-

×

MarketSharks Forex Training

1 × $31.00

MarketSharks Forex Training

1 × $31.00 -

×

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Big Fish: Mako Momentum Strategy

1 × $23.00

Big Fish: Mako Momentum Strategy

1 × $23.00 -

×

On-Demand Options with Sang Lucci

1 × $6.00

On-Demand Options with Sang Lucci

1 × $6.00 -

×

Professional Trader Training Programme with Jarrat Davis

1 × $39.00

Professional Trader Training Programme with Jarrat Davis

1 × $39.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

S&P Reloaded System with Ryan Jones

1 × $4.00

S&P Reloaded System with Ryan Jones

1 × $4.00 -

×

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

NYC REPLAYS 2018

1 × $6.00

NYC REPLAYS 2018

1 × $6.00 -

×

The Price Action Method

1 × $15.00

The Price Action Method

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

Fig Combo Course

1 × $5.00

Fig Combo Course

1 × $5.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

USDX Trading Course with Jared Martinez - MTI

1 × $6.00

USDX Trading Course with Jared Martinez - MTI

1 × $6.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Trader University with Matthew Kratter

1 × $6.00

Trader University with Matthew Kratter

1 × $6.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

System Trading Unleashed with Better System Trader

1 × $5.00

System Trading Unleashed with Better System Trader

1 × $5.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Chris Swaggy C Williams - The Swag Academy

1 × $6.00

Chris Swaggy C Williams - The Swag Academy

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

Private Ephemeris 1941-1950

1 × $23.00

Private Ephemeris 1941-1950

1 × $23.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

Forex Masterclass - BKForex

1 × $5.00

Forex Masterclass - BKForex

1 × $5.00 -

×

Trading System Mastery with Brian McAboy

1 × $6.00

Trading System Mastery with Brian McAboy

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

Evolution Markets Forex Course - Evolution Markets

1 × $5.00

Evolution Markets Forex Course - Evolution Markets

1 × $5.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00

March 2023 Intensive Live Trading Event with Apteros Trading

1 × $5.00 -

×

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00 -

×

The Science of Trading with Mark Boucher

1 × $6.00

The Science of Trading with Mark Boucher

1 × $6.00 -

×

Self-Study Day Trading Course

1 × $39.00

Self-Study Day Trading Course

1 × $39.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00 -

×

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Hub 4.0 Ebook

1 × $5.00

Trading Hub 4.0 Ebook

1 × $5.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

BalanceTrader II – For Advanced Traders

1 × $6.00

BalanceTrader II – For Advanced Traders

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

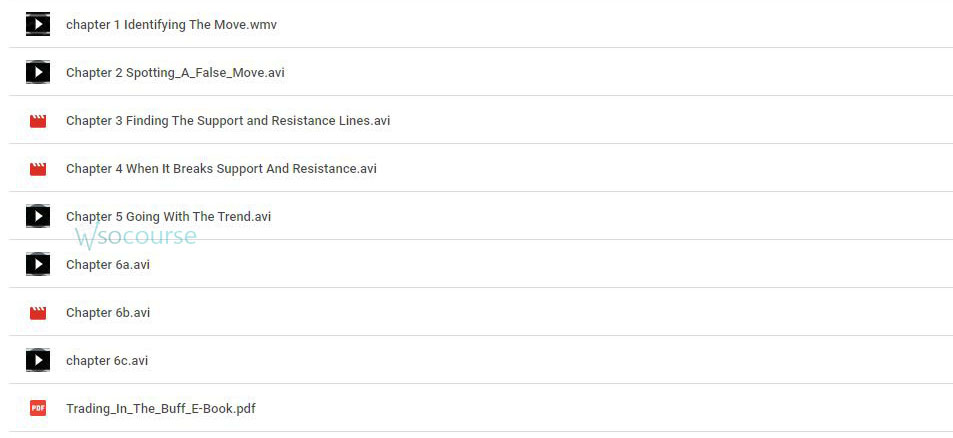

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.