-

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

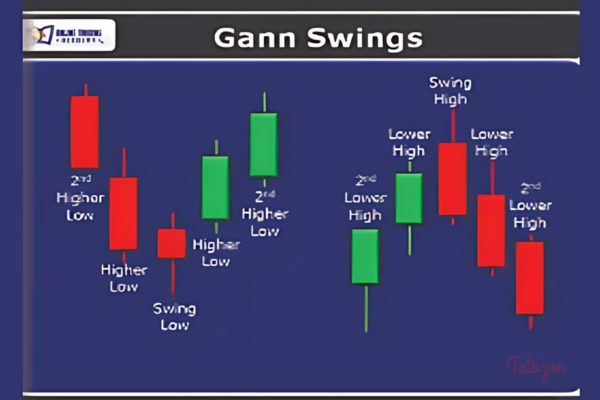

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

IncomeMax Spreads with Hari Swaminathan

1 × $23.00

IncomeMax Spreads with Hari Swaminathan

1 × $23.00 -

×

Market Internals & Intraday Timing Webinar

1 × $6.00

Market Internals & Intraday Timing Webinar

1 × $6.00 -

×

The Blueprint to Success with Humair FX

1 × $5.00

The Blueprint to Success with Humair FX

1 × $5.00 -

×

Elite Trader Package

1 × $31.00

Elite Trader Package

1 × $31.00 -

×

ApexFX Pro

1 × $5.00

ApexFX Pro

1 × $5.00 -

×

JJ Dream Team Workshop Training Full Course

1 × $55.00

JJ Dream Team Workshop Training Full Course

1 × $55.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

The Subtle Trap of Trading with Brian McAboy

1 × $6.00

The Subtle Trap of Trading with Brian McAboy

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

Trading Full Circle with Jea Yu

1 × $6.00

Trading Full Circle with Jea Yu

1 × $6.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00 -

×

Stock Market Trading Systems with Gerald Appel

1 × $6.00

Stock Market Trading Systems with Gerald Appel

1 × $6.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Exit Strategies for Stock and Futures with Charles LeBeau

1 × $6.00

Exit Strategies for Stock and Futures with Charles LeBeau

1 × $6.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00 -

×

Applied Portfolio Management with Catherine Shenoy

1 × $6.00

Applied Portfolio Management with Catherine Shenoy

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Sure Thing Stock Investing with Larry Williams

1 × $6.00

Sure Thing Stock Investing with Larry Williams

1 × $6.00 -

×

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00 -

×

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Beating the Financial Futures Market

1 × $6.00

Beating the Financial Futures Market

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

The New Multi-10x on Steroids Pro Package

1 × $78.00

The New Multi-10x on Steroids Pro Package

1 × $78.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

The Next Great Bull Market with Matthew McCall

1 × $6.00

The Next Great Bull Market with Matthew McCall

1 × $6.00 -

×

Mission Million Money Management Course

1 × $31.00

Mission Million Money Management Course

1 × $31.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

Breakouts with Feibel Trading

1 × $5.00

Breakouts with Feibel Trading

1 × $5.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00 -

×

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00 -

×

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Made Easy: 6 Ways to Trade the Dollar with James Dicks

1 × $6.00

Forex Made Easy: 6 Ways to Trade the Dollar with James Dicks

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

The Late-Start Investor with John Wasik

1 × $6.00

The Late-Start Investor with John Wasik

1 × $6.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

Mean Reversion Strategy with The Chartist

1 × $78.00

Mean Reversion Strategy with The Chartist

1 × $78.00 -

×

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Money Flow Trading System: A Profitable Trend Following System So Easy You Can Run it On Your Phone! (English Edition) (Kindle) - Bernd Traxl

1 × $6.00

The Money Flow Trading System: A Profitable Trend Following System So Easy You Can Run it On Your Phone! (English Edition) (Kindle) - Bernd Traxl

1 × $6.00 -

×

Getting Started in Options with Michael Thomsett

1 × $6.00

Getting Started in Options with Michael Thomsett

1 × $6.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

The Triad Formula System with Jason Fielder

1 × $6.00

The Triad Formula System with Jason Fielder

1 × $6.00 -

×

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00 -

×

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

Rapid Results Method with Russ Horn

1 × $6.00

Rapid Results Method with Russ Horn

1 × $6.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

How to Stack Your Trades

1 × $6.00

How to Stack Your Trades

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

Trading Systems Explained with Martin Pring

1 × $6.00

Trading Systems Explained with Martin Pring

1 × $6.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Bennett McDowell – A Trader’s Money Management System

1 × $6.00

Bennett McDowell – A Trader’s Money Management System

1 × $6.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

Advanced Fibonacci Course with Major League Trading

1 × $23.00

Advanced Fibonacci Course with Major League Trading

1 × $23.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

AnswerStock with Timothy Sykes

1 × $5.00

AnswerStock with Timothy Sykes

1 × $5.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00 -

×

Creating & Using a Trading Plan with Paul Lange

1 × $8.00

Creating & Using a Trading Plan with Paul Lange

1 × $8.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00 -

×

Cycle Hunter Books 1-3 with Brian James Sklenka

1 × $6.00

Cycle Hunter Books 1-3 with Brian James Sklenka

1 × $6.00 -

×

DayTrading Made Simple with William Greenspan

1 × $4.00

DayTrading Made Simple with William Greenspan

1 × $4.00 -

×

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

Five Trading Trends of 2005 with Dan Denning

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Five Trading Trends of 2005 with Dan Denning” below:

Five Trading Trends of 2005 with Dan Denning

The year 2005 was a significant period in the financial markets, marked by notable trading trends that influenced investment strategies and market behavior. Dan Denning, a renowned financial analyst, provided valuable insights into these trends. In this article, we explore the five key trading trends of 2005 as analyzed by Dan Denning, offering a comprehensive guide to understanding their impact and relevance.

