-

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Advanced Strategy Design Techniques Bundle with NinjaTrader

1 × $20.00

Advanced Strategy Design Techniques Bundle with NinjaTrader

1 × $20.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Time Trap System with Alex Krzhechevsky

1 × $6.00

Time Trap System with Alex Krzhechevsky

1 × $6.00 -

×

Theo Trade - 128 Course Bundle

1 × $93.00

Theo Trade - 128 Course Bundle

1 × $93.00 -

×

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

![Trading The Elliott Wave Indicator (2003) [1 MP4] by Robert Prechter image](https://www.totozon.com/wp-content/uploads/2024/05/Trading-The-Elliott-Wave-Indicator-2003-1-MP4-by-Robert-Prechter-image.png) Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00

Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00 -

×

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

$199.00 Original price was: $199.00.$31.00Current price is: $31.00.

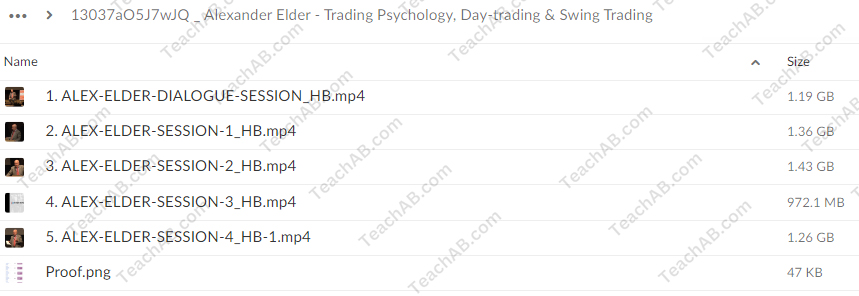

File Size: 6.19 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Psychology, Day-trading & Swing Trading with Alexander Elder” below:

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

Introduction to Alexander Elder

Trading in the financial markets requires more than just technical skills. It demands a deep understanding of trading psychology and strategies. Alexander Elder, a renowned trader and psychologist, provides invaluable insights into the mental and strategic aspects of trading. In this article, we delve into trading psychology, day-trading, and swing trading techniques as taught by Elder.

Who is Alexander Elder?

Background and Expertise

Alexander Elder is a professional trader, author, and psychiatrist. He is best known for his best-selling book, “Trading for a Living,” which combines his expertise in psychology with practical trading strategies.

Educational Contributions

Elder has made significant contributions to trading education through his books, seminars, and training programs. His unique approach blends psychological insights with technical analysis, helping traders achieve consistent success.

Understanding Trading Psychology

The Importance of Trading Psychology

Trading psychology is the study of how emotions and mental state affect trading decisions. Mastering trading psychology is crucial for making rational decisions and maintaining discipline.

Common Psychological Pitfalls

- Fear and Greed: Two powerful emotions that can lead to impulsive decisions.

- Overconfidence: Can result in excessive risk-taking.

- Revenge Trading: Trying to recover losses quickly, often leading to further losses.

Mastering Your Emotions

Developing Emotional Discipline

Emotional discipline involves staying calm and composed regardless of market conditions. This can be achieved through regular practice and self-awareness.

Techniques for Emotional Control

- Mindfulness Meditation: Helps in reducing stress and maintaining focus.

- Journaling: Keeping a trading journal to reflect on decisions and emotions.

- Setting Clear Rules: Following a well-defined trading plan.

Day-Trading Strategies

What is Day-Trading?

Day-trading involves buying and selling financial instruments within the same trading day. The goal is to profit from short-term price movements.

Key Characteristics of Day-Trading

- High Frequency: Multiple trades within a single day.

- Short Holding Period: Positions are not held overnight.

- Technical Analysis: Heavy reliance on technical indicators and chart patterns.

Effective Day-Trading Techniques

Scalping

Scalping is a day-trading strategy that aims to make numerous small profits on minor price changes. Traders who scalp execute dozens or hundreds of trades in a single day.

Momentum Trading

Momentum trading involves identifying stocks that are moving significantly in one direction with high volume and trading in the direction of the momentum.

Breakout Trading

Breakout trading focuses on entering a position as soon as the price breaks through a key level of support or resistance.

Swing Trading Strategies

What is Swing Trading?

Swing trading is a style of trading that attempts to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks.

Key Characteristics of Swing Trading

- Medium-Term Focus: Holding positions longer than day-trading but shorter than long-term investing.

- Combining Analysis: Uses both technical and fundamental analysis.

Effective Swing Trading Techniques

Trend Following

Trend following involves identifying the overall trend direction and making trades that align with the trend.

Reversal Trading

Reversal trading focuses on identifying points where the market trend is likely to reverse and trading in the new direction.

Channel Trading

Channel trading involves identifying price channels and making trades based on the price bouncing off the upper and lower bounds of the channel.

Technical Tools for Day-Trading and Swing Trading

Moving Averages

Moving averages smooth out price data to help identify the direction of the trend. They are commonly used in both day-trading and swing trading.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements and helps identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages.

Bollinger Bands

Bollinger Bands measure market volatility and provide a framework for identifying overbought and oversold conditions.

Risk Management

Importance of Risk Management

Effective risk management is crucial for protecting your capital and ensuring long-term trading success.

Techniques for Managing Risk

- Stop-Loss Orders: Automatically close a position at a predetermined price to limit losses.

- Position Sizing: Determine the appropriate amount to invest in each trade based on risk tolerance.

- Diversification: Spread investments across various assets to reduce risk.

Building a Trading Plan

Components of a Trading Plan

A well-defined trading plan includes your trading goals, risk tolerance, strategy rules, and criteria for entering and exiting trades.

Benefits of a Trading Plan

A trading plan helps you stay focused, disciplined, and aligned with your trading objectives.

Continuous Learning and Adaptation

Staying Updated

The financial markets are constantly evolving. Stay updated with the latest market news, trends, and trading strategies.

Learning from Experience

Regularly analyze your trades to understand what works and what doesn’t. Adapt and refine your trading strategies based on your experiences.

Conclusion

Trading Psychology, Day-trading & Swing Trading with Alexander Elder provides a comprehensive approach to mastering the financial markets. By understanding and controlling your emotions, applying effective day-trading and swing trading strategies, and continuously learning and adapting, you can achieve consistent trading success. Elder’s insights offer valuable guidance for both novice and experienced traders looking to enhance their trading performance.

Frequently Asked Questions

1. What is trading psychology?

Trading psychology is the study of how emotions and mental state affect trading decisions. It is crucial for making rational and disciplined trading choices.

2. Who is Alexander Elder?

Alexander Elder is a professional trader, author, and psychiatrist known for his expertise in trading psychology and technical analysis.

3. What are some effective day-trading strategies?

Effective day-trading strategies include scalping, momentum trading, and breakout trading.

4. How can I manage risk in trading?

Risk management techniques include using stop-loss orders, determining proper position sizing, and diversifying your investments.

5. Why is a trading plan important?

A trading plan helps you stay focused, disciplined, and aligned with your trading goals, enhancing your chances of long-term success.

Be the first to review “Trading Psychology, Day-trading & Swing Trading with Alexander Elder” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.