-

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

George Bayer Squarring the Circle for Excel

1 × $6.00

George Bayer Squarring the Circle for Excel

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Forex Secrets Exposed

1 × $15.00

Forex Secrets Exposed

1 × $15.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

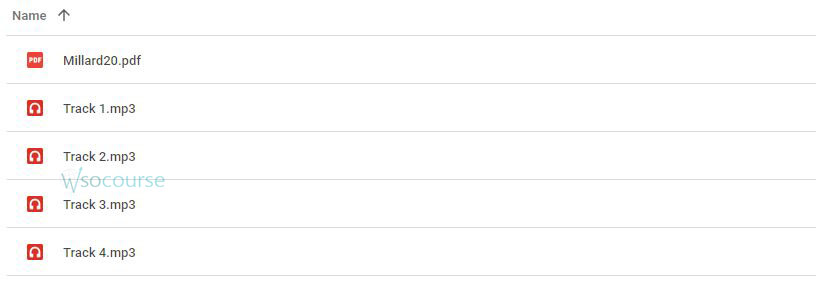

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.