-

×

Heiken Ashi 101

1 × $15.00

Heiken Ashi 101

1 × $15.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

Programming in Python For Traders

1 × $78.00

Programming in Python For Traders

1 × $78.00 -

×

Investment Valuation

1 × $6.00

Investment Valuation

1 × $6.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

The Stock Rocket Trading System with Dave Wooding

1 × $6.00

The Stock Rocket Trading System with Dave Wooding

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

The Cash Flow Bootcamp with John Macgregor

1 × $233.00

The Cash Flow Bootcamp with John Macgregor

1 × $233.00 -

×

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00 -

×

Options for Begginers with Lucas Downey

1 × $6.00

Options for Begginers with Lucas Downey

1 × $6.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

60 Minute Trader with Chris Kobewka

1 × $6.00

60 Minute Trader with Chris Kobewka

1 × $6.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Optimize Funding Program with Solo Network

1 × $5.00

Optimize Funding Program with Solo Network

1 × $5.00 -

×

Live Online Masterclass with XSPY Trader

1 × $5.00

Live Online Masterclass with XSPY Trader

1 × $5.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Full Credit Spreads with Ryan Litchfield

1 × $6.00

Full Credit Spreads with Ryan Litchfield

1 × $6.00 -

×

Cluster Delta with Gova Trading Academy

1 × $5.00

Cluster Delta with Gova Trading Academy

1 × $5.00 -

×

Seasonality. Systems, Strategies & Signals

1 × $6.00

Seasonality. Systems, Strategies & Signals

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

Foolproof Forex Trading with Louise Woof

1 × $6.00

Foolproof Forex Trading with Louise Woof

1 × $6.00 -

×

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00 -

×

Emini Volume Break Out System

1 × $6.00

Emini Volume Break Out System

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

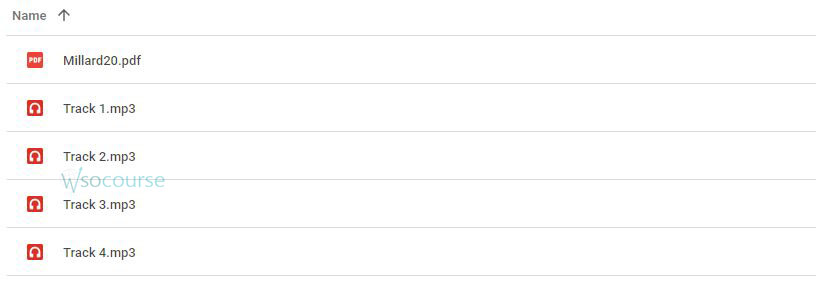

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.