-

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

Trading Trend Pullbacks – 3-Step Technical Analysis Method with Richard Deutsch

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

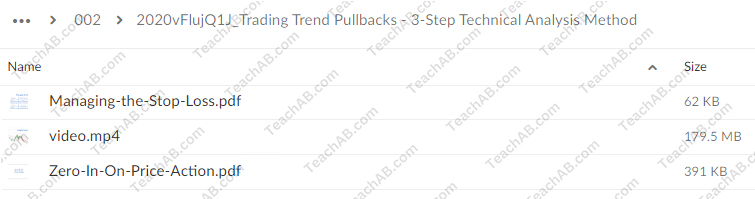

File Size: 179.9 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Trend Pullbacks – 3-Step Technical Analysis Method with Richard Deutsch” below:

Trading Trend Pullbacks – 3-Step Technical Analysis Method with Richard Deutsch

Trading trend pullbacks can be a highly effective strategy for capturing market moves. Richard Deutsch, a renowned trader, has developed a simple yet powerful three-step method for identifying and trading pullbacks. This article will guide you through the 3-step technical analysis method for trading trend pullbacks, helping you to enhance your trading skills and profitability.

Understanding Trend Pullbacks

What Are Trend Pullbacks?

Trend pullbacks are temporary reversals within a larger trend. They offer opportunities to enter a trade at a better price point before the trend resumes.

Why Trade Pullbacks?

- Better Entry Points: Entering during pullbacks allows for buying low and selling high.

- Risk Management: Provides a clear risk-reward ratio.

- Trend Confirmation: Ensures the larger trend is still in place.

Step 1: Identifying the Trend

Before you can trade pullbacks, you must first identify the overall trend. This step is crucial as it sets the stage for the entire trading strategy.

Using Moving Averages

Moving averages are effective tools for identifying trends. The two most common types are:

- Simple Moving Average (SMA): Calculated by averaging the closing prices over a specific period.

- Exponential Moving Average (EMA): Places more weight on recent prices, making it more responsive to new data.

Trend Indicators

- Uptrend: Higher highs and higher lows.

- Downtrend: Lower highs and lower lows.

Step 2: Recognizing Pullbacks

Once the trend is identified, the next step is to recognize pullbacks within that trend. Pullbacks are short-term movements against the direction of the prevailing trend.

Using Fibonacci Retracement

Fibonacci retracement levels are commonly used to identify potential pullback areas. Key levels include 38.2%, 50%, and 61.8%.

Support and Resistance

- Support Levels: Areas where the price tends to find buying interest.

- Resistance Levels: Areas where the price tends to face selling pressure.

Step 3: Entering the Trade

After identifying the trend and recognizing the pullback, the final step is entering the trade. This step involves determining the best entry point, stop-loss, and target levels.

Entry Points

- Confirmation Signals: Look for candlestick patterns or technical indicators that confirm the trend is resuming.

- Volume Analysis: Increased volume during a pullback can signal a strong continuation of the trend.

Setting Stop-Loss and Take-Profit Levels

- Stop-Loss: Place it below the pullback low in an uptrend or above the pullback high in a downtrend.

- Take-Profit: Set it at a previous high in an uptrend or a previous low in a downtrend.

Common Mistakes to Avoid

Trading trend pullbacks can be rewarding, but it’s important to avoid common pitfalls.

Ignoring the Larger Trend

Always ensure that the larger trend is still intact before entering a trade based on a pullback.

Overtrading

Trading too frequently can lead to significant losses. Stick to your strategy and avoid impulsive decisions.

Poor Risk Management

Never trade without a stop-loss. Proper risk management is crucial to long-term success.

Advanced Tips for Trading Pullbacks

For those looking to refine their pullback trading strategy, consider these advanced tips.

Combining Indicators

Use multiple technical indicators to confirm your analysis. For example, combine moving averages with Fibonacci retracement levels.

Staying Updated with Market News

Market news and events can impact trends and pullbacks. Stay informed to make more accurate trading decisions.

Practicing with Demo Accounts

Use demo accounts to practice your pullback trading strategy without risking real money. This helps in honing your skills and gaining confidence.

Case Study: Successful Pullback Trade

Let’s look at a case study to understand how to apply the 3-step method in real trading scenarios.

Case Study: Apple Inc. (AAPL)

- Identifying the Trend: AAPL is in a strong uptrend, confirmed by the 50-day EMA.

- Recognizing the Pullback: The stock pulls back to the 38.2% Fibonacci retracement level.

- Entering the Trade: A bullish candlestick pattern forms at the retracement level, confirming the trend resumption. Enter the trade with a stop-loss below the pullback low and a take-profit at the previous high.

Conclusion

Trading trend pullbacks using Richard Deutsch’s 3-step technical analysis method can significantly improve your trading outcomes. By identifying the trend, recognizing pullbacks, and executing well-planned trades, you can take advantage of market movements with confidence and precision.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trading Trend Pullbacks – 3-Step Technical Analysis Method with Richard Deutsch” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.