-

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

Advanced Fibonacci Course with Major League Trading

1 × $23.00

Advanced Fibonacci Course with Major League Trading

1 × $23.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00 -

×

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

Elliott Wave Street Course with Juan Maldonado

1 × $17.00

Elliott Wave Street Course with Juan Maldonado

1 × $17.00 -

×

Gann’s Secret with Jeanne Long

1 × $4.00

Gann’s Secret with Jeanne Long

1 × $4.00 -

×

Spread Trading

1 × $6.00

Spread Trading

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

MACK - PATS Simple ES Scalping Strategy

1 × $15.00

MACK - PATS Simple ES Scalping Strategy

1 × $15.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Forex Mastermind with FOREX4NOOBS

1 × $5.00

Forex Mastermind with FOREX4NOOBS

1 × $5.00 -

×

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00 -

×

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00 -

×

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00 -

×

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Road Map to Riches with Steve Wirrick

1 × $6.00

Road Map to Riches with Steve Wirrick

1 × $6.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Campaign Trading with John Sweeney

1 × $6.00

Campaign Trading with John Sweeney

1 × $6.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

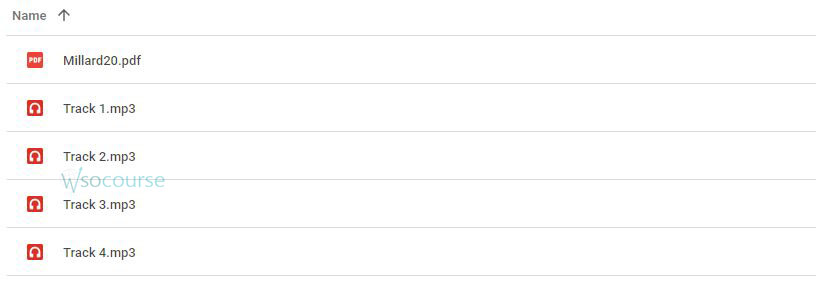

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.