-

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Monster IPO with Trick Trades

1 × $23.00

Monster IPO with Trick Trades

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00 -

×

Trading Pivot Points with Andrew Peters

1 × $6.00

Trading Pivot Points with Andrew Peters

1 × $6.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00 -

×

In Jeremy's Stock Market Brain

1 × $62.00

In Jeremy's Stock Market Brain

1 × $62.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00 -

×

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Romeo’s University of Turtle Soup with Romeo

1 × $6.00

Romeo’s University of Turtle Soup with Romeo

1 × $6.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

Orderflows - The Imbalance Course

1 × $8.00

Orderflows - The Imbalance Course

1 × $8.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

Falcon FX Pro

1 × $31.00

Falcon FX Pro

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

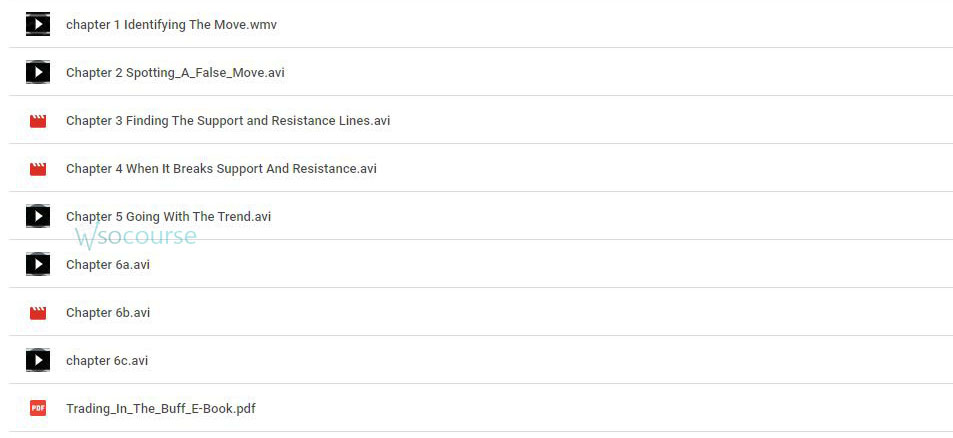

Content Proof: Watch Here!

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.