-

×

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

The Volatility Edge in Options Trading: New Technical Strategies for Investing in Unstable Markets with Jeff Augen

1 × $6.00

The Volatility Edge in Options Trading: New Technical Strategies for Investing in Unstable Markets with Jeff Augen

1 × $6.00 -

×

Smart Money with Chart Engineers

1 × $7.00

Smart Money with Chart Engineers

1 × $7.00 -

×

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00 -

×

Jarratt Davis Forex Trading Course

1 × $23.00

Jarratt Davis Forex Trading Course

1 × $23.00 -

×

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

Black Edge FX – Professional Forex Trader

1 × $31.00

Black Edge FX – Professional Forex Trader

1 × $31.00 -

×

Claytrader - Options Trading Simplified

1 × $15.00

Claytrader - Options Trading Simplified

1 × $15.00 -

×

Tradingology Complete Options Course with David Vallieres

1 × $6.00

Tradingology Complete Options Course with David Vallieres

1 × $6.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00 -

×

Optionetics Trading Strategies

1 × $5.00

Optionetics Trading Strategies

1 × $5.00 -

×

Mastering Debit Spreads with Vince Vora

1 × $15.00

Mastering Debit Spreads with Vince Vora

1 × $15.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Advanced Fibonacci Course with Major League Trading

1 × $23.00

Advanced Fibonacci Course with Major League Trading

1 × $23.00 -

×

The 10 Year Trading Formula with Todd Mitchell

1 × $62.00

The 10 Year Trading Formula with Todd Mitchell

1 × $62.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Intro to Options Trading with Real Life Trading

1 × $13.00

Intro to Options Trading with Real Life Trading

1 × $13.00 -

×

Profiting From Forex

1 × $15.00

Profiting From Forex

1 × $15.00 -

×

Forex for Profits with Todd Mitchell

1 × $85.00

Forex for Profits with Todd Mitchell

1 × $85.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Gold & Silver Profit System with Bill Poulos

1 × $6.00

Gold & Silver Profit System with Bill Poulos

1 × $6.00 -

×

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00 -

×

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00 -

×

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Price Action Trader Training

1 × $6.00

Price Action Trader Training

1 × $6.00 -

×

Volatility Trading with Euan Sinclair

1 × $6.00

Volatility Trading with Euan Sinclair

1 × $6.00 -

×

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

Pay me in Stock Options with Carol Curtis

1 × $6.00

Pay me in Stock Options with Carol Curtis

1 × $6.00 -

×

Managing Debt for Dummies with John Ventura

1 × $6.00

Managing Debt for Dummies with John Ventura

1 × $6.00 -

×

Trading the Ross Hook (tradingeducators.com)

1 × $6.00

Trading the Ross Hook (tradingeducators.com)

1 × $6.00 -

×

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00 -

×

Four Steps to Trading Economic Indicators

1 × $6.00

Four Steps to Trading Economic Indicators

1 × $6.00 -

×

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

TopTradeTools - Trend Breakout Levels

1 × $15.00

TopTradeTools - Trend Breakout Levels

1 × $15.00 -

×

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Learning Track: Quantitative Approach in Options Trading

1 × $39.00

Learning Track: Quantitative Approach in Options Trading

1 × $39.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

The Full EMA Strategy with King Of Forex

1 × $5.00

The Full EMA Strategy with King Of Forex

1 × $5.00 -

×

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00 -

×

The Sixth Market. The Electronic Investor Revolution with Howard Abell

1 × $6.00

The Sixth Market. The Electronic Investor Revolution with Howard Abell

1 × $6.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

Characteristics and Risks of Standardized Options

1 × $6.00

Characteristics and Risks of Standardized Options

1 × $6.00 -

×

Strategy Factory Workshop

1 × $23.00

Strategy Factory Workshop

1 × $23.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00 -

×

Flux Trigger Pack - Back To The Future Trading

1 × $15.00

Flux Trigger Pack - Back To The Future Trading

1 × $15.00 -

×

The Stock Market Crash of 1929 The End of Prosperity with Brenda Lange

1 × $6.00

The Stock Market Crash of 1929 The End of Prosperity with Brenda Lange

1 × $6.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00 -

×

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

DayTrading Made Simple with William Greenspan

1 × $4.00

DayTrading Made Simple with William Greenspan

1 × $4.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Fundamentals of Algorithmic Trading

1 × $23.00

Fundamentals of Algorithmic Trading

1 × $23.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

Austin Passamonte Package ( Discount 25 % )

1 × $15.00

Austin Passamonte Package ( Discount 25 % )

1 × $15.00 -

×

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Onyx Trade House

1 × $7.00

Onyx Trade House

1 × $7.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

The Best of the Professional Traders Journal: Best Trading Patters Volume I and Volume II with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Best Trading Patters Volume I and Volume II with Larry Connors

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

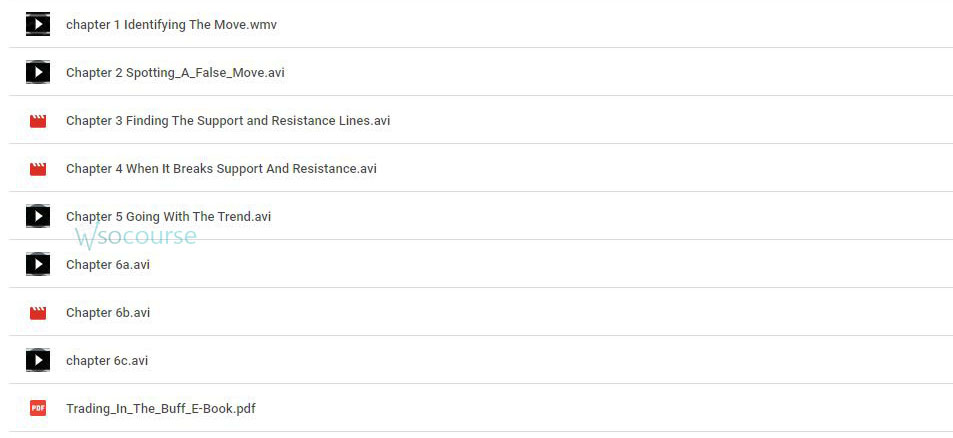

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.