-

×

Pete Fader VSA Course

1 × $6.00

Pete Fader VSA Course

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

FMG Online Course with FMG Traders

1 × $6.00

FMG Online Course with FMG Traders

1 × $6.00 -

×

Bill Williams Package ( Discount 30% )

1 × $6.00

Bill Williams Package ( Discount 30% )

1 × $6.00 -

×

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

Portfolio Management using Machine Learning: Hierarchical Risk Parity

1 × $39.00

Portfolio Management using Machine Learning: Hierarchical Risk Parity

1 × $39.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Stock Selection Course with Dave Landry

1 × $6.00

Stock Selection Course with Dave Landry

1 × $6.00 -

×

The Binary Trigger (Video, Books) with John Piper

1 × $6.00

The Binary Trigger (Video, Books) with John Piper

1 × $6.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

Computational Financial Mathematics with Mathematica

1 × $6.00

Computational Financial Mathematics with Mathematica

1 × $6.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

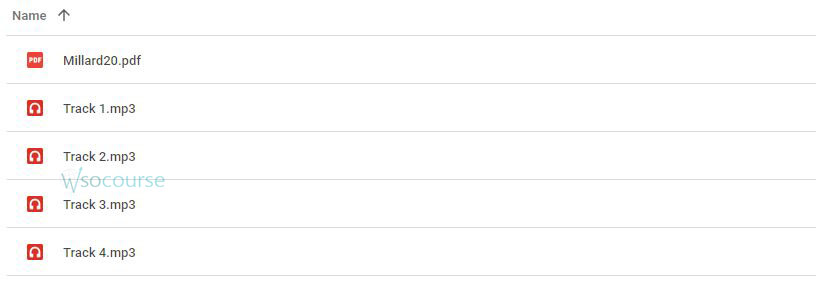

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.