-

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Affinity Foundation Option Course with Affinitytrading

1 × $6.00

Affinity Foundation Option Course with Affinitytrading

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

FX Accelerator

1 × $31.00

FX Accelerator

1 × $31.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Prometheus Course with QuantProgram

1 × $13.00

Prometheus Course with QuantProgram

1 × $13.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

The Janus Factor with Gary Anderson

1 × $6.00

The Janus Factor with Gary Anderson

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

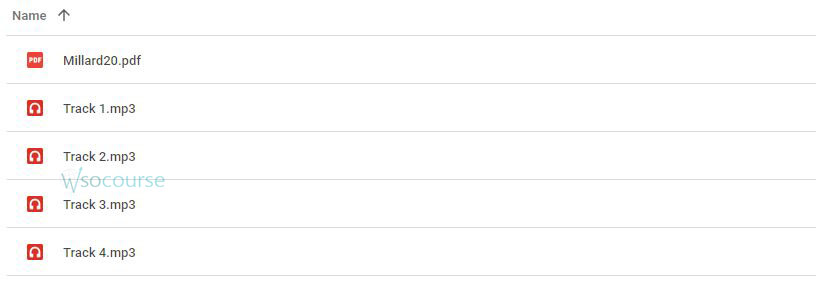

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.