-

×

Rapid Revenue Formula with Kate Beeders

1 × $54.00

Rapid Revenue Formula with Kate Beeders

1 × $54.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Opening Range Success Formula with Geoff Bysshe

1 × $4.00

Opening Range Success Formula with Geoff Bysshe

1 × $4.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Imperial FX Academy

1 × $5.00

Imperial FX Academy

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Harmonic Pattern Detection Indicator

1 × $6.00

Harmonic Pattern Detection Indicator

1 × $6.00 -

×

Fast Fibonacci for Day Traders

1 × $15.00

Fast Fibonacci for Day Traders

1 × $15.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00 -

×

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

1 × $6.00

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Reading The Tape Trade Series with CompassFX

1 × $10.00

Reading The Tape Trade Series with CompassFX

1 × $10.00 -

×

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00 -

×

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Master Indicator with Elite Money Trader

1 × $5.00

The Master Indicator with Elite Money Trader

1 × $5.00 -

×

Trading System Development 101,102,103

1 × $6.00

Trading System Development 101,102,103

1 × $6.00 -

×

Brian James Sklenka Package

1 × $31.00

Brian James Sklenka Package

1 × $31.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Big Money Little Effort with Mark Shipman

1 × $6.00

Big Money Little Effort with Mark Shipman

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TopTradeTools - Trend Breakout Levels

1 × $15.00

TopTradeTools - Trend Breakout Levels

1 × $15.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00 -

×

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Tradacc – The Volume Profile Formula + Futures Masterclass and Rapid Setups Pack + S&P 500 Secrets Bundle - Aaron Korbs

1 × $5.00

Tradacc – The Volume Profile Formula + Futures Masterclass and Rapid Setups Pack + S&P 500 Secrets Bundle - Aaron Korbs

1 × $5.00 -

×

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

PRICE ACTION MASTERY

1 × $39.00

PRICE ACTION MASTERY

1 × $39.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Beginner Boot Camp with Optionpit

1 × $62.00

Beginner Boot Camp with Optionpit

1 × $62.00 -

×

Member Only Videos with Henry W Steele

1 × $27.00

Member Only Videos with Henry W Steele

1 × $27.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

Small Account Growth Class – Strategies Course

1 × $23.00

Small Account Growth Class – Strategies Course

1 × $23.00 -

×

Get Rich with Dividends

1 × $6.00

Get Rich with Dividends

1 × $6.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00 -

×

Grand Slam Options

1 × $23.00

Grand Slam Options

1 × $23.00 -

×

Sovereign Man Price Value International 2016

1 × $15.00

Sovereign Man Price Value International 2016

1 × $15.00

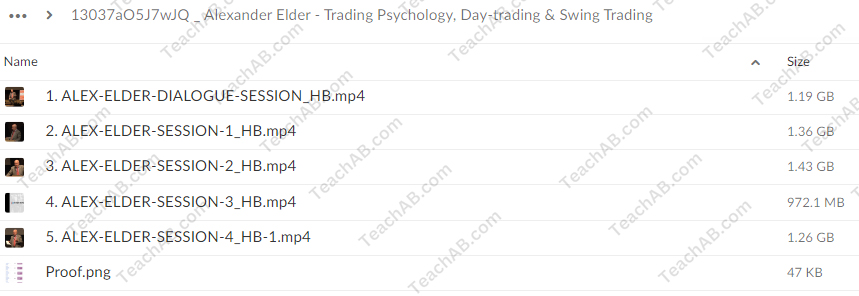

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

$199.00 Original price was: $199.00.$31.00Current price is: $31.00.

File Size: 6.19 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Psychology, Day-trading & Swing Trading with Alexander Elder” below:

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

Introduction to Alexander Elder

Trading in the financial markets requires more than just technical skills. It demands a deep understanding of trading psychology and strategies. Alexander Elder, a renowned trader and psychologist, provides invaluable insights into the mental and strategic aspects of trading. In this article, we delve into trading psychology, day-trading, and swing trading techniques as taught by Elder.

Who is Alexander Elder?

Background and Expertise

Alexander Elder is a professional trader, author, and psychiatrist. He is best known for his best-selling book, “Trading for a Living,” which combines his expertise in psychology with practical trading strategies.

Educational Contributions

Elder has made significant contributions to trading education through his books, seminars, and training programs. His unique approach blends psychological insights with technical analysis, helping traders achieve consistent success.

Understanding Trading Psychology

The Importance of Trading Psychology

Trading psychology is the study of how emotions and mental state affect trading decisions. Mastering trading psychology is crucial for making rational decisions and maintaining discipline.

