-

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00 -

×

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00 -

×

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00 -

×

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00 -

×

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Forecast for 2010 with Larry Williams

1 × $6.00

Forecast for 2010 with Larry Williams

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00 -

×

David Landry On Swing Trading

1 × $6.00

David Landry On Swing Trading

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

The Ticker Investment Digest Articles

1 × $6.00

The Ticker Investment Digest Articles

1 × $6.00 -

×

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Timing the Market with Curtis Arnold

1 × $6.00

Timing the Market with Curtis Arnold

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

Pring on Price Patterns with Martin Pring

1 × $6.00

Pring on Price Patterns with Martin Pring

1 × $6.00 -

×

Cluster Delta with Gova Trading Academy

1 × $5.00

Cluster Delta with Gova Trading Academy

1 × $5.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Beginner Options Trading Class with Bill Johnson

1 × $6.00

Beginner Options Trading Class with Bill Johnson

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Fire Your Stock Analyst: Analyzing Stocks on Your Own with Harry Domash

1 × $6.00

Fire Your Stock Analyst: Analyzing Stocks on Your Own with Harry Domash

1 × $6.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Trading Plan with Andrew Baxter

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

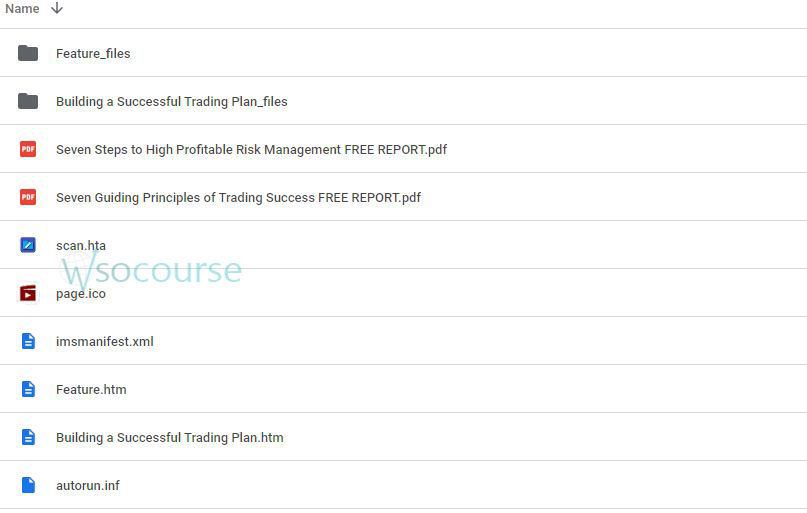

You may check content proof of “Trading Plan with Andrew Baxter” below:

Trading Plan with Andrew Baxter

Introduction to Trading Plans

Creating a solid trading plan is essential for success in the financial markets. Andrew Baxter, a renowned trader and educator, emphasizes the importance of having a well-structured trading plan to guide your decisions and manage risks effectively. Let’s dive into the components of a robust trading plan and learn how to implement it successfully.

What is a Trading Plan?

Definition and Purpose

A trading plan is a comprehensive set of rules and guidelines that outline how you will execute your trades. It includes your trading goals, risk management strategies, and specific criteria for entering and exiting trades.

Why You Need a Trading Plan

A trading plan helps you stay disciplined, avoid emotional decisions, and manage your risk effectively. It serves as a roadmap to achieve your trading goals and improve your consistency.

Key Components of a Trading Plan

1. Trading Goals

Setting clear, achievable goals is the first step in developing a trading plan. Your goals should be specific, measurable, attainable, relevant, and time-bound (SMART).

Short-Term Goals

These might include daily or weekly profit targets, learning new strategies, or improving specific trading skills.

Long-Term Goals

Long-term goals could involve annual profit targets, building a diversified portfolio, or achieving financial independence through trading.

2. Risk Management

Effective risk management is crucial to protect your capital and ensure long-term success.

Position Sizing

Determine how much of your capital you will risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set your stop-loss level based on technical analysis and your risk tolerance.

3. Market Analysis

Conduct thorough market analysis to identify trading opportunities.

Technical Analysis

Use charts and technical indicators to analyze price movements and trends. Common tools include moving averages, RSI, and MACD.

Fundamental Analysis

Consider economic indicators, company financials, and market news to make informed trading decisions.

4. Entry and Exit Criteria

Define specific criteria for entering and exiting trades. This helps you avoid impulsive decisions and stay disciplined.

Entry Signals

Identify conditions that must be met before entering a trade. This could include specific price levels, chart patterns, or indicator signals.

Exit Signals

Set criteria for closing a trade, such as reaching a profit target, hitting a stop-loss, or changes in market conditions.

5. Trading Strategy

Your trading strategy should align with your goals and risk tolerance.

Day Trading

Focus on short-term price movements and execute multiple trades within a single day.

Swing Trading

Hold positions for several days or weeks to capture medium-term price movements.

Long-Term Investing

Invest in assets with the intention of holding them for several months or years to benefit from long-term growth.

6. Record Keeping

Maintain detailed records of all your trades. This helps you analyze your performance and identify areas for improvement.

Trading Journal

Keep a trading journal that includes the date, entry and exit points, position size, profit/loss, and notes on each trade.

Performance Review

Regularly review your trading journal to assess your performance and make necessary adjustments to your trading plan.

Implementing Your Trading Plan

Backtesting Your Plan

Test your trading plan on historical data to evaluate its effectiveness. This helps you identify any potential flaws and make improvements before trading with real money.

Paper Trading

Practice your trading plan using a demo account. This allows you to refine your strategies without risking actual capital.

Starting Small

When you’re ready to trade with real money, start with a small amount of capital. Gradually increase your position sizes as you gain confidence and experience.

Common Mistakes to Avoid

Ignoring Risk Management

Neglecting risk management can lead to significant losses. Always prioritize protecting your capital.

Overtrading

Avoid overtrading by sticking to your trading plan and only taking trades that meet your criteria.

Emotional Trading

Emotional decisions can undermine your trading plan. Stay disciplined and avoid making impulsive trades based on fear or greed.

Benefits of Having a Trading Plan

Improved Discipline

A trading plan helps you stay disciplined and avoid impulsive decisions that can lead to losses.

Consistent Performance

By following a structured plan, you can achieve more consistent trading results and steadily grow your capital.

Enhanced Confidence

Having a clear plan boosts your confidence, as you know exactly what steps to take in different market conditions.

Conclusion

Developing a comprehensive trading plan with insights from Andrew Baxter can significantly enhance your trading success. By setting clear goals, managing risk effectively, and staying disciplined, you can navigate the financial markets with confidence and consistency. Embrace the process, continuously refine your plan, and watch your trading performance improve over time.

Frequently Asked Questions:

What is a trading plan?

A trading plan is a set of rules and guidelines that outline how you will execute your trades, including your goals, risk management strategies, and entry/exit criteria.

Why is risk management important in a trading plan?

Risk management helps protect your capital and ensures long-term success by limiting potential losses on each trade.

How can I develop a successful trading strategy?

Develop a strategy that aligns with your goals and risk tolerance, conduct thorough market analysis, and define clear entry and exit criteria.

What should be included in a trading journal?

A trading journal should include the date, entry and exit points, position size, profit/loss, and notes on each trade to help you analyze your performance.

Why is it important to backtest a trading plan?

Backtesting evaluates the effectiveness of your trading plan on historical data, allowing you to identify and correct any flaws before trading with real money.

Be the first to review “Trading Plan with Andrew Baxter” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.