-

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Module 3 – Volume, Trendlines and Indicators

1 × $31.00

Module 3 – Volume, Trendlines and Indicators

1 × $31.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Stocks, Options & Collars with J.L.Lord

1 × $6.00

Stocks, Options & Collars with J.L.Lord

1 × $6.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

LT Gamma Confirmation

1 × $23.00

LT Gamma Confirmation

1 × $23.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

ETF Profit Driver Course with Bill Poulos

1 × $6.00

ETF Profit Driver Course with Bill Poulos

1 × $6.00 -

×

eASCTrend Training Seminar with Richard Kalla by Ablesys

1 × $6.00

eASCTrend Training Seminar with Richard Kalla by Ablesys

1 × $6.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Special Webinars Module 2 with Trader Dante

1 × $6.00

Special Webinars Module 2 with Trader Dante

1 × $6.00 -

×

The 1% Club with Trader Mike

1 × $5.00

The 1% Club with Trader Mike

1 × $5.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Attracting Abundance with EFT by Carol Look

1 × $6.00

Attracting Abundance with EFT by Carol Look

1 × $6.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00 -

×

JJ Dream Team Workshop Training Full Course

1 × $55.00

JJ Dream Team Workshop Training Full Course

1 × $55.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00 -

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00 -

×

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

The Best of the Professional Traders Journal: Best Trading Patters Volume I and Volume II with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Best Trading Patters Volume I and Volume II with Larry Connors

1 × $6.00 -

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

TTM Slingshot & Value Charts Indicators

1 × $6.00

TTM Slingshot & Value Charts Indicators

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Greatest Trading Tools with Michael Parsons

1 × $6.00

Greatest Trading Tools with Michael Parsons

1 × $6.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00 -

×

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

Options for Begginers with Lucas Downey

1 × $6.00

Options for Begginers with Lucas Downey

1 × $6.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

TRADING WITH TIME with Frank Barillaro

1 × $8.00

TRADING WITH TIME with Frank Barillaro

1 × $8.00 -

×

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00 -

×

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00 -

×

Binance Trading Bots Passive Income with Rhodnnie Jessnor Austria

1 × $5.00

Binance Trading Bots Passive Income with Rhodnnie Jessnor Austria

1 × $5.00 -

×

Investment Mathematics with Andrew Adams

1 × $6.00

Investment Mathematics with Andrew Adams

1 × $6.00 -

×

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00 -

×

Trading Online

1 × $6.00

Trading Online

1 × $6.00 -

×

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00 -

×

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00 -

×

Learn To Trade Markets with Karl Richards

1 × $6.00

Learn To Trade Markets with Karl Richards

1 × $6.00 -

×

Scientific Trading Machine with Nicola Delic

1 × $54.00

Scientific Trading Machine with Nicola Delic

1 × $54.00 -

×

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00 -

×

Seasonal Charts for Future Traders with Courtney Smith

1 × $4.00

Seasonal Charts for Future Traders with Courtney Smith

1 × $4.00 -

×

Elite Trader Package

1 × $31.00

Elite Trader Package

1 × $31.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Trading in the Bluff with John Templeton

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

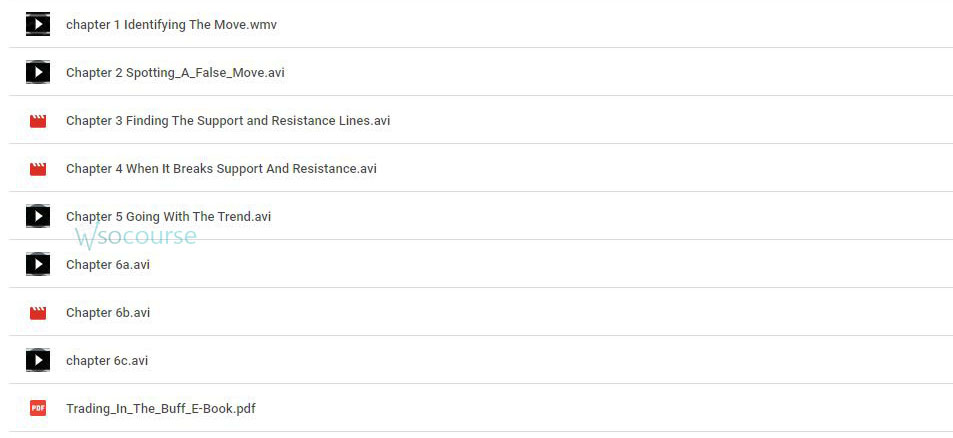

Content Proof: Watch Here!

You may check content proof of “Trading in the Bluff with John Templeton” below:

Trading in the Bluff with John Templeton

Introduction

John Templeton, a pioneer in global investing, offers invaluable insights into the world of trading. In his guide, “Trading in the Bluff,” Templeton shares strategies that combine shrewd market analysis with the art of bluffing. This article delves into the key concepts from Templeton’s guide, providing practical advice for traders looking to enhance their skills and achieve success.

