-

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00 -

×

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

Smashing False Breakouts with Better System Trader

1 × $5.00

Smashing False Breakouts with Better System Trader

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Know Where You Live. Risk Management Toolkit - Seth Gregory & Bob Lambert

1 × $6.00

Know Where You Live. Risk Management Toolkit - Seth Gregory & Bob Lambert

1 × $6.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Complete Guide to Online Stock Market Investing (2nd Edition) with Alexander Davidson

1 × $6.00

Complete Guide to Online Stock Market Investing (2nd Edition) with Alexander Davidson

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00 -

×

Correct Stage for Average with Stan Weinstein

1 × $6.00

Correct Stage for Average with Stan Weinstein

1 × $6.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Sample Item Sets 2003 - CFA Level 3

1 × $6.00

Sample Item Sets 2003 - CFA Level 3

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Market Evolution

1 × $6.00

Market Evolution

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

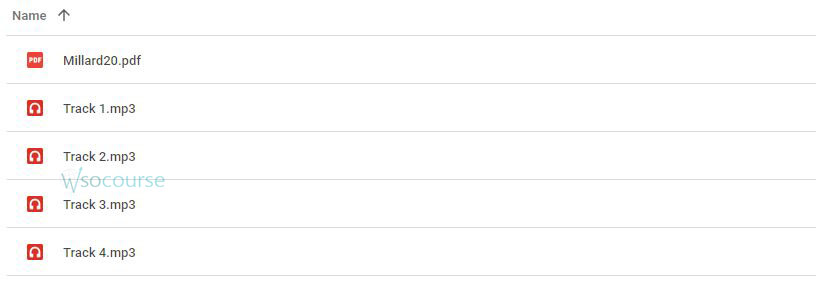

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.