-

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

Price Action Trader Training

1 × $6.00

Price Action Trader Training

1 × $6.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00 -

×

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00 -

×

Snapbacks CD

1 × $6.00

Snapbacks CD

1 × $6.00 -

×

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00 -

×

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Trade Like a Market Maker with James Ramelli - AlphaShark

1 × $15.00

Trade Like a Market Maker with James Ramelli - AlphaShark

1 × $15.00 -

×

Read the Greed-Live! Course

1 × $15.00

Read the Greed-Live! Course

1 × $15.00 -

×

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00 -

×

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

Constellation Software

1 × $85.00

Constellation Software

1 × $85.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Pinpoint Profit Method Class

1 × $31.00

Pinpoint Profit Method Class

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Speculator King 1967 with Jesse Livermore

1 × $6.00

Speculator King 1967 with Jesse Livermore

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

Advanced Price Action Course with ZenFX

1 × $5.00

Advanced Price Action Course with ZenFX

1 × $5.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

MahadFX Lifetime Discord Access

1 × $20.00

MahadFX Lifetime Discord Access

1 × $20.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

Understanding the Markets with David Loader

1 × $6.00

Understanding the Markets with David Loader

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Trading System Building Blocks with John Hill

1 × $6.00

Trading System Building Blocks with John Hill

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

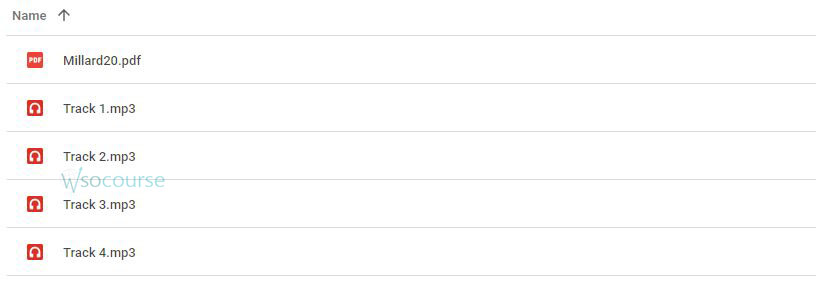

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.