-

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

Trading The Nasdaq Seminar with Alan Rich

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

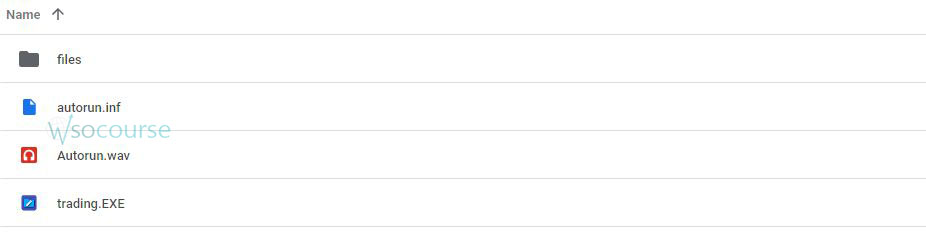

Content Proof: Watch Here!

You may check content proof of “Trading The Nasdaq Seminar with Alan Rich” below:

Trading The Nasdaq Seminar with Alan Rich

Introduction to the Nasdaq Seminar

Trading the Nasdaq can be a rewarding yet challenging endeavor. Alan Rich, a seasoned trader and market analyst, offers a comprehensive seminar on mastering the Nasdaq. This article delves into the key insights and strategies from his seminar, equipping traders with the knowledge to navigate this dynamic market.

Understanding the Nasdaq

What is the Nasdaq?

The Nasdaq, short for the National Association of Securities Dealers Automated Quotations, is a global electronic marketplace for buying and selling securities. It is known for its high-tech and biotech companies.

Importance of the Nasdaq

The Nasdaq is a leading indicator of the technology sector and is often seen as a barometer for the overall health of the tech industry.

Alan Rich’s Approach to Trading the Nasdaq

Rich’s Trading Philosophy

Alan Rich emphasizes a disciplined approach to trading, focusing on technical analysis, market trends, and risk management. His philosophy is to trade smart, not hard, by leveraging technology and data-driven insights.

Key Principles of Rich’s Methodology

- Technical Analysis: Using charts and indicators to identify trading opportunities.

- Market Trends: Understanding and following market trends to make informed decisions.

- Risk Management: Implementing strategies to minimize losses and protect gains.

Technical Analysis Techniques

Understanding Price Charts

Price charts are fundamental tools in technical analysis. They help traders visualize market movements and identify trends.

Types of Price Charts

- Line Charts: Simplest form, showing closing prices over a period.

- Bar Charts: Display opening, closing, high, and low prices for each period.

- Candlestick Charts: Provide more detailed information about price movements.

Using Moving Averages

Moving averages smooth out price data to identify the direction of the trend. Common types include:

- Simple Moving Average (SMA): The average price over a set period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Identifying Support and Resistance Levels

Support and resistance levels are critical for making trading decisions. These levels indicate where the price is likely to find a floor or ceiling.

Applying Indicators

Technical indicators provide additional insights into market trends. Key indicators include:

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Moving Average Convergence Divergence (MACD): Identifies changes in the strength, direction, momentum, and duration of a trend.

Market Trends and Patterns

Recognizing Market Trends

Understanding market trends is crucial for trading the Nasdaq. Trends can be upward (bullish), downward (bearish), or sideways (neutral).

Common Chart Patterns

Chart patterns help predict future price movements. Important patterns include:

- Head and Shoulders: Indicates a reversal of a trend.

- Double Top and Double Bottom: Suggest potential trend reversals.

- Triangles and Flags: Show continuation patterns in the market.

Risk Management Strategies

Setting Stop-Loss Orders

Stop-loss orders protect traders from significant losses by automatically selling a security when it reaches a certain price.

Using Position Sizing

Position sizing involves determining the number of shares to buy or sell based on the size of your account and risk tolerance.

Diversifying Investments

Diversification reduces risk by spreading investments across different sectors or assets.

Practical Applications from the Seminar

Case Study: Successful Trade

A trader applied Rich’s techniques to a tech stock, using technical indicators to identify an entry point and setting a stop-loss to manage risk. The result was a profitable trade with minimized risk.

Real-World Examples

Rich’s seminar includes numerous real-world examples, demonstrating how his strategies have been successfully applied in various market conditions.

Tools and Resources for Traders

Trading Platforms

Selecting the right trading platform is essential for executing trades efficiently. Look for platforms that offer robust charting tools, real-time data, and low fees.

Educational Resources

Continuous learning is crucial. Alan Rich recommends using books, online courses, and trading communities to stay informed and improve skills.

Market News and Analysis

Keeping up with market news and analysis helps traders make informed decisions. Use reliable sources to stay updated on market trends and economic events.

Common Challenges in Trading the Nasdaq

Market Volatility

The Nasdaq can be highly volatile, with rapid price movements. Traders need to be prepared for sudden changes and manage their risk accordingly.

Emotional Decision-Making

Emotions can cloud judgment and lead to impulsive decisions. Following a disciplined trading plan helps mitigate emotional bias.

Staying Informed

The fast-paced nature of the Nasdaq requires traders to stay constantly informed. Regularly reviewing market news and updates is essential.

Conclusion

Trading the Nasdaq with insights from Alan Rich’s seminar equips traders with the tools and strategies needed to succeed. By mastering technical analysis, understanding market trends, and implementing robust risk management practices, traders can navigate the Nasdaq with confidence.

Frequently Asked Questions

1. What is the main focus of Alan Rich’s seminar?

Alan Rich’s seminar focuses on technical analysis, market trends, and risk management to help traders succeed in the Nasdaq market.

2. How can technical analysis help in trading the Nasdaq?

Technical analysis uses charts and indicators to identify trading opportunities and predict future price movements, aiding in informed decision-making.

3. What are some key indicators used by Alan Rich?

Key indicators include moving averages, RSI, and MACD, which help identify trends and potential entry and exit points.

4. Why is risk management important in trading?

Risk management is crucial to minimize losses and protect gains, ensuring long-term trading success.

5. How can I stay informed about Nasdaq market trends?

Use reliable sources for market news and analysis, and continuously educate yourself through books, online courses, and trading communities.

Be the first to review “Trading The Nasdaq Seminar with Alan Rich” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.