-

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advance Courses for Members

1 × $15.00

Advance Courses for Members

1 × $15.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

W.D.Ganns Astrological Method

1 × $6.00

W.D.Ganns Astrological Method

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Ultimate Option Strategy Guide

1 × $31.00

Ultimate Option Strategy Guide

1 × $31.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$31.00Current price is: $31.00.

SKU: 54176Rf49al

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

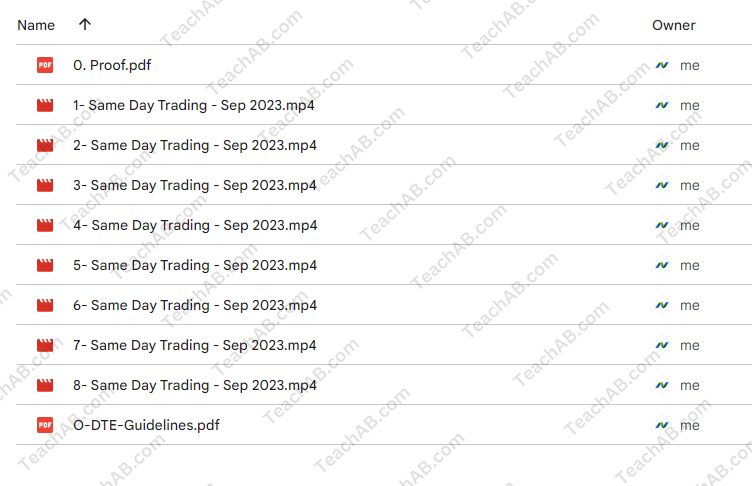

You may check content proof of “Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Trading Short-Term Same Day Trades Sep 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

In the dynamic world of trading, where the tide turns with the blink of an eye, mastering the art of short-term, same-day trades is crucial for those looking to capitalize on fleeting market opportunities. September 2023 saw a remarkable collaboration between Dan Sheridan and Mark Fenton, veterans in the field, under the banner of Sheridan Options Mentoring. This article delves into the essence of their strategy, offering insights into making the most of same-day trades.

Understanding Short-Term Trades

What Constitutes a Short-Term Trade?

Short-term trading involves holding onto your assets for a brief period, typically a day. This approach seeks to benefit from minor market movements, offering a fast-paced trading environment that requires quick decisions and an acute understanding of market trends.

The Appeal of Same-Day Trades

Why do traders gravitate towards such a whirlwind approach? The answer lies in the potential for rapid gains, the excitement of a fast-moving market, and the ability to mitigate long-term risks associated with market fluctuations.

The Sheridan-Fenton Strategy

Philosophy Behind the Approach

Dan Sheridan and Mark Fenton’s strategy for same-day trades revolves around meticulous market analysis, precise timing, and risk management. Their method is not just about making quick moves but making smart, informed ones.

Core Principles

- Risk Management: Emphasizing the importance of knowing when to exit, not just when to enter.

- Market Analysis: Leveraging technical analysis to identify potential entry and exit points.

- Discipline: Maintaining a disciplined approach to trading without succumbing to market emotions.

Implementing the Strategy

Starting with Research

Before diving into the fray, conducting thorough research is imperative. This includes understanding market trends, the factors influencing them, and the potential impact on your trades.

Technical Analysis Tools

Utilizing various technical analysis tools can provide insights into market behavior, helping identify profitable trading opportunities.

Setting Stop Losses

An essential component of risk management, setting stop losses ensures that potential losses are capped, protecting the trader from significant downturns.

Risk Management in Short-Term Trading

Understanding Leverage

Leverage can amplify gains but also losses. It’s vital to use leverage wisely, understanding its implications on your trading capital.

The Role of Stop Losses

Stop losses are not just a safety net but a strategic tool that can be used to lock in profits and limit losses.

Making the Most of Market Movements

Identifying Entry and Exit Points

Key to the Sheridan-Fenton strategy is the ability to pinpoint when to enter and exit a trade, maximizing potential profits while minimizing risks.

Adapting to Market Changes

The market is ever-changing, and flexibility in strategy is crucial. Adapting to market conditions can mean the difference between profit and loss.

Psychology of Short-Term Trading

Dealing with Volatility

Short-term trading involves navigating through market volatility. It requires a cool head and a clear strategy to turn market movements to your advantage.

Avoiding Emotional Trading

One of the biggest pitfalls in trading is letting emotions drive decisions. The Sheridan-Fenton approach advocates for a disciplined, emotion-free trading environment.

Leveraging Technology

Utilizing Trading Platforms

Modern trading platforms offer a plethora of tools and resources that can enhance the trading experience, from charting software to real-time data feeds.

The Importance of Continuous Learning

The trading landscape is constantly evolving, and staying informed through webinars, courses, and other resources is key to maintaining an edge in the market.

Specifics of the Class

Class Description:

Dan is thrilled to be back teaching the “Short Term / Same Day Trades or Zero DTE” course in September 2023 for another month.

After learning risk management strategies at the Chicago Board Options Exchange Pits, Dan Sheridan has been a risk management instructor for many years.

In September 2023, enroll in our 4-week Live Teaching Course on Trading Short-Term Trades.

There will be two components to this class:

#1 Dan Sheridan’s focus will be on Range Bound Trades (Iron Condors, Butterflies, Credit Spreads, or Calendars) that can be made the same day or the next.

Same-day trades excite me much because they eliminate all gap risk and allow us to select the precise one or two days per week that we are willing to play.

We will evaluate the different approaches and provide you with a very detailed implementation strategy along with comprehensive risk management advice.

#2. Mark Fenton will concentrate on directional or speculative short-term trades, or deals with an entry date of one to four days from expiration.

Note: We will attempt to place one live range bound and one directional trade each class day. We will send you emails and texts about the live trades, as well as the game plan and detailed instructions. and any modifications.

Join Mark Fenton and Dan Sheridan on Mondays and Wednesdays as they trade short-term contracts over a four-week period.

Class Format:

For four weeks, there will be two live classes taught each week.

Timetable of Classes:

- Class #1: Monday September 11th class With Dan & Mark at 11:00am CT.

- Class #2: Wednesday September 13th class With Dan & Mark at 11:00am CT.

- Class #3: Monday September 18th class With Dan & Mark at 11:00am CT.

- Class #4: Wednesday September 20th class With Dan & Mark at 11:00am CT.

- Class #5: Monday September 25th class With Dan & Mark at 11:00am CT.

- Class #6: Wednesday September 27th class With Dan & Mark at 11:00am CT.

- Class #7: Monday October 2nd class With Dan & Mark at 11:00am CT.

- Class #8: Wednesday October 4th class With Dan & Mark at 11:00am CT.

Details of the class:

- Each Session will be at least an hour in length.

- Each event will be recorded and archive for your review.

- Each event will have a PDF of presentation slides, if used.

Conclusion

Trading short-term same-day trades, as espoused by Dan Sheridan and Mark Fenton in September 2023, is a nuanced strategy that requires a deep understanding of market dynamics, a disciplined approach, and effective risk management. By embracing these principles and continuously honing their skills, traders can navigate the tumultuous waters of the market with confidence and success.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued

Be the first to review “Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.