-

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Daily Price Action Lifetime Membership

1 × $23.00

Daily Price Action Lifetime Membership

1 × $23.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

The Price Action Method

1 × $15.00

The Price Action Method

1 × $15.00 -

×

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Divergent swing trading

1 × $54.00

Divergent swing trading

1 × $54.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Trading BIG Moves With Options

1 × $31.00

Trading BIG Moves With Options

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Setups, Entries, and Stops with Rob Hoffman - Become A Better Trader

1 × $6.00

Setups, Entries, and Stops with Rob Hoffman - Become A Better Trader

1 × $6.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Mission Million Money Management Course

1 × $31.00

Mission Million Money Management Course

1 × $31.00 -

×

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00 -

×

FX Cartel Online Course

1 × $31.00

FX Cartel Online Course

1 × $31.00 -

×

FX Accelerator 2

1 × $31.00

FX Accelerator 2

1 × $31.00 -

×

Crypto and Blockchain with MasterClass

1 × $6.00

Crypto and Blockchain with MasterClass

1 × $6.00 -

×

Paradox Forex Course

1 × $5.00

Paradox Forex Course

1 × $5.00 -

×

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00 -

×

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Big Picture Collection with Barbara Rockefeller

1 × $6.00

The Big Picture Collection with Barbara Rockefeller

1 × $6.00 -

×

Trading The Nasdaq Seminar with Alan Rich

1 × $6.00

Trading The Nasdaq Seminar with Alan Rich

1 × $6.00 -

×

Nico FX Journal (SMC)

1 × $5.00

Nico FX Journal (SMC)

1 × $5.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

Thursday Morning Income Strategy with Todd Mitchell

1 × $23.00

Thursday Morning Income Strategy with Todd Mitchell

1 × $23.00 -

×

Module I - Foundation with FX MindShift

1 × $6.00

Module I - Foundation with FX MindShift

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

The Next Great Bubble Boom: How to Profit from the Greatest Boom in History with Harry S.Dent

1 × $6.00

The Next Great Bubble Boom: How to Profit from the Greatest Boom in History with Harry S.Dent

1 × $6.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Investment Valuation

1 × $6.00

Investment Valuation

1 × $6.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

Flux Trigger Pack - Back To The Future Trading

1 × $15.00

Flux Trigger Pack - Back To The Future Trading

1 × $15.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

I3T3 Complete Course with All Modules

1 × $10.00

I3T3 Complete Course with All Modules

1 × $10.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Catching Trend Reversals

1 × $6.00

Catching Trend Reversals

1 × $6.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Radioactive Trading Mastery Course

1 × $6.00

Radioactive Trading Mastery Course

1 × $6.00 -

×

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00 -

×

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00 -

×

Rate of Change Indicator with Alphashark

1 × $31.00

Rate of Change Indicator with Alphashark

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Trend Trader PRO Suite Training Course

1 × $5.00

Trend Trader PRO Suite Training Course

1 × $5.00 -

×

Combo 4 New Courses From AmiBroker

1 × $54.00

Combo 4 New Courses From AmiBroker

1 × $54.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Intermediate to Advance Trading Strategies

1 × $6.00

Intermediate to Advance Trading Strategies

1 × $6.00 -

×

TechnicalGodsFX Advanced Forex Education

1 × $7.00

TechnicalGodsFX Advanced Forex Education

1 × $7.00 -

×

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

Wysetrade Forex Masterclass 3.0

1 × $6.00

Wysetrade Forex Masterclass 3.0

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00 -

×

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

TheVWAP with Zach Hurwitz

1 × $5.00

TheVWAP with Zach Hurwitz

1 × $5.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00 -

×

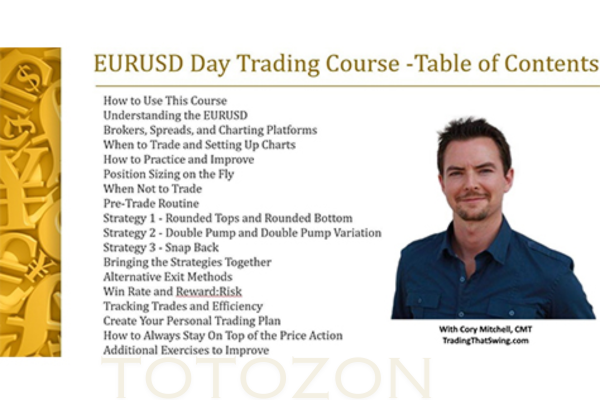

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Options for Begginers with Lucas Downey

