-

×

Opening Range Success Formula with Geoff Bysshe

1 × $4.00

Opening Range Success Formula with Geoff Bysshe

1 × $4.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

Pips&Profit Trading Course

1 × $13.00

Pips&Profit Trading Course

1 × $13.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00 -

×

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00 -

×

Finding Top Secret Statagies with AlphaShark Trading

1 × $109.00

Finding Top Secret Statagies with AlphaShark Trading

1 × $109.00 -

×

Main Online Course with Cue Banks

1 × $90.00

Main Online Course with Cue Banks

1 × $90.00 -

×

The Price Action Protocol - 2015 Edition

1 × $15.00

The Price Action Protocol - 2015 Edition

1 × $15.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

Workshop: The Best Way to Trade Stock Movement

1 × $6.00

Workshop: The Best Way to Trade Stock Movement

1 × $6.00 -

×

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

How to Get Rich Buying Stocks with Ira U.Cobleigh

1 × $6.00

How to Get Rich Buying Stocks with Ira U.Cobleigh

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Evolution Markets Forex Course - Evolution Markets

1 × $5.00

Evolution Markets Forex Course - Evolution Markets

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

Setups, Entries, and Stops with Rob Hoffman - Become A Better Trader

1 × $6.00

Setups, Entries, and Stops with Rob Hoffman - Become A Better Trader

1 × $6.00 -

×

Wall Street Training

1 × $6.00

Wall Street Training

1 × $6.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Introduction To The STRAT Course with Rob Smith

1 × $8.00

Introduction To The STRAT Course with Rob Smith

1 × $8.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Phantom of the Pit BY Art Simpson

1 × $6.00

Phantom of the Pit BY Art Simpson

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

ETF and Leveraged ETF Trading Summit

1 × $23.00

ETF and Leveraged ETF Trading Summit

1 × $23.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00 -

×

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Central Bank Trading Strategies with AXIA Futures

1 × $5.00

Central Bank Trading Strategies with AXIA Futures

1 × $5.00 -

×

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00 -

×

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00 -

×

Tick Trader Day Trading Course with David Marsh

1 × $6.00

Tick Trader Day Trading Course with David Marsh

1 × $6.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

Hustle Trading FX Course

1 × $10.00

Hustle Trading FX Course

1 × $10.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

Stonhill Forex 201 Advanced Course

1 × $5.00

Stonhill Forex 201 Advanced Course

1 × $5.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Tom Williams Final Mentorship Course

1 × $6.00

Tom Williams Final Mentorship Course

1 × $6.00 -

×

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Position Dissection with Charles Cottle

1 × $4.00

Position Dissection with Charles Cottle

1 × $4.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

Dan Sheridan Butterfly Course + Iron Condor Class Bundle Pack

1 × $23.00

Dan Sheridan Butterfly Course + Iron Condor Class Bundle Pack

1 × $23.00 -

×

Activedaytrader - Workshop: Unusual Options

1 × $6.00

Activedaytrader - Workshop: Unusual Options

1 × $6.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Volatility Trading with Euan Sinclair

1 × $6.00

Volatility Trading with Euan Sinclair

1 × $6.00 -

×

Atlas Forex Trading Course

1 × $5.00

Atlas Forex Trading Course

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Options Trading Accelerator with Base Camp Trading

1 × $23.00

Options Trading Accelerator with Base Camp Trading

1 × $23.00 -

×

Advanced Price Action Course with ZenFX

1 × $5.00

Advanced Price Action Course with ZenFX

1 × $5.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Level 2 Trading Warfare

1 × $6.00

Level 2 Trading Warfare

1 × $6.00 -

×

The Science of Trading with Mark Boucher

1 × $6.00

The Science of Trading with Mark Boucher

1 × $6.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Flipping Markets Video Course (2022)

1 × $5.00

Flipping Markets Video Course (2022)

1 × $5.00 -

×

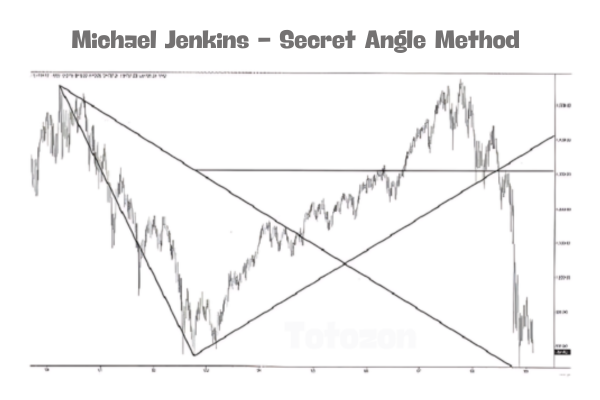

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Natural Resources in a Volatile Market with Kevin Kerr” below:

Trading Natural Resources in a Volatile Market with Kevin Kerr

Natural resources trading is an exciting yet challenging venture, especially in today’s volatile market. With Kevin Kerr’s insights, we explore how to navigate this unpredictable landscape effectively.

