-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

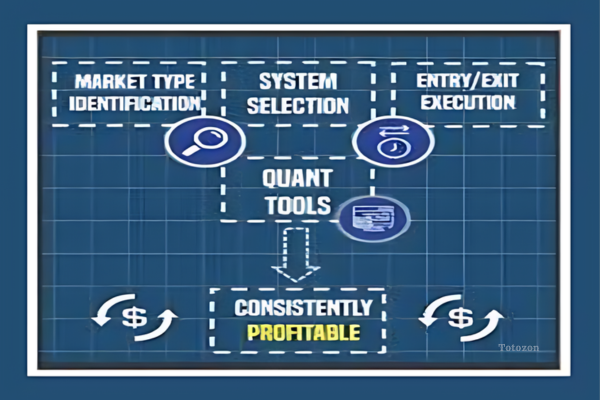

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Swinging For The Fences

1 × $15.00

Swinging For The Fences

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Self-Study Day Trading Course

1 × $39.00

Self-Study Day Trading Course

1 × $39.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The BFI Trading Course

1 × $6.00

The BFI Trading Course

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

The New Technical Trader with Chande Kroll

1 × $6.00

The New Technical Trader with Chande Kroll

1 × $6.00 -

×

W.D.Ganns Astrological Method

1 × $6.00

W.D.Ganns Astrological Method

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

Buy the Fear Sell the Greed

1 × $6.00

Buy the Fear Sell the Greed

1 × $6.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Backtrade Marathon NEW with Real Life Trading

1 × $23.00

Backtrade Marathon NEW with Real Life Trading

1 × $23.00 -

×

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00 -

×

M3-4u Trading System with John Locke

1 × $5.00

M3-4u Trading System with John Locke

1 × $5.00 -

×

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00 -

×

Expectations Investing with Alfred Rappaport

1 × $6.00

Expectations Investing with Alfred Rappaport

1 × $6.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00 -

×

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00 -

×

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

Quantifiable Edges - 3 Course Bundle

1 × $31.00

Quantifiable Edges - 3 Course Bundle

1 × $31.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

Trading Economic Data System with CopperChips

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Economic Data System with CopperChips” below:

Trading Economic Data System with CopperChips

Navigating the complexities of financial markets requires robust tools and strategies. The Trading Economic Data System with CopperChips offers traders a powerful framework for leveraging economic data to make informed trading decisions. This article explores the intricacies of this system, providing valuable insights for both novice and experienced traders.

Introduction to CopperChips

CopperChips is an innovative platform that integrates economic data with advanced trading strategies. It empowers traders to harness the power of economic indicators, ensuring a comprehensive approach to market analysis.

What is CopperChips?

CopperChips is a sophisticated trading platform designed to analyze and utilize economic data for trading purposes. It provides real-time access to a plethora of economic indicators, helping traders make data-driven decisions.

Why Use Economic Data in Trading?

Economic data reflects the underlying health of economies and can significantly impact market movements. By incorporating this data into their strategies, traders can better predict market trends and optimize their trading performance.

The Fundamentals of Economic Data

Key Economic Indicators

Economic indicators are statistical metrics used to gauge economic performance. They include:

- Gross Domestic Product (GDP): Measures the total economic output of a country.

- Inflation Rates: Indicate the rate at which prices for goods and services rise.

- Unemployment Rates: Reflect the percentage of the labor force that is unemployed.

- Interest Rates: Set by central banks, influencing borrowing and spending.

Importance of Economic Indicators

Understanding these indicators helps traders anticipate market movements. For instance, a higher-than-expected GDP growth rate might boost market confidence, leading to a bullish trend.

CopperChips Trading Economic Data System

Integrating Economic Data

CopperChips seamlessly integrates various economic indicators into its trading platform, providing users with real-time data and analysis tools.

Real-Time Data Access

Traders have access to the latest economic data, ensuring they can respond swiftly to market changes.

Advanced Analytical Tools

CopperChips offers a suite of analytical tools that help traders interpret economic data and identify trading opportunities.

Developing Trading Strategies

Using CopperChips, traders can develop robust strategies based on economic data.

Step-by-Step Guide to Strategy Development

- Select Relevant Indicators: Choose the economic indicators most relevant to your trading strategy.

- Analyze Historical Data: Study historical trends and patterns associated with these indicators.

- Set Trading Rules: Define rules for entering and exiting trades based on the economic data.

- Backtest Your Strategy: Use CopperChips to backtest your strategy against historical data to assess its viability.

- Implement and Monitor: Deploy your strategy in the live market and continuously monitor its performance.

Risk Management with CopperChips

Effective risk management is crucial for long-term trading success. CopperChips provides tools to help traders manage risk effectively.

Position Sizing

Determine the size of your trades based on your risk tolerance and account size.

Stop-Loss Orders

Set stop-loss orders to limit potential losses and protect your capital.

Diversification

Diversify your trades across different assets and economic indicators to reduce risk.

Practical Applications of CopperChips

Case Study: Trading GDP Announcements

Consider a trader using CopperChips to trade based on GDP announcements. By analyzing historical GDP data and its impact on the market, the trader can predict potential market movements and position themselves accordingly.

Steps in the Case Study

- Analyze Historical GDP Data: Review past GDP announcements and market reactions.

- Develop a Strategy: Create a trading strategy that leverages GDP data.

- Backtest the Strategy: Test the strategy using CopperChips’ backtesting tools.

- Trade Live: Implement the strategy in the live market during GDP announcements.

- Monitor and Adjust: Continuously monitor the strategy’s performance and make necessary adjustments.

Utilizing Inflation Data

Inflation data can provide valuable insights into market trends. Traders can use CopperChips to analyze inflation rates and develop strategies to capitalize on expected market movements.

Advantages of Using CopperChips

Comprehensive Data Integration

CopperChips integrates a wide range of economic indicators, providing traders with a holistic view of the market.

Real-Time Data and Analysis

Access to real-time data and advanced analytical tools ensures traders can make informed decisions quickly.

Enhanced Trading Strategies

By incorporating economic data into their strategies, traders can improve their market predictions and optimize their trading performance.

Challenges and Considerations

Complexity of Economic Data

Economic data can be complex and difficult to interpret. Traders must invest time in understanding how different indicators impact the market.

Market Volatility

Economic announcements can lead to significant market volatility. Traders must be prepared to manage increased risk during these times.

Conclusion

The Trading Economic Data System with CopperChips offers a powerful approach to trading by integrating comprehensive economic data with advanced analytical tools. By leveraging these resources, traders can enhance their market analysis, develop robust trading strategies, and achieve consistent success. Embrace the potential of CopperChips to navigate the complexities of the financial markets with confidence.

FAQs

What is CopperChips?

CopperChips is a trading platform that integrates economic data with advanced trading strategies to help traders make informed decisions.

Why is economic data important in trading?

Economic data reflects the underlying health of economies and can significantly impact market movements, helping traders predict trends.

How does CopperChips help in developing trading strategies?

CopperChips provides real-time economic data and analytical tools to help traders develop and backtest trading strategies based on economic indicators.

What are some key economic indicators?

Key indicators include GDP, inflation rates, unemployment rates, and interest rates, all of which provide insights into economic performance.

How can traders manage risk using CopperChips?

Traders can manage risk using CopperChips by determining position sizes, setting stop-loss orders, and diversifying their trades.

Be the first to review “Trading Economic Data System with CopperChips” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.