-

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

BuySide Global Professional (Jul 2018)

1 × $101.00

BuySide Global Professional (Jul 2018)

1 × $101.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Way of the Turtle with Curtis Faith

1 × $6.00

The Way of the Turtle with Curtis Faith

1 × $6.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The WWA Core Concepts Bootcamp

1 × $6.00

The WWA Core Concepts Bootcamp

1 × $6.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

Ninja Order Flow Trader (NOFT)

1 × $39.00

Ninja Order Flow Trader (NOFT)

1 × $39.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

The Sleuth Investor with Avner Mandelman

1 × $6.00

The Sleuth Investor with Avner Mandelman

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Investing Courses Bundle

1 × $31.00

Investing Courses Bundle

1 × $31.00 -

×

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Pattern Trader with Mark Shawzin

1 × $6.00

The Pattern Trader with Mark Shawzin

1 × $6.00 -

×

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Options Income Generating Blueprint

1 × $31.00

Options Income Generating Blueprint

1 × $31.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Offshore Keys (2023)

1 × $5.00

Offshore Keys (2023)

1 × $5.00 -

×

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Haller Theory of Stock Market Trends

1 × $6.00

The Haller Theory of Stock Market Trends

1 × $6.00 -

×

The Truth About Day Trading Stocks with Josh DiPietro

1 × $6.00

The Truth About Day Trading Stocks with Josh DiPietro

1 × $6.00 -

×

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00 -

×

Atlas Forex Trading Course

1 × $5.00

Atlas Forex Trading Course

1 × $5.00 -

×

The Forex Scalper

1 × $5.00

The Forex Scalper

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Super MACD Indicator Package

1 × $15.00

The Super MACD Indicator Package

1 × $15.00 -

×

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Learning KST

1 × $6.00

Learning KST

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00

Ultimate Trading Systems 2.0 with David Jenyns

1 × $6.00 -

×

The Encyclopedia Trading Strategies

1 × $6.00

The Encyclopedia Trading Strategies

1 × $6.00 -

×

Trading Hub 2.0 Book

1 × $6.00

Trading Hub 2.0 Book

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Bollinger Bands Trading Strategies That Work

1 × $6.00

Bollinger Bands Trading Strategies That Work

1 × $6.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00 -

×

The In-N-Out Butterfly

1 × $6.00

The In-N-Out Butterfly

1 × $6.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00 -

×

The World in Your Oyester with Jeff D. Opdyke

1 × $6.00

The World in Your Oyester with Jeff D. Opdyke

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00 -

×

Broken Wing Butterfly Course

1 × $6.00

Broken Wing Butterfly Course

1 × $6.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

The Master Indicator with Elite Money Trader

1 × $5.00

The Master Indicator with Elite Money Trader

1 × $5.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

Vertical Spreads. Strategy Intensive

1 × $4.00

Vertical Spreads. Strategy Intensive

1 × $4.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

The Ultimate Trading Solution

1 × $15.00

The Ultimate Trading Solution

1 × $15.00 -

×

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Extracted MBA with Kelly Vinal

1 × $6.00

The Extracted MBA with Kelly Vinal

1 × $6.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00 -

×

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00 -

×

The Ultimate Trading Program with Tradeciety

1 × $5.00

The Ultimate Trading Program with Tradeciety

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00

Wolfe Wave Indicator for ThinkorSwim

1 × $6.00 -

×

Trading System Mastery with Brian McAboy

1 × $6.00

Trading System Mastery with Brian McAboy

1 × $6.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

August Forex Golem V3

1 × $6.00

August Forex Golem V3

1 × $6.00 -

×

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

How to Day Trade Micro Eminis with Dr Stoxx

1 × $5.00

How to Day Trade Micro Eminis with Dr Stoxx

1 × $5.00 -

×

Opportunity Investing with Gerald Appel

1 × $6.00

Opportunity Investing with Gerald Appel

1 × $6.00 -

×

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00

Strategies for Profiting with Japanese Candlestick Charts

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

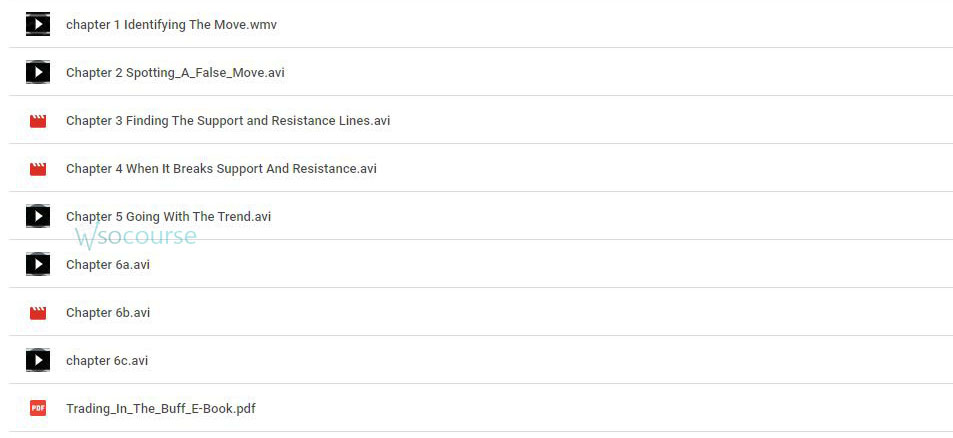

Content Proof: Watch Here!

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.