1 × $6.00

Options for Begginers with Lucas Downey

1 × $6.00 -

×

Bennett McDowell – A Trader’s Money Management System

1 × $6.00

Bennett McDowell – A Trader’s Money Management System

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00 -

×

The Ultimate Forex System

1 × $6.00

The Ultimate Forex System

1 × $6.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Atlas Edition Course with Apex Paragon Trading

1 × $6.00

Atlas Edition Course with Apex Paragon Trading

1 × $6.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

The WWA Bootcamp

1 × $7.00

The WWA Bootcamp

1 × $7.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

Trader University with Matthew Kratter

1 × $6.00

Trader University with Matthew Kratter

1 × $6.00 -

×

Trading Signals And Training 100

1 × $6.00

Trading Signals And Training 100

1 × $6.00 -

×

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Day Trading Academy

1 × $54.00

Day Trading Academy

1 × $54.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Ultimate Options Blue Print Course

1 × $23.00

Ultimate Options Blue Print Course

1 × $23.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

CyberTrading University – Advanced Stock Course

1 × $31.00

CyberTrading University – Advanced Stock Course

1 × $31.00 -

×

Austin Passamonte Package ( Discount 25 % )

1 × $15.00

Austin Passamonte Package ( Discount 25 % )

1 × $15.00 -

×

Tradingology Home Study Options Course

1 × $23.00

Tradingology Home Study Options Course

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00 -

×

Value Investing Today with Charles Brandes

1 × $6.00

Value Investing Today with Charles Brandes

1 × $6.00 -

×

Options Master Class

1 × $54.00

Options Master Class

1 × $54.00 -

×

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00

Secrets of a Pivot Boss. Revealing Proven Methods for Profiting in The Market with Franklin Ochoa

1 × $6.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

Demystifying Fed's Monetary Policy

1 × $6.00

Demystifying Fed's Monetary Policy

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

All in One Forex Course with VintagEducation

1 × $31.00

All in One Forex Course with VintagEducation

1 × $31.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

The Ultimate Investor with Dean LeBaron

1 × $4.00

The Ultimate Investor with Dean LeBaron

1 × $4.00 -

×

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00 -

×

Fund of Funds Investing: A Roadmap to Portfolio Diversification with David Strachman & Richard Bookbinder

1 × $6.00

Fund of Funds Investing: A Roadmap to Portfolio Diversification with David Strachman & Richard Bookbinder

1 × $6.00 -

×

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00 -

×

Pivot Day Trader for NinjaTrader

1 × $31.00

Pivot Day Trader for NinjaTrader

1 × $31.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The WallStreet Waltz with Ken Fisher

1 × $6.00

The WallStreet Waltz with Ken Fisher

1 × $6.00 -

×

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00 -

×

International Assignments with Linda K.Stroh

1 × $6.00

International Assignments with Linda K.Stroh

1 × $6.00 -

×

Day Trading With Short Term Price Patterns and Opening Range Breakout

1 × $6.00

Day Trading With Short Term Price Patterns and Opening Range Breakout

1 × $6.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

TRADING WITH TIME with Frank Barillaro

1 × $8.00

TRADING WITH TIME with Frank Barillaro

1 × $8.00 -

×

Big Fish: Mako Momentum Strategy

1 × $23.00

Big Fish: Mako Momentum Strategy

1 × $23.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

Profit Freedom Blueprint with High Performance Trading

1 × $5.00

Profit Freedom Blueprint with High Performance Trading

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Five Trading Trends of 2005 with Dan Denning

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Five Trading Trends of 2005 with Dan Denning” below:

Five Trading Trends of 2005 with Dan Denning

The year 2005 was a significant period in the financial markets, marked by notable trading trends that influenced investment strategies and market behavior. Dan Denning, a renowned financial analyst, provided valuable insights into these trends. In this article, we explore the five key trading trends of 2005 as analyzed by Dan Denning, offering a comprehensive guide to understanding their impact and relevance.

Introduction

Who is Dan Denning?

Dan Denning is a respected financial author and investment strategist known for his deep insights into global markets. With a keen eye for identifying market trends, Denning has guided many investors through the complexities of financial markets.

Why Focus on 2005 Trading Trends?

