-

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

Smart Money Concepts with JordyBanks

1 × $6.00

Smart Money Concepts with JordyBanks

1 × $6.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00 -

×

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

The M21 Strategy

1 × $15.00

The M21 Strategy

1 × $15.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Set & Forget Complete 2021

1 × $13.00

Set & Forget Complete 2021

1 × $13.00 -

×

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00 -

×

Price Headley - Using Williams %R The BigTrends Way

1 × $6.00

Price Headley - Using Williams %R The BigTrends Way

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

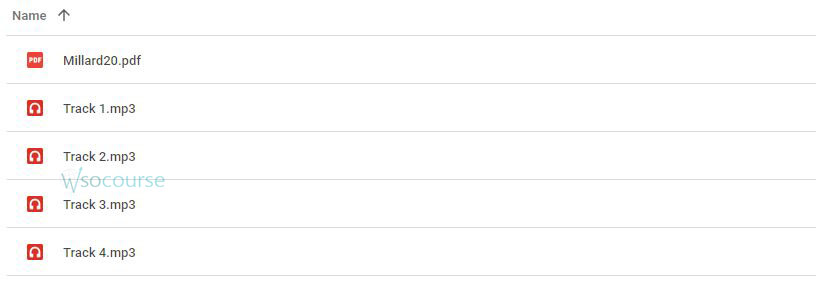

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.