-

×

Small Account Growth Class – Strategies Course

1 × $23.00

Small Account Growth Class – Strategies Course

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00 -

×

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00 -

×

Objective Evaluation of Indicators with Constance Brown

1 × $6.00

Objective Evaluation of Indicators with Constance Brown

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00 -

×

TIMfundamentals with Timothy Sykes

1 × $5.00

TIMfundamentals with Timothy Sykes

1 × $5.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00 -

×

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

Online Forex University Course

1 × $10.00

Online Forex University Course

1 × $10.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

Redler Ultimate Access

1 × $54.00

Redler Ultimate Access

1 × $54.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Spread Trading Webinar

1 × $6.00

Spread Trading Webinar

1 × $6.00 -

×

Gann’s Secret with Jeanne Long

1 × $4.00

Gann’s Secret with Jeanne Long

1 × $4.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Forex Eye

1 × $5.00

Forex Eye

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Trade Queen Pro with Tamia Johnson

1 × $54.00

Trade Queen Pro with Tamia Johnson

1 × $54.00 -

×

Constellation Software

1 × $85.00

Constellation Software

1 × $85.00 -

×

The Way of the Turtle with Curtis Faith

1 × $6.00

The Way of the Turtle with Curtis Faith

1 × $6.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

Introduction to Amibroker with Howard B.Bandy

1 × $6.00

Introduction to Amibroker with Howard B.Bandy

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

How to Trade Stock Options Course

1 × $6.00

How to Trade Stock Options Course

1 × $6.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00 -

×

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00 -

×

Complete Stockmarket Trading and Forecasting Course

1 × $6.00

Complete Stockmarket Trading and Forecasting Course

1 × $6.00 -

×

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Conquering Stock Market Hype with Allan Campbell

1 × $6.00

Conquering Stock Market Hype with Allan Campbell

1 × $6.00 -

×

Opportunity Investing with Gerald Appel

1 × $6.00

Opportunity Investing with Gerald Appel

1 × $6.00 -

×

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

DayTrading Made Simple with William Greenspan

1 × $4.00

DayTrading Made Simple with William Greenspan

1 × $4.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00 -

×

Market Gems Manual with Barbara J.Simon

1 × $6.00

Market Gems Manual with Barbara J.Simon

1 × $6.00 -

×

Advanced Fibonacci Course with Major League Trading

1 × $23.00

Advanced Fibonacci Course with Major League Trading

1 × $23.00 -

×

LT Gamma Confirmation

1 × $23.00

LT Gamma Confirmation

1 × $23.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Catching Trend Reversals

1 × $6.00

Catching Trend Reversals

1 × $6.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00 -

×

Weekly Credit Spreads for Income

1 × $6.00

Weekly Credit Spreads for Income

1 × $6.00 -

×

Exit Strategies for Stock and Futures with Charles LeBeau

1 × $6.00

Exit Strategies for Stock and Futures with Charles LeBeau

1 × $6.00 -

×

The Guerrilla Online Video Course with Guerrilla Trading

1 × $5.00

The Guerrilla Online Video Course with Guerrilla Trading

1 × $5.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Fig Combo Course

1 × $5.00

Fig Combo Course

1 × $5.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00 -

×

The NDX100 Momo Stock Portfolio Trading System with Backtest Wizard

1 × $6.00

The NDX100 Momo Stock Portfolio Trading System with Backtest Wizard

1 × $6.00 -

×

The Best of the Professional Traders Journal: Day Trading with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Day Trading with Larry Connors

1 × $6.00 -

×

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00 -

×

Harmonic Pattern Detection Indicator

1 × $6.00

Harmonic Pattern Detection Indicator

1 × $6.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

DVD Series Trading Course

1 × $15.00

DVD Series Trading Course

1 × $15.00 -

×

Beginner to Advanced Trader with Mikesh Shah

1 × $6.00

Beginner to Advanced Trader with Mikesh Shah

1 × $6.00 -

×

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00 -

×

Chicago Trading Workshop 2017 with Marketdelta

1 × $23.00

Chicago Trading Workshop 2017 with Marketdelta

1 × $23.00 -

×

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00 -

×

Duration Iron Condors Class: An Income Strategy for All Markets with Don Kaufman

1 × $6.00

Duration Iron Condors Class: An Income Strategy for All Markets with Don Kaufman

1 × $6.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00 -

×

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00 -

×

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Evolution Markets (Full Main Course)

1 × $5.00

Evolution Markets (Full Main Course)

1 × $5.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Trading NQ At The US Open with TradeSmart

1 × $10.00

Trading NQ At The US Open with TradeSmart

1 × $10.00 -

×

Unlearn and Relearn with Market Fluidity

1 × $6.00

Unlearn and Relearn with Market Fluidity

1 × $6.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00 -

×

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Crash Course Special Edition Set with Chris Martenson

1 × $6.00

Crash Course Special Edition Set with Chris Martenson

1 × $6.00 -

×

Mentfx Paid Mentoship (2021)

1 × $5.00

Mentfx Paid Mentoship (2021)

1 × $5.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

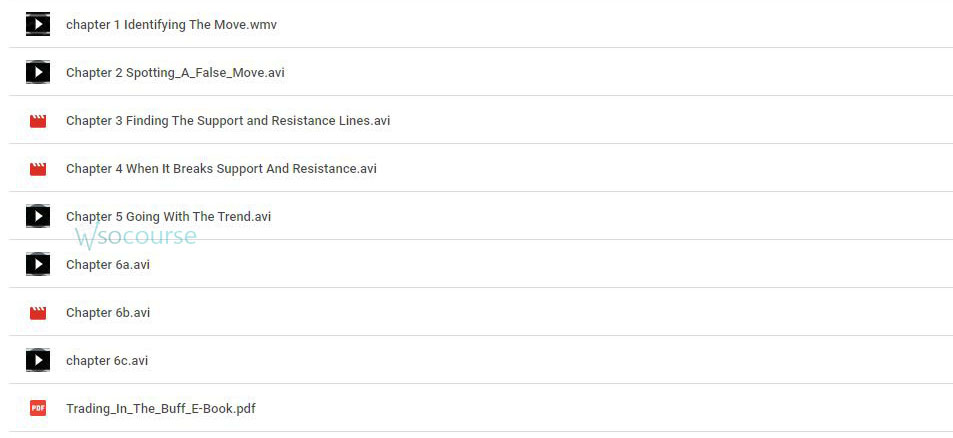

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.