-

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

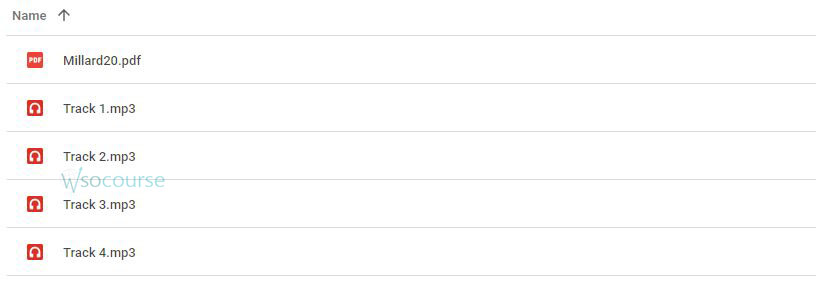

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.