-

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Does a Holy Grail Really Exist with John Hayden

1 × $6.00

Does a Holy Grail Really Exist with John Hayden

1 × $6.00 -

×

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Stupid Trader – Play Safe!

1 × $6.00

Stupid Trader – Play Safe!

1 × $6.00 -

×

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Superstock Investor with Charles LaLoggia

1 × $6.00

The Superstock Investor with Charles LaLoggia

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Master Class with Gerald Appel

1 × $6.00

Master Class with Gerald Appel

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

Smart Money Course with Forex XL

1 × $6.00

Smart Money Course with Forex XL

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Supply and Demand Video Course with JamesFXS

1 × $13.00

Supply and Demand Video Course with JamesFXS

1 × $13.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

George Bayer Squarring the Circle for Excel

1 × $6.00

George Bayer Squarring the Circle for Excel

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

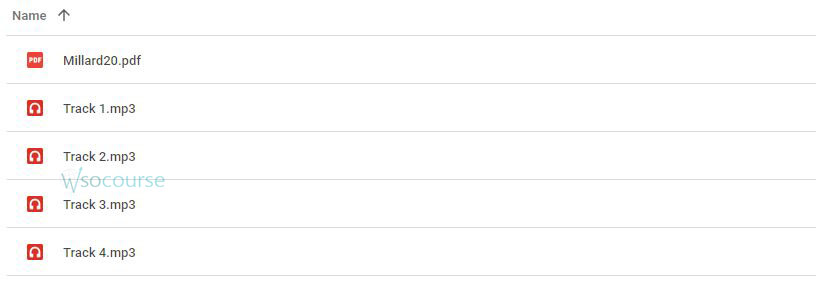

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.