-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

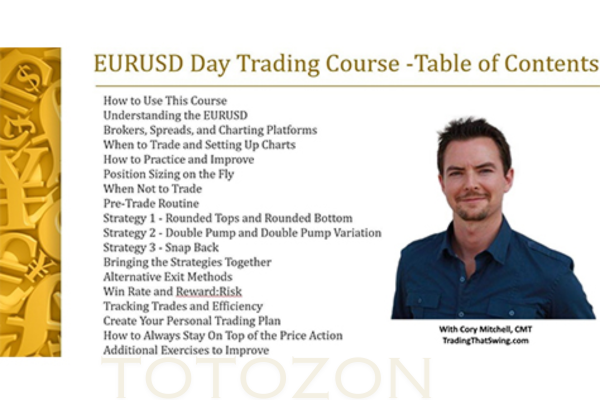

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Double Thurst Stock Trading System

1 × $15.00

The Double Thurst Stock Trading System

1 × $15.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

The Volatility Surface with Jim Gatheral

1 × $6.00

The Volatility Surface with Jim Gatheral

1 × $6.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Optionetics Trading Strategies

1 × $5.00

Optionetics Trading Strategies

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

Bookmap Masterclass with Trading To Win

1 × $6.00

Bookmap Masterclass with Trading To Win

1 × $6.00 -

×

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00 -

×

Bobokus Training Program

1 × $6.00

Bobokus Training Program

1 × $6.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Pivot Day Trader for NinjaTrader

1 × $31.00

Pivot Day Trader for NinjaTrader

1 × $31.00 -

×

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Trading Harmonically with the Universe By John Jace

1 × $4.00

Trading Harmonically with the Universe By John Jace

1 × $4.00 -

×

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00

Price Action Stock Day Trading Course with Trade That Swing

1 × $62.00 -

×

Ultimate Options Blue Print Course

1 × $23.00

Ultimate Options Blue Print Course

1 × $23.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

The Complete Day Trading Course (New 2020)

1 × $6.00

The Complete Day Trading Course (New 2020)

1 × $6.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

The Option Trader’s Handbook (2008) with Jeff Augen

1 × $6.00

The Option Trader’s Handbook (2008) with Jeff Augen

1 × $6.00 -

×

Breakouts with Feibel Trading

1 × $5.00

Breakouts with Feibel Trading

1 × $5.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Getting Rich in America with Dwight Lee

1 × $6.00

Getting Rich in America with Dwight Lee

1 × $6.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

How To Predict The Future DVD with Robert Kiyosaki

1 × $6.00

How To Predict The Future DVD with Robert Kiyosaki

1 × $6.00 -

×

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Rich Jerk Program

1 × $15.00

Rich Jerk Program

1 × $15.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

How to Spot Trading Opportunities

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

How to Spot Trading Opportunities

Introduction

In the dynamic world of trading, identifying profitable opportunities is crucial for success. Whether you’re a novice trader or a seasoned professional, understanding how to spot trading opportunities can significantly enhance your trading strategy. This article delves into the key methods and indicators that can help you identify these opportunities effectively.

Understanding Market Trends

What Are Market Trends?

Market trends are the general direction in which a market is moving. They can be upward, downward, or sideways.

Types of Market Trends

- Uptrend: A series of higher highs and higher lows.

- Downtrend: A series of lower highs and lower lows.

- Sideways Trend: Little to no movement in either direction.

Analyzing Trends

Identifying the current market trend is the first step in spotting trading opportunities. Use tools like moving averages and trend lines to help determine the direction.

Technical Analysis

What is Technical Analysis?

Technical analysis involves examining past market data, primarily price and volume, to forecast future price movements.

Key Technical Indicators

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

Using Charts for Technical Analysis

Charts provide a visual representation of price movements. Candlestick charts, bar charts, and line charts are commonly used.

Fundamental Analysis

What is Fundamental Analysis?

Fundamental analysis evaluates a security’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors.

Key Fundamentals to Consider

- Company Earnings

- Revenue Growth

- Debt Levels

- Economic Indicators

Combining Fundamental and Technical Analysis

Using both fundamental and technical analysis provides a more comprehensive view of the market and helps identify trading opportunities.

Identifying Support and Resistance Levels

What Are Support and Resistance Levels?

Support is a price level where a downtrend can be expected to pause due to a concentration of demand. Resistance is a price level where a uptrend can be expected to pause due to a concentration of selling.

How to Identify Support and Resistance

- Historical Price Levels

- Trend Lines

- Moving Averages

Using Support and Resistance in Trading

Spotting support and resistance levels can help you determine entry and exit points for trades.

Volume Analysis

Importance of Volume in Trading

Volume measures the number of shares or contracts traded in a security or market.

Key Volume Indicators

- On-Balance Volume (OBV)

- Volume Price Trend (VPT)

- Accumulation/Distribution Line

Interpreting Volume Data

High volume can indicate strong investor interest and confirm a price movement, while low volume might suggest a lack of conviction.

Utilizing Trading Signals

What Are Trading Signals?

Trading signals are triggers for action, based on criteria such as specific price levels or technical indicators.

Common Trading Signals

- Golden Cross and Death Cross

- Divergences

- Breakouts

Implementing Trading Signals

Incorporate trading signals into your strategy to automate decision-making and enhance your ability to spot opportunities.

Risk Management

Importance of Risk Management

Effective risk management protects your capital and ensures longevity in trading.

Key Risk Management Techniques

- Stop-Loss Orders

- Position Sizing

- Diversification

Balancing Risk and Reward

Evaluate the risk-reward ratio of each trade to ensure it aligns with your overall trading strategy.

The Role of News and Events

Impact of News on Markets

News events, such as economic reports or geopolitical developments, can significantly impact market movements.

How to Stay Informed

Use news aggregators, financial websites, and trading platforms to keep up with the latest news.

Trading on News

Be cautious when trading based on news, as markets can be volatile and react unpredictably.

Developing a Trading Plan

What is a Trading Plan?

A trading plan outlines your trading goals, strategies, risk tolerance, and rules.

Components of a Trading Plan

- Objectives

- Entry and Exit Criteria

- Risk Management Rules

- Performance Evaluation

Sticking to Your Trading Plan

Discipline is key. Stick to your plan to avoid emotional decision-making and improve your chances of success.

Using Trading Platforms

Choosing a Trading Platform

Select a platform that offers the tools and features you need, such as charting capabilities, technical indicators, and real-time data.

Features to Look For

- User-Friendly Interface

- Mobile Access

- Educational Resources

Maximizing Platform Use

Take advantage of demo accounts to practice and refine your trading strategies without financial risk.

Conclusion

Spotting trading opportunities requires a blend of technical analysis, fundamental analysis, and staying informed about market news and trends. By understanding and applying these methods, you can enhance your trading strategy and increase your chances of success. Remember to maintain a disciplined approach, manage your risks effectively, and continually refine your techniques.

FAQs

What is the best way to identify trading opportunities?

Combining technical analysis, fundamental analysis, and staying informed about market news and trends is the best way to identify trading opportunities.

How do support and resistance levels help in trading?

Support and resistance levels help determine entry and exit points by identifying price levels where the market tends to reverse direction.

Why is volume important in trading?

Volume indicates the strength of a price movement. High volume confirms trends, while low volume suggests weakness.

What is a trading signal?

A trading signal is a trigger for action based on specific criteria, such as price levels or technical indicators, that suggests a buy or sell opportunity.

How should I manage risk in trading?

Manage risk by using stop-loss orders, position sizing, and diversification to protect your capital and ensure longevity in trading.

Be the first to review “How to Spot Trading Opportunities” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.