Common Psychological Pitfalls

- Fear and Greed: Two powerful emotions that can lead to impulsive decisions.

- Overconfidence: Can result in excessive risk-taking.

- Revenge Trading: Trying to recover losses quickly, often leading to further losses.

Mastering Your Emotions

Developing Emotional Discipline

Emotional discipline involves staying calm and composed regardless of market conditions. This can be achieved through regular practice and self-awareness.

Techniques for Emotional Control

- Mindfulness Meditation: Helps in reducing stress and maintaining focus.

- Journaling: Keeping a trading journal to reflect on decisions and emotions.

- Setting Clear Rules: Following a well-defined trading plan.

Day-Trading Strategies

What is Day-Trading?

Day-trading involves buying and selling financial instruments within the same trading day. The goal is to profit from short-term price movements.

Key Characteristics of Day-Trading

- High Frequency: Multiple trades within a single day.

- Short Holding Period: Positions are not held overnight.

- Technical Analysis: Heavy reliance on technical indicators and chart patterns.

Effective Day-Trading Techniques

Scalping

Scalping is a day-trading strategy that aims to make numerous small profits on minor price changes. Traders who scalp execute dozens or hundreds of trades in a single day.

Momentum Trading

Momentum trading involves identifying stocks that are moving significantly in one direction with high volume and trading in the direction of the momentum.

Breakout Trading

Breakout trading focuses on entering a position as soon as the price breaks through a key level of support or resistance.

Swing Trading Strategies

What is Swing Trading?

Swing trading is a style of trading that attempts to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks.

Key Characteristics of Swing Trading

- Medium-Term Focus: Holding positions longer than day-trading but shorter than long-term investing.

- Combining Analysis: Uses both technical and fundamental analysis.

Effective Swing Trading Techniques

Trend Following

Trend following involves identifying the overall trend direction and making trades that align with the trend.

Reversal Trading

Reversal trading focuses on identifying points where the market trend is likely to reverse and trading in the new direction.

Channel Trading

Channel trading involves identifying price channels and making trades based on the price bouncing off the upper and lower bounds of the channel.

Technical Tools for Day-Trading and Swing Trading

Moving Averages

Moving averages smooth out price data to help identify the direction of the trend. They are commonly used in both day-trading and swing trading.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements and helps identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages.

Bollinger Bands

Bollinger Bands measure market volatility and provide a framework for identifying overbought and oversold conditions.

Risk Management

Importance of Risk Management

Effective risk management is crucial for protecting your capital and ensuring long-term trading success.

Techniques for Managing Risk

- Stop-Loss Orders: Automatically close a position at a predetermined price to limit losses.

- Position Sizing: Determine the appropriate amount to invest in each trade based on risk tolerance.

- Diversification: Spread investments across various assets to reduce risk.

Building a Trading Plan

Components of a Trading Plan

A well-defined trading plan includes your trading goals, risk tolerance, strategy rules, and criteria for entering and exiting trades.

Benefits of a Trading Plan

A trading plan helps you stay focused, disciplined, and aligned with your trading objectives.

Continuous Learning and Adaptation

Staying Updated

The financial markets are constantly evolving. Stay updated with the latest market news, trends, and trading strategies.

Learning from Experience

Regularly analyze your trades to understand what works and what doesn’t. Adapt and refine your trading strategies based on your experiences.

Conclusion

Trading Psychology, Day-trading & Swing Trading with Alexander Elder provides a comprehensive approach to mastering the financial markets. By understanding and controlling your emotions, applying effective day-trading and swing trading strategies, and continuously learning and adapting, you can achieve consistent trading success. Elder’s insights offer valuable guidance for both novice and experienced traders looking to enhance their trading performance.

Frequently Asked Questions

1. What is trading psychology?

Trading psychology is the study of how emotions and mental state affect trading decisions. It is crucial for making rational and disciplined trading choices.

2. Who is Alexander Elder?

Alexander Elder is a professional trader, author, and psychiatrist known for his expertise in trading psychology and technical analysis.

3. What are some effective day-trading strategies?

Effective day-trading strategies include scalping, momentum trading, and breakout trading.

4. How can I manage risk in trading?

Risk management techniques include using stop-loss orders, determining proper position sizing, and diversifying your investments.

5. Why is a trading plan important?

A trading plan helps you stay focused, disciplined, and aligned with your trading goals, enhancing your chances of long-term success.

Be the first to review “Trading Psychology, Day-trading & Swing Trading with Alexander Elder” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.