Understanding the trading trends of 2005 provides valuable lessons for current and future market conditions. These trends offer insights into market dynamics, helping investors make informed decisions.

Trend 1: The Rise of Commodities

What Fueled the Commodity Boom?

In 2005, commodities experienced a significant boom driven by increased demand from emerging markets, particularly China and India. This demand surge led to higher prices for oil, metals, and agricultural products.

Impact on Markets

The rise in commodity prices had a ripple effect on global markets. Investors flocked to commodity-related stocks and ETFs, seeking to capitalize on the upward trend.

Oil Prices Surge

Oil prices hit record highs in 2005, affecting various sectors, including transportation and manufacturing. This trend underscored the importance of energy resources in the global economy.

Metals and Mining

Metals like gold, silver, and copper saw substantial price increases. Mining companies benefited significantly, leading to a bullish market for mining stocks.

Trend 2: Growth of Emerging Markets

Why Emerging Markets?

Emerging markets like China, India, and Brazil showed robust economic growth, attracting investors looking for higher returns compared to developed markets.

Investment Opportunities

Stock Market Performance

Emerging market stock indices outperformed their developed market counterparts, providing lucrative investment opportunities.

Foreign Direct Investment (FDI)

Increased FDI flows into emerging markets fueled infrastructure development and economic expansion, further enhancing their attractiveness to investors.

Trend 3: Technology and Innovation

Technological Advancements

2005 witnessed rapid advancements in technology, particularly in the fields of telecommunications and information technology. These innovations spurred growth in tech stocks.

Key Tech Trends

Internet Expansion

The internet continued to expand its reach, with increasing numbers of users and businesses going online. This growth supported the rise of e-commerce and digital advertising.

Mobile Technology

Mobile technology saw significant improvements, leading to the proliferation of smartphones and mobile applications. Companies in the mobile tech space experienced substantial growth.

Trend 4: Interest Rate Policies

Central Bank Actions

Central banks, particularly the Federal Reserve, adjusted interest rates to manage economic growth and inflation. These policy changes influenced market behavior and investment strategies.

Impact on Bonds and Equities

Bond Market Reactions

Interest rate hikes typically lead to lower bond prices. Investors adjusted their portfolios accordingly, shifting towards equities and other asset classes.

Equity Market Dynamics

Equity markets responded to interest rate changes with increased volatility. Investors sought to balance their portfolios to mitigate the impact of rate fluctuations.

Trend 5: Real Estate Boom

Housing Market Surge

The real estate market experienced a boom in 2005, driven by low interest rates and increased demand for housing. This trend led to rising property prices and increased construction activity.

Investment Implications

REITs Performance

Real Estate Investment Trusts (REITs) performed exceptionally well, providing investors with attractive returns through dividends and capital appreciation.

Homebuilders and Developers

Companies involved in homebuilding and property development saw significant growth, benefiting from the robust housing market.

Lessons from 2005

Diversification is Key

One of the key lessons from the 2005 trading trends is the importance of diversification. Spreading investments across different asset classes helps mitigate risk and capitalize on various market opportunities.

Stay Informed

Staying informed about global economic trends and market dynamics is crucial for making sound investment decisions. Regularly monitoring market developments can help identify emerging opportunities.

Conclusion

Why Study Past Trends?

Studying past trading trends, such as those from 2005, provides valuable insights into market behavior and helps investors develop strategies for future market conditions. Dan Denning’s analysis of these trends offers a comprehensive understanding of the factors that drive market movements.

FAQs

1. What were the major trading trends in 2005?

The major trading trends in 2005 included the rise of commodities, growth of emerging markets, technological advancements, interest rate policies, and the real estate boom.

2. How did commodities perform in 2005?

Commodities experienced a significant boom in 2005, driven by increased demand from emerging markets, particularly China and India.

3. Why were emerging markets attractive to investors in 2005?

Emerging markets showed robust economic growth, offering higher returns compared to developed markets. Increased FDI and infrastructure development further enhanced their attractiveness.

4. How did interest rate policies affect the markets in 2005?

Interest rate adjustments by central banks influenced bond and equity markets, leading to increased volatility and shifts in investment strategies.

5. What was the impact of the real estate boom in 2005?

The real estate boom led to rising property prices and increased construction activity. REITs and homebuilding companies benefited significantly from this trend.

Be the first to review “Five Trading Trends of 2005 with Dan Denning” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.