-

×

Dhia’s Journal 2022

1 × $6.00

Dhia’s Journal 2022

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

Seasonality. Systems, Strategies & Signals

1 × $6.00

Seasonality. Systems, Strategies & Signals

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

The Binary Trigger (Video, Books) with John Piper

1 × $6.00

The Binary Trigger (Video, Books) with John Piper

1 × $6.00 -

×

Forex Strategy Master with Russ Horn

1 × $6.00

Forex Strategy Master with Russ Horn

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

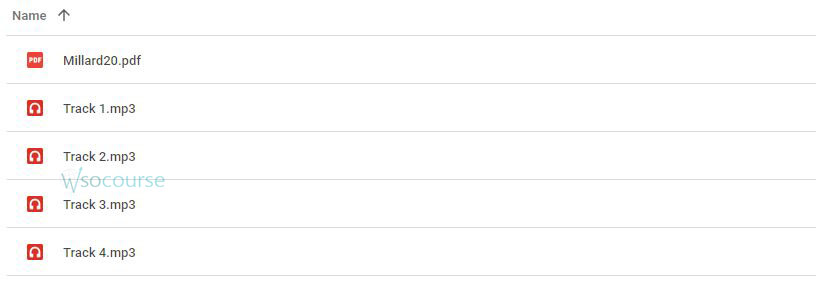

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.