-

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Climate Behaviour with Feibel Trading

1 × $6.00

Climate Behaviour with Feibel Trading

1 × $6.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Trading Option Greeks with Dan Passarelli

1 × $6.00

Trading Option Greeks with Dan Passarelli

1 × $6.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

The Ones That know

1 × $41.00

The Ones That know

1 × $41.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

Forecast, Filings, & News with Jtrader

1 × $6.00

Forecast, Filings, & News with Jtrader

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Trading Straddles, Strangles, Long Gamma, VXX & UVXY with Option Pit

1 × $39.00

Trading Straddles, Strangles, Long Gamma, VXX & UVXY with Option Pit

1 × $39.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

Elite Core Advance Course with Urban Forex

1 × $5.00

Elite Core Advance Course with Urban Forex

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

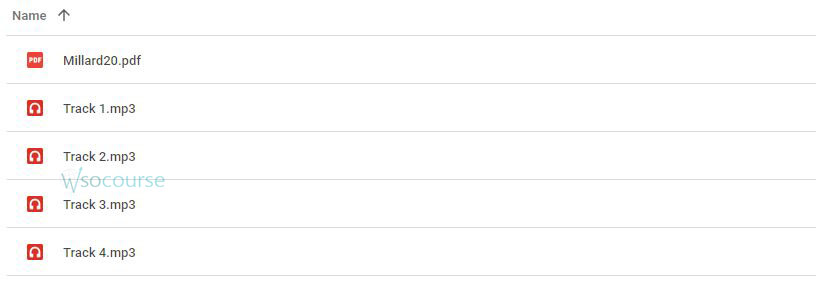

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.