Introduction

Who is Dan Denning?

Dan Denning is a respected financial author and investment strategist known for his deep insights into global markets. With a keen eye for identifying market trends, Denning has guided many investors through the complexities of financial markets.

Why Focus on 2005 Trading Trends?

Understanding the trading trends of 2005 provides valuable lessons for current and future market conditions. These trends offer insights into market dynamics, helping investors make informed decisions.

Trend 1: The Rise of Commodities

What Fueled the Commodity Boom?

In 2005, commodities experienced a significant boom driven by increased demand from emerging markets, particularly China and India. This demand surge led to higher prices for oil, metals, and agricultural products.

Impact on Markets

The rise in commodity prices had a ripple effect on global markets. Investors flocked to commodity-related stocks and ETFs, seeking to capitalize on the upward trend.

Oil Prices Surge

Oil prices hit record highs in 2005, affecting various sectors, including transportation and manufacturing. This trend underscored the importance of energy resources in the global economy.

Metals and Mining

Metals like gold, silver, and copper saw substantial price increases. Mining companies benefited significantly, leading to a bullish market for mining stocks.

Trend 2: Growth of Emerging Markets

Why Emerging Markets?

Emerging markets like China, India, and Brazil showed robust economic growth, attracting investors looking for higher returns compared to developed markets.

Investment Opportunities

Stock Market Performance

Emerging market stock indices outperformed their developed market counterparts, providing lucrative investment opportunities.

Foreign Direct Investment (FDI)

Increased FDI flows into emerging markets fueled infrastructure development and economic expansion, further enhancing their attractiveness to investors.

Trend 3: Technology and Innovation

Technological Advancements

2005 witnessed rapid advancements in technology, particularly in the fields of telecommunications and information technology. These innovations spurred growth in tech stocks.

Key Tech Trends

Internet Expansion

The internet continued to expand its reach, with increasing numbers of users and businesses going online. This growth supported the rise of e-commerce and digital advertising.

Mobile Technology

Mobile technology saw significant improvements, leading to the proliferation of smartphones and mobile applications. Companies in the mobile tech space experienced substantial growth.

Trend 4: Interest Rate Policies

Central Bank Actions

Central banks, particularly the Federal Reserve, adjusted interest rates to manage economic growth and inflation. These policy changes influenced market behavior and investment strategies.

Impact on Bonds and Equities

Bond Market Reactions

Interest rate hikes typically lead to lower bond prices. Investors adjusted their portfolios accordingly, shifting towards equities and other asset classes.

Equity Market Dynamics

Equity markets responded to interest rate changes with increased volatility. Investors sought to balance their portfolios to mitigate the impact of rate fluctuations.

Trend 5: Real Estate Boom

Housing Market Surge

The real estate market experienced a boom in 2005, driven by low interest rates and increased demand for housing. This trend led to rising property prices and increased construction activity.

Investment Implications

REITs Performance

Real Estate Investment Trusts (REITs) performed exceptionally well, providing investors with attractive returns through dividends and capital appreciation.

Homebuilders and Developers

Companies involved in homebuilding and property development saw significant growth, benefiting from the robust housing market.

Lessons from 2005

Diversification is Key

One of the key lessons from the 2005 trading trends is the importance of diversification. Spreading investments across different asset classes helps mitigate risk and capitalize on various market opportunities.

Stay Informed

Staying informed about global economic trends and market dynamics is crucial for making sound investment decisions. Regularly monitoring market developments can help identify emerging opportunities.

Conclusion

Why Study Past Trends?

Studying past trading trends, such as those from 2005, provides valuable insights into market behavior and helps investors develop strategies for future market conditions. Dan Denning’s analysis of these trends offers a comprehensive understanding of the factors that drive market movements.

FAQs

1. What were the major trading trends in 2005?

The major trading trends in 2005 included the rise of commodities, growth of emerging markets, technological advancements, interest rate policies, and the real estate boom.

2. How did commodities perform in 2005?

Commodities experienced a significant boom in 2005, driven by increased demand from emerging markets, particularly China and India.

3. Why were emerging markets attractive to investors in 2005?

Emerging markets showed robust economic growth, offering higher returns compared to developed markets. Increased FDI and infrastructure development further enhanced their attractiveness.

4. How did interest rate policies affect the markets in 2005?

Interest rate adjustments by central banks influenced bond and equity markets, leading to increased volatility and shifts in investment strategies.

5. What was the impact of the real estate boom in 2005?

The real estate boom led to rising property prices and increased construction activity. REITs and homebuilding companies benefited significantly from this trend.

Be the first to review “Five Trading Trends of 2005 with Dan Denning” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.