Understanding Natural Resources Trading

Trading natural resources involves buying and selling commodities like oil, gas, metals, and agricultural products. It’s a market driven by supply and demand, geopolitical events, and economic indicators.

Why Trade Natural Resources?

- High Liquidity: Natural resources markets are highly liquid, allowing for quick buying and selling.

- Diversification: Investing in natural resources helps diversify a portfolio, reducing risk.

- Hedge Against Inflation: Commodities often retain value even when inflation rises.

The Role of Volatility in Natural Resources Markets

Volatility is both a risk and an opportunity in natural resources trading. Prices can swing dramatically due to various factors, providing traders with potential profit opportunities.

Factors Contributing to Market Volatility

- Geopolitical Events: Wars, political instability, and sanctions can disrupt supply chains.

- Weather Conditions: Natural disasters and seasonal changes can impact production and supply.

- Economic Indicators: Inflation rates, interest rates, and economic growth can influence prices.

Kevin Kerr’s Approach to Trading

Kevin Kerr, a renowned commodities trader, emphasizes a strategic approach to trading natural resources in volatile markets.

Risk Management

Managing risk is crucial. Kerr advises setting stop-loss orders to limit potential losses and using hedging strategies to protect investments.

Research and Analysis

In-depth research and analysis are vital. Kerr recommends staying updated on market news, studying historical data, and using technical analysis tools.

Diversification

Diversification is key. Kerr suggests spreading investments across different commodities to mitigate risks associated with any single resource.

Strategies for Trading Natural Resources

Trend Following

This strategy involves identifying and following market trends. Traders buy when prices are rising and sell when they start to fall.

Contrarian Investing

Contrarian investing involves going against the market trends. Traders buy when prices are low and sell when they are high, betting on market reversals.

Arbitrage

Arbitrage involves taking advantage of price differences in different markets. Traders buy a commodity in one market at a lower price and sell it in another market at a higher price.

Scalping

Scalping is a short-term strategy where traders make small profits from minor price movements. It requires quick decision-making and excellent risk management skills.

Tools and Resources for Natural Resources Trading

Trading Platforms

Using reliable trading platforms is essential. Look for platforms offering real-time data, analytical tools, and secure transactions.

Market News and Reports

Staying informed is critical. Subscribe to market news services and reports to get the latest updates and insights.

Technical Analysis Tools

Utilize technical analysis tools to identify trends, patterns, and potential trading opportunities. Common tools include moving averages, Bollinger Bands, and MACD.

Challenges in Natural Resources Trading

Market Uncertainty

Uncertainty is inherent in natural resources markets. Prices can be affected by unpredictable events, making it challenging to forecast accurately.

Regulatory Changes

Changes in regulations can impact market conditions. Traders must stay informed about policy changes and adapt their strategies accordingly.

Environmental Concerns

Environmental issues and sustainability concerns are increasingly influencing natural resources markets. Traders need to consider the long-term impact of their investments.

Conclusion

Trading natural resources in a volatile market requires a strategic approach, thorough research, and effective risk management. With Kevin Kerr’s guidance, traders can navigate this complex landscape and potentially achieve significant profits.

FAQs

1. What are the key factors driving volatility in natural resources markets?

Geopolitical events, weather conditions, and economic indicators are major factors contributing to volatility.

2. How can I manage risk in natural resources trading?

Implement risk management strategies such as setting stop-loss orders and diversifying your investments.

3. What is the trend-following strategy in natural resources trading?

Trend following involves buying commodities when prices are rising and selling when they start to fall.

4. What tools are essential for natural resources trading?

Reliable trading platforms, market news services, and technical analysis tools are essential for successful trading.

5. How do environmental concerns impact natural resources trading?

Environmental issues and sustainability concerns can influence market conditions and long-term investment decisions.

Be the first to review “Trading Natural Resources in a Volatile Market with Kevin Kerr” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.