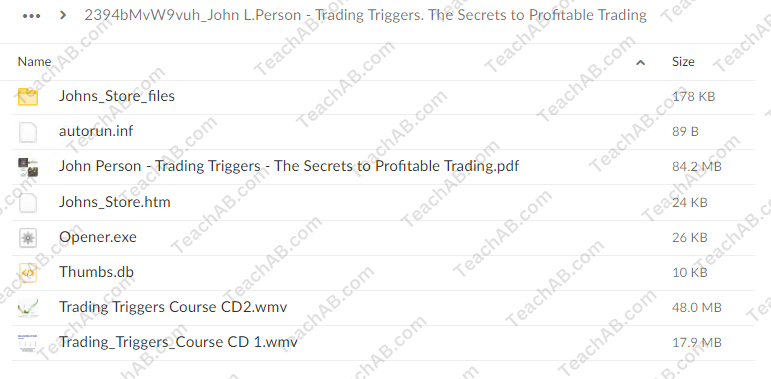

File Size: 150.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Triggers – The Secrets to Profitable Trading with John Person” below:

Trading Triggers – The Secrets to Profitable Trading with John Person

Introduction

Welcome to the world of profitable trading with John Person’s Trading Triggers. This comprehensive guide will unravel the secrets to effective trading, leveraging John Person’s renowned strategies. Whether you’re a novice or an experienced trader, this article will provide valuable insights into maximizing your trading potential.

Who is John Person?

Background and Expertise

John Person is a seasoned trader, author, and educator with over 30 years of experience in the financial markets. He is widely recognized for his innovative trading systems and has authored several books on trading strategies.

Contributions to Trading

- Innovative Strategies: Developed unique trading methods that have become industry standards.

- Educational Influence: A prominent figure in trader education through books, seminars, and webinars.

What are Trading Triggers?

Definition and Overview

Trading triggers are specific conditions or signals that prompt a trader to enter or exit a trade. These triggers are based on technical analysis, market patterns, and other indicators.

Importance of Trading Triggers

- Precision: Help in making precise entry and exit decisions.

- Consistency: Ensure consistent application of trading strategies.

- Risk Management: Aid in managing and minimizing risk.

Core Concepts of John Person’s Trading Triggers

Pivot Points

Understanding Pivot Points

Pivot points are significant levels calculated using the high, low, and close prices of a previous period. They help identify potential support and resistance levels.

Using Pivot Points in Trading

- Entry Points: Enter trades near support or resistance levels identified by pivot points.

- Exit Points: Use pivot points to determine optimal exit levels.

Candlestick Patterns

Importance of Candlestick Patterns

Candlestick patterns provide visual insights into market sentiment and potential price reversals.

Key Candlestick Patterns

- Doji: Indicates market indecision and potential reversal.

- Hammer: Suggests a bullish reversal after a downtrend.

- Engulfing Patterns: Signal strong reversals when a smaller candle is followed by a larger one that engulfs it.

Technical Indicators

Relative Strength Index (RSI)

RSI measures the speed and change of price movements, helping identify overbought or oversold conditions.

Moving Averages

Moving averages smooth out price data to identify trends and potential reversal points.

Developing a Trading Plan with Trading Triggers

Setting Clear Objectives

Defining Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals for your trading activities.

Risk Tolerance

Determine your risk tolerance and adjust your trading strategies accordingly.

Identifying Trading Triggers

Combining Indicators

Use a combination of pivot points, candlestick patterns, and technical indicators to identify reliable trading triggers.

Entry and Exit Rules

Establish clear entry and exit rules based on your identified triggers to maintain consistency.

Executing Trades

Implementing Your Trading Plan

Order Types

- Market Orders: Execute trades immediately at the current market price.

- Limit Orders: Set specific prices at which you want to buy or sell an asset.

Position Sizing

Determine the size of your trade positions to manage risk effectively.

Monitoring and Adjusting

Trade Monitoring

Keep a close watch on your trades and market conditions to make necessary adjustments.

Adjusting Strategies

Be prepared to adjust your strategies based on market changes and new information.

Risk Management with Trading Triggers

Stop-Loss Orders

Setting Stop-Loss Levels

Use stop-loss orders to limit potential losses by exiting trades at predetermined price levels.

Trailing Stops

Implement trailing stops to protect profits by moving the stop-loss level as the market price moves in your favor.

Position Sizing

Calculating Position Size

Use position sizing techniques to determine the appropriate amount of capital to risk on each trade.

Diversification

Diversify your trades across different assets to spread risk.

Advanced Strategies with Trading Triggers

Backtesting Strategies

Historical Data Analysis

Test your trading strategies using historical data to evaluate their effectiveness.

Refining Strategies

Continuously refine your strategies based on backtesting results and market feedback.

Automating Trading

Trading Bots

Implement trading bots to automate your strategies and execute trades based on predefined triggers.

Algorithmic Trading

Develop algorithms to trade based on complex strategies and multiple indicators.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to trade too frequently. Focus on quality trades rather than quantity.

Ignoring Risk Management

Always implement risk management techniques to protect your capital.

Lack of Discipline

Stick to your trading plan and avoid making impulsive decisions based on emotions.

Benefits of Using Trading Triggers

Consistency

Ensure consistent application of your trading strategies by relying on specific triggers.

Improved Decision-Making

Enhance your decision-making process with clear entry and exit signals.

Reduced Emotional Trading

Minimize emotional trading by following predefined triggers and strategies.

Conclusion

Trading triggers, as taught by John Person, offer a structured and effective approach to trading. By understanding and implementing these triggers, you can enhance your trading performance, manage risks effectively, and achieve consistent profits. Start incorporating trading triggers into your strategy today and unlock the secrets to profitable trading.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trading Triggers – The Secrets to Profitable Trading with John Person” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.