-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Advanced Trading Course with Edney Pinheiro

1 × $5.00

Advanced Trading Course with Edney Pinheiro

1 × $5.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Spartan Renko 2.0 Workshop 2017

1 × $23.00

Spartan Renko 2.0 Workshop 2017

1 × $23.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Stock Patterns for Day Trading Home Study Course

1 × $23.00

Stock Patterns for Day Trading Home Study Course

1 × $23.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

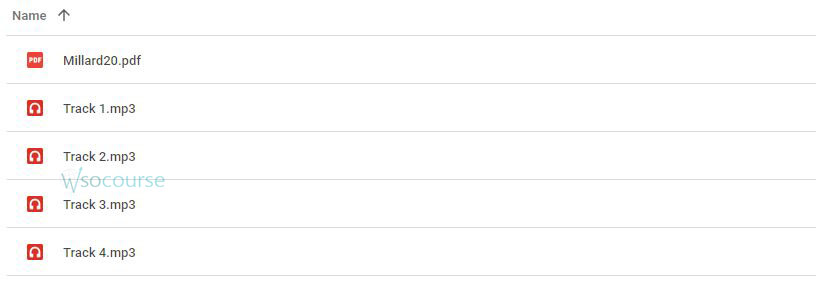

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.