-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

TC Top & Bottom Finder with Trader Confident

1 × $93.00

TC Top & Bottom Finder with Trader Confident

1 × $93.00 -

×

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00 -

×

The Rare Writings of W.D Gann

1 × $6.00

The Rare Writings of W.D Gann

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Forex 360 Complete Course

1 × $6.00

Forex 360 Complete Course

1 × $6.00 -

×

DVD Series Trading Course

1 × $15.00

DVD Series Trading Course

1 × $15.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Pro Trend Trader 2017 with James Orr

1 × $31.00

Pro Trend Trader 2017 with James Orr

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Tradingology Home Study Options Course

1 × $23.00

Tradingology Home Study Options Course

1 × $23.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

Currency Trading System 2003 with Peter Bain

1 × $6.00

Currency Trading System 2003 with Peter Bain

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Fast Fibonacci for Day Traders

1 × $15.00

Fast Fibonacci for Day Traders

1 × $15.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00 -

×

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00 -

×

Flex EA Correlated Hedge V1.02

1 × $6.00

Flex EA Correlated Hedge V1.02

1 × $6.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

Forex Shockwave Analysis with James Bickford

1 × $6.00

Forex Shockwave Analysis with James Bickford

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

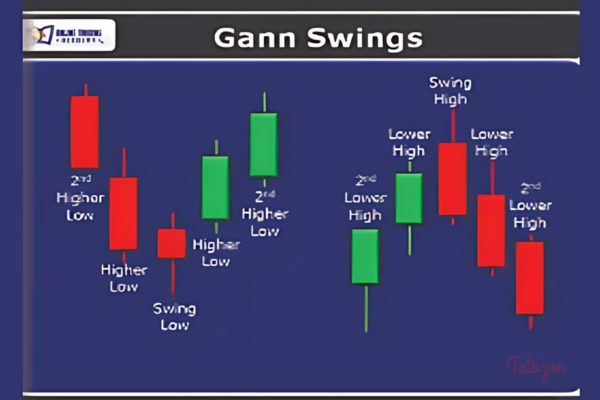

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

SMT FX Trading

1 × $5.00

SMT FX Trading

1 × $5.00 -

×

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

The Price Action Method

1 × $15.00

The Price Action Method

1 × $15.00 -

×

Profit Freedom Blueprint with High Performance Trading

1 × $5.00

Profit Freedom Blueprint with High Performance Trading

1 × $5.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

The Three Secrets to Trading Momentum Indicators with David Penn

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Three Secrets to Trading Momentum Indicators with David Penn” below:

The Three Secrets to Trading Momentum Indicators with David Penn

Introduction

Momentum indicators are powerful tools in the world of trading. David Penn, a renowned trading expert, sheds light on these invaluable instruments in his guide, “The Three Secrets to Trading Momentum Indicators.” Let’s explore these secrets and how they can transform your trading strategies.

What Are Momentum Indicators?

Momentum indicators measure the speed and change of price movements. They help traders identify the strength of a trend and potential reversal points.

Why Use Momentum Indicators?

Momentum indicators provide insights that are not always visible through price movements alone. They are essential for confirming trends and spotting potential entry and exit points.

Types of Momentum Indicators

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Stochastic Oscillator

Secret #1: Understanding the Underlying Trend

Before using momentum indicators, it’s crucial to understand the underlying trend.

Identifying Trends

Trends can be categorized into:

- Uptrends: Characterized by higher highs and higher lows.

- Downtrends: Characterized by lower highs and lower lows.

- Sideways Trends: Occur when prices move within a horizontal range.

Using Moving Averages

Moving averages smooth out price data to help identify the direction of the trend.

Combining Indicators with Trends

Momentum indicators are more effective when used in conjunction with trend analysis. For instance, in an uptrend, traders should look for buying opportunities when momentum indicators signal strength.

Secret #2: Timing Your Entries and Exits

Proper timing is critical in trading. Momentum indicators can help pinpoint the best moments to enter and exit trades.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements on a scale of 0 to 100. It helps identify overbought and oversold conditions.

Interpreting RSI Values

- Above 70: Overbought conditions, potential sell signal.

- Below 30: Oversold conditions, potential buy signal.

Moving Average Convergence Divergence (MACD)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages.

Using MACD for Entries and Exits

- Signal Line Crossovers: When the MACD line crosses above the signal line, it’s a buy signal. When it crosses below, it’s a sell signal.

- Divergence: When the price moves in the opposite direction of the MACD, it indicates a potential reversal.

Stochastic Oscillator

The stochastic oscillator compares a particular closing price to a range of prices over a certain period.

Using Stochastic for Timing

- Above 80: Indicates overbought conditions.

- Below 20: Indicates oversold conditions.

Secret #3: Managing Risk Effectively

Effective risk management is the cornerstone of successful trading.

Setting Stop-Loss Orders

Stop-loss orders automatically close a position at a predetermined price, limiting potential losses.

How to Set Stop-Loss Orders

Place stop-loss orders based on volatility and the specific momentum indicator signals.

Position Sizing

Determining the correct position size is crucial for managing risk.

Calculating Position Size

Position size should be based on the distance to the stop-loss and the percentage of your account you’re willing to risk.

Combining Secrets for Maximum Results

Integrating these three secrets can significantly enhance your trading performance.

Creating a Trading Plan

A solid trading plan includes:

- Trend Analysis

- Momentum Indicator Signals

- Risk Management Strategies

Continuous Learning and Adaptation

The market is always evolving. Continuously refine your strategies and stay informed about new developments.

Common Mistakes to Avoid

Avoiding common pitfalls can save you from costly mistakes.

Over-Reliance on Indicators

Indicators should complement, not replace, your overall trading strategy.

Ignoring Risk Management

Never underestimate the importance of managing risk.

Emotional Trading

Stick to your plan and avoid making decisions based on emotions.

Practical Examples

Applying these secrets in real trading scenarios can illustrate their effectiveness.

Example 1: Trading with RSI

In an uptrend, wait for the RSI to drop below 30 and then rise above it before entering a buy position.

Example 2: Using MACD for Confirmation

Combine MACD crossovers with trend analysis to confirm entry and exit points.

Conclusion

“The Three Secrets to Trading Momentum Indicators” by David Penn offers invaluable insights into mastering momentum trading. By understanding trends, timing entries and exits, and managing risk effectively, traders can enhance their trading performance and achieve consistent results.

FAQs

1. What is the main purpose of momentum indicators?

Momentum indicators measure the speed and change of price movements, helping traders identify trend strength and potential reversal points.

2. How can RSI be used in trading?

RSI helps identify overbought and oversold conditions, indicating potential entry and exit points based on the speed and change of price movements.

3. What is the significance of MACD crossovers?

MACD crossovers signal potential buy or sell opportunities when the MACD line crosses above or below the signal line.

4. Why is risk management important in trading?

Risk management is crucial for minimizing potential losses and protecting your trading capital, ensuring long-term success.

5. How can traders avoid emotional trading?

Traders can avoid emotional trading by sticking to a well-defined trading plan and using indicators to make informed decisions.

Be the first to review “The Three Secrets to Trading Momentum Indicators with David Penn” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.