-

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Mastering Real Estate – Subject To & Lending Deals with Kyle Chisamore

1 × $20.00

Mastering Real Estate – Subject To & Lending Deals with Kyle Chisamore

1 × $20.00

Trading For Busy People with Josias Kere

$29.00 Original price was: $29.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

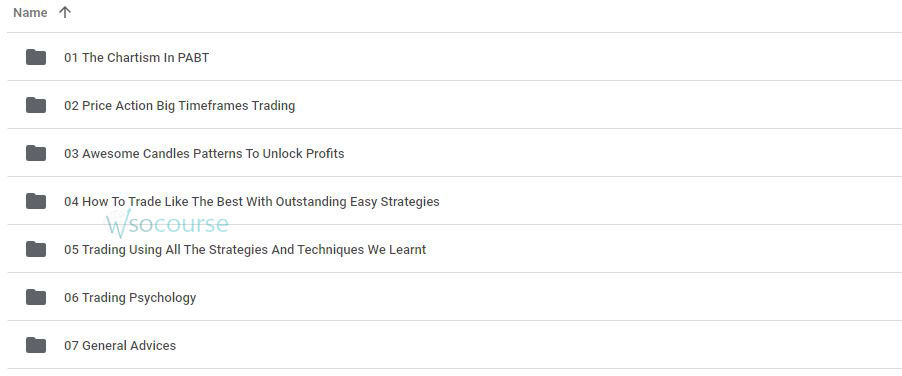

You may check content proof of “Trading For Busy People with Josias Kere” below:

Trading For Busy People with Josias Kere

Introduction to Trading for Busy People

In today’s fast-paced world, finding time to manage investments can be challenging. Josias Kere, a seasoned trader and financial expert, provides valuable insights into how busy individuals can effectively engage in trading without sacrificing their time.

Who is Josias Kere?

A Brief Biography

Josias Kere is a renowned trader and financial strategist known for his practical approaches to trading. With years of experience, he has developed methods tailored to meet the needs of those with tight schedules.

Contributions to the Trading Community

Kere’s strategies focus on simplicity and efficiency, making trading accessible to everyone. His work has helped many busy professionals successfully navigate the complexities of the financial markets.

Understanding the Basics of Trading

What is Trading?

Trading involves buying and selling financial instruments like stocks, bonds, or currencies with the aim of making a profit. It requires knowledge, strategy, and a keen eye for market trends.

Types of Trading

- Day Trading: Buying and selling securities within the same day.

- Swing Trading: Holding positions for several days to weeks.

- Position Trading: Long-term trading based on comprehensive analysis.

The Challenges of Trading for Busy People

Time Constraints

Busy schedules make it difficult to monitor markets constantly. Kere’s strategies address this by focusing on time-efficient trading methods.

Information Overload

The vast amount of information available can be overwhelming. Kere emphasizes the importance of filtering and prioritizing relevant data.

Josias Kere’s Trading Strategies

Simplifying the Process

Kere advocates for simplifying trading processes to make them manageable for busy individuals. This involves focusing on key indicators and avoiding unnecessary complexities.

Leveraging Technology

Using technology effectively can save time and enhance trading efficiency. Kere recommends using trading apps, automated alerts, and other tools to stay updated.

Risk Management

Effective risk management is crucial. Kere emphasizes setting stop-loss orders and diversifying investments to minimize potential losses.

Practical Tips for Busy Traders

Setting Clear Goals

Define your trading objectives. Are you looking for short-term gains or long-term growth? Clear goals help streamline the trading process.

Developing a Routine

Establish a trading routine that fits into your schedule. This could involve dedicating specific times of the day to review and manage your trades.

Utilizing Automated Trading

Automated trading systems can execute trades based on predefined criteria, freeing up your time while ensuring your strategies are implemented.

Tools and Resources

Trading Platforms

Choosing the right trading platform is essential. Kere suggests platforms that offer robust features, user-friendly interfaces, and reliable customer support.

Educational Resources

Continuous learning is key. Utilize online courses, webinars, and books to stay informed about market trends and trading strategies.

Financial News Apps

Stay updated with the latest market news using financial news apps. These apps provide real-time updates and analysis, helping you make informed decisions.

Case Studies

Successful Busy Traders

Kere shares examples of busy professionals who have successfully implemented his strategies. These case studies provide practical insights and inspiration.

Lessons Learned

Analyzing past successes and failures helps refine trading strategies. Kere’s work includes valuable lessons from real-life trading experiences.

Conclusion

Josias Kere’s approach to trading for busy people offers a practical and efficient way to engage in the financial markets. By simplifying processes, leveraging technology, and focusing on key strategies, busy individuals can successfully navigate trading without overwhelming their schedules.

FAQs

1. Who is Josias Kere?

Josias Kere is a renowned trader and financial strategist known for his practical trading methods tailored to busy individuals.

2. What is swing trading?

Swing trading involves holding positions for several days to weeks, allowing traders to capitalize on market fluctuations.

3. How can technology aid in trading?

Technology offers tools like trading apps and automated alerts that help busy traders stay updated and manage their trades efficiently.

4. What is a stop-loss order?

A stop-loss order is a risk management tool that automatically sells a security when it reaches a predetermined price, limiting potential losses.

5. Why is continuous learning important in trading?

The financial markets are constantly evolving, and continuous learning helps traders stay informed about new trends and strategies.

Be the first to review “Trading For Busy People with Josias Kere” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.