-

×

The Secrets to Successful Forex Trading 2004

1 × $6.00

The Secrets to Successful Forex Trading 2004

1 × $6.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

The Forex Scalper

1 × $5.00

The Forex Scalper

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Technical Analysis Classes (Video, Manuals)

1 × $6.00

Technical Analysis Classes (Video, Manuals)

1 × $6.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

The Ultimate Professional Trader Plus CD Library

1 × $31.00

The Ultimate Professional Trader Plus CD Library

1 × $31.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Weekly Playbook Workshop #1

1 × $31.00

Weekly Playbook Workshop #1

1 × $31.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00 -

×

Bitcoin - Trading – Watch me manage my own account

1 × $8.00

Bitcoin - Trading – Watch me manage my own account

1 × $8.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00 -

×

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Forex On Fire System

1 × $6.00

The Forex On Fire System

1 × $6.00 -

×

The Forex Equinox

1 × $54.00

The Forex Equinox

1 × $54.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Forex Trading Academy with Steve Luke

1 × $5.00

The Forex Trading Academy with Steve Luke

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Ultimate MT4 Course

1 × $15.00

Ultimate MT4 Course

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Turtle Soup Course with ICT Trader Romeo

1 × $5.00

Turtle Soup Course with ICT Trader Romeo

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Claytrader - Options Trading Simplified

1 × $15.00

Claytrader - Options Trading Simplified

1 × $15.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

The Forex Trading Coach Course

1 × $6.00

The Forex Trading Coach Course

1 × $6.00 -

×

Universal Clock with Jeanne Long

1 × $6.00

Universal Clock with Jeanne Long

1 × $6.00 -

×

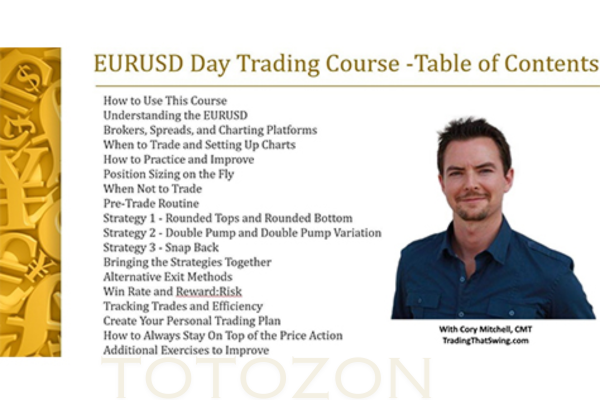

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

DreamerGG – Mentorship 2023

1 × $5.00

DreamerGG – Mentorship 2023

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Bottom Springers. Bonsai Elite WaveTrader Course

1 × $15.00

Bottom Springers. Bonsai Elite WaveTrader Course

1 × $15.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Transparent FX Course

1 × $6.00

Transparent FX Course

1 × $6.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00 -

×

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

Forex Eye

1 × $5.00

Forex Eye

1 × $5.00

Self-Managed Trading with Stochastics By George Lane

$4.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Self-Managed Trading Stochastics Lane Guide

Introduction

Self-managed trading empowers individual traders to take control of their investment strategies. One of the most effective tools for achieving this is the stochastic oscillator, developed by George Lane. This article delves into the intricacies of self-managed trading with stochastics, providing a comprehensive guide to mastering this powerful technical indicator.

Understanding Stochastics

What is the Stochastic Oscillator?

The stochastic oscillator is a momentum indicator that compares a particular closing price of a security to a range of its prices over a certain period. The sensitivity of the oscillator to market movements can be reduced by adjusting the time period or taking a moving average of the result.

Historical Background

George Lane introduced the stochastic oscillator in the late 1950s. Lane believed that the oscillator’s position relative to its range indicated the momentum of the security, with the best signals often occurring when the momentum changes direction.

Components of the Stochastic Oscillator

%K Line

The %K line represents the raw stochastic value for each period. It is calculated as follows: %K=(Current Close−Lowest Low)(Highest High−Lowest Low)×100\%K = \frac{(Current\ Close – Lowest\ Low)}{(Highest\ High – Lowest\ Low)} \times 100%K=(Highest High−Lowest Low)(Current Close−Lowest Low)×100

%D Line

The %D line is a moving average of the %K line, often a 3-period simple moving average, which smooths out the %K line to produce a more reliable signal.

Stochastic Ranges

- 0-20: Indicates an oversold condition.

- 80-100: Indicates an overbought condition.

Applying Stochastics in Trading

Identifying Overbought and Oversold Conditions

Overbought

When the stochastic lines are above 80, it suggests that the security might be overbought and due for a correction.

Oversold

When the stochastic lines are below 20, it suggests that the security might be oversold and due for a bounce.

Generating Buy and Sell Signals

Buy Signals

A buy signal occurs when the %K line crosses above the %D line while both are below 20, indicating a potential upward momentum.

Sell Signals

A sell signal occurs when the %K line crosses below the %D line while both are above 80, indicating a potential downward momentum.

Divergence Analysis

Bullish Divergence

Occurs when prices are making new lows, but the stochastic is making higher lows, indicating a potential upward reversal.

Bearish Divergence

Occurs when prices are making new highs, but the stochastic is making lower highs, indicating a potential downward reversal.

Advanced Strategies with Stochastics

Stochastics and Moving Averages

Combining Indicators

Combining the stochastic oscillator with moving averages can enhance signal accuracy. For example, using a 50-day moving average can help confirm stochastic signals.

Entry and Exit Points

Use stochastic crossovers in conjunction with moving average crossovers to identify optimal entry and exit points.

Multi-Time Frame Analysis

Aligning Time Frames

Analyze stochastics across multiple time frames (e.g., daily and weekly) to confirm signals and improve trading accuracy.

Strategy Example

A buy signal on the daily chart that aligns with an oversold condition on the weekly chart can provide a stronger confirmation for entering a trade.

Stochastics and Support/Resistance Levels

Identifying Key Levels

Combine stochastic signals with support and resistance levels to enhance trade reliability.

Trade Execution

Enter trades when stochastic signals align with bounces off support or rejections from resistance levels.

Benefits of Using Stochastics

Simplicity and Clarity

The stochastic oscillator is straightforward to understand and apply, making it accessible for traders of all experience levels.

Effective in Various Markets

Stochastics can be used across different markets, including stocks, forex, and commodities, providing versatile trading opportunities.

Momentum Insights

The oscillator provides valuable insights into market momentum, helping traders make informed decisions about potential price reversals.

Challenges and Limitations

False Signals

In choppy or sideways markets, the stochastic oscillator can generate false signals. Combining it with other indicators can help mitigate this risk.

Lagging Indicator

As a lagging indicator, stochastics can sometimes be slow to respond to sudden market changes. It’s essential to use it alongside leading indicators.

Tips for Effective Use

Combining Indicators

Always combine stochastics with other technical indicators like RSI, moving averages, or MACD to confirm signals and reduce false positives.

Continuous Learning

Stay updated with the latest trading strategies and continuously refine your skills in using the stochastic oscillator.

Backtesting Strategies

Before applying any new strategy in live trading, backtest it on historical data to ensure its effectiveness.

Conclusion

Self-managed trading with stochastics, as pioneered by George Lane, offers a robust framework for making informed trading decisions. By understanding the components and applications of the stochastic oscillator, traders can enhance their ability to identify potential market reversals and improve their overall trading performance. As with any trading tool, continuous learning and adaptation are key to success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Self-Managed Trading with Stochastics By George Lane” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.