-

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Seasonal Charts for Future Traders with Courtney Smith

1 × $4.00

Seasonal Charts for Future Traders with Courtney Smith

1 × $4.00 -

×

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

The Newsbeat Bandit Program with Mark Melnick - T3 Live

1 × $6.00

The Newsbeat Bandit Program with Mark Melnick - T3 Live

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Option Trading Camp

1 × $15.00

Option Trading Camp

1 × $15.00 -

×

The Next Big Investment Boom with Mark Shipman

1 × $6.00

The Next Big Investment Boom with Mark Shipman

1 × $6.00 -

×

FX Money Mentor Academy with KobenFX

1 × $6.00

FX Money Mentor Academy with KobenFX

1 × $6.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

All in One Forex Course with VintagEducation

1 × $31.00

All in One Forex Course with VintagEducation

1 × $31.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Mind of a Trader with Alpesh Patel

1 × $6.00

Mind of a Trader with Alpesh Patel

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00 -

×

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00 -

×

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Kaizen Pipsology: Forex Mentorship

1 × $8.00

Kaizen Pipsology: Forex Mentorship

1 × $8.00 -

×

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Investing Courses Bundle

1 × $31.00

Investing Courses Bundle

1 × $31.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

Crypto and Blockchain with MasterClass

1 × $6.00

Crypto and Blockchain with MasterClass

1 × $6.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

Intermediate Options Trading Course

1 × $39.00

Intermediate Options Trading Course

1 × $39.00 -

×

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Market Internals & Intraday Timing Webinar

1 × $6.00

Market Internals & Intraday Timing Webinar

1 × $6.00 -

×

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00 -

×

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00 -

×

The Coin FX Academy

1 × $6.00

The Coin FX Academy

1 × $6.00 -

×

DVD Series Trading Course

1 × $15.00

DVD Series Trading Course

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

Complete Course of Astrology with George Bayer

1 × $6.00

Complete Course of Astrology with George Bayer

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00

Online Trading Stocks - Cryptocurrencies & Forex with Set & Forget

1 × $5.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

How to Get Rich Buying Stocks with Ira U.Cobleigh

1 × $6.00

How to Get Rich Buying Stocks with Ira U.Cobleigh

1 × $6.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

Markers System Plus v5 (Oct 2016)

1 × $31.00

Markers System Plus v5 (Oct 2016)

1 × $31.00 -

×

The BFI Trading Course

1 × $6.00

The BFI Trading Course

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

The Bulls Eye System – Ready Aim Fire

1 × $31.00

The Bulls Eye System – Ready Aim Fire

1 × $31.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

Evolution Markets FX – TPOT 2.0

1 × $5.00

Evolution Markets FX – TPOT 2.0

1 × $5.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

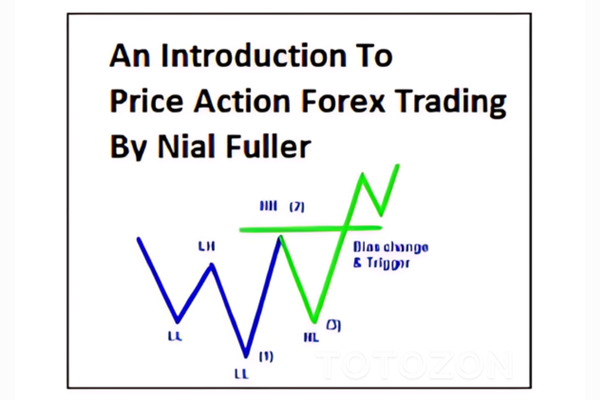

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.