Understanding Bluffing in Trading

What is Bluffing?

Bluffing in trading involves creating a perception of market conditions or intentions that may not necessarily align with reality. It’s a strategic tool used to influence market behavior and gain an advantage.

Why Bluffing Matters

Bluffing can help traders protect their positions, manage market expectations, and create opportunities. When used wisely, it can be a powerful component of a trader’s toolkit.

The Role of Psychology in Trading

Understanding Market Psychology

Market movements are often driven by investor sentiment and psychology. Understanding these factors can help traders anticipate market reactions and make informed decisions.

Emotional Discipline

Maintaining emotional discipline is crucial for effective trading. Successful traders control their emotions, avoid impulsive decisions, and stick to their strategies.

Cognitive Biases

Be aware of cognitive biases such as overconfidence, herd behavior, and loss aversion, which can negatively impact trading decisions.

Key Strategies in “Trading in the Bluff”

Analyzing Market Trends

Templeton emphasizes the importance of thorough market analysis. Traders should analyze historical data, identify trends, and use technical indicators to inform their strategies.

Creating Perception

Bluffing involves creating a perception that influences other market participants. This could involve strategic buying or selling to signal confidence or concern.

Timing the Market

Effective bluffing requires precise timing. Traders must be adept at entering and exiting positions at the right moments to maximize their impact and minimize risk.

Practical Tips for Successful Bluffing

Know Your Limits

Understand your financial limits and risk tolerance. Never risk more than you can afford to lose, and always have a clear exit strategy.

Use Stop-Loss Orders

Implement stop-loss orders to protect your positions from significant losses. This safety net allows you to manage risk while employing bluffing strategies.

Diversify Your Portfolio

Diversification reduces risk by spreading investments across different asset classes and sectors. This helps mitigate the impact of any single investment’s poor performance.

Tools and Techniques for Bluffing

Technical Analysis Tools

Utilize technical analysis tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential bluffing opportunities.

Fundamental Analysis

Combine bluffing with fundamental analysis to ensure your strategies are grounded in solid financial data. This approach enhances the credibility of your bluffs.

Market Indicators

Keep an eye on market indicators like volume, volatility, and sentiment indexes. These indicators can provide insights into market conditions and potential bluffing opportunities.

Case Studies: Successful Bluffing

Case Study 1: Strategic Selling

A trader strategically sells a portion of their holdings in a stock to signal a lack of confidence, causing a temporary dip in the stock price. They then buy back at a lower price, capitalizing on the market’s reaction.

Case Study 2: Market Entry Bluff

A trader makes a large buy order in a relatively illiquid market, creating a perception of strong demand. This attracts other buyers, driving up the price, allowing the initial trader to sell at a profit.

Risks and Challenges of Bluffing

Market Misinterpretation

There’s always a risk that the market will misinterpret your bluff, leading to unintended consequences. Clear and strategic communication is key to effective bluffing.

Ethical Considerations

Bluffing walks a fine line between strategy and manipulation. Traders must consider the ethical implications and ensure their actions comply with market regulations.

Over-Reliance on Bluffing

Relying too heavily on bluffing can be risky. It’s essential to balance bluffing with solid trading fundamentals and not depend solely on deception.

Developing a Bluffing Strategy

Define Your Objectives

Clearly define what you aim to achieve with your bluffing strategy. Whether it’s protecting a position or influencing market perception, having clear objectives is crucial.

Plan and Execute

Develop a detailed plan outlining your bluffing strategy, including entry and exit points, risk management techniques, and contingency plans.

Monitor and Adjust

Continuously monitor the market and your positions. Be prepared to adjust your strategy based on changing market conditions and feedback.

Conclusion

“Trading in the Bluff” by John Templeton provides a unique perspective on trading strategies, blending traditional market analysis with the art of bluffing. By understanding market psychology, using technical and fundamental analysis, and employing strategic bluffing, traders can enhance their performance and achieve greater success. Remember, the key to effective bluffing is balance – combine it with sound trading principles and ethical considerations.

FAQs

1. What is the main concept of bluffing in trading?

Bluffing in trading involves creating a perception that influences market behavior, allowing traders to gain an advantage.

2. How can I manage risks when bluffing?

Use stop-loss orders, diversify your portfolio, and understand your financial limits to manage risks effectively.

3. Why is understanding market psychology important in bluffing?

Market psychology drives investor behavior. Understanding it helps traders anticipate market reactions and make informed decisions.

4. What tools can help with bluffing strategies?

Technical analysis tools, fundamental analysis, and market indicators are essential for identifying and executing bluffing strategies.

5. What are the ethical considerations of bluffing in trading?

Bluffing should be done within the bounds of market regulations and ethical standards, avoiding manipulation and ensuring fair market practices.

Be the first to review “Trading in the Bluff with John Templeton” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.