-

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

Forex Trend Line Strategy with Kelvin Lee

1 × $6.00

Forex Trend Line Strategy with Kelvin Lee

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Breakout Trading Systems with Chris Tate

1 × $6.00

Breakout Trading Systems with Chris Tate

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Flex EA Correlated Hedge V1.02

1 × $6.00

Flex EA Correlated Hedge V1.02

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

Managing Debt for Dummies with John Ventura

1 × $6.00

Managing Debt for Dummies with John Ventura

1 × $6.00 -

×

Indicator Companion for Metastock with Martin Pring

1 × $6.00

Indicator Companion for Metastock with Martin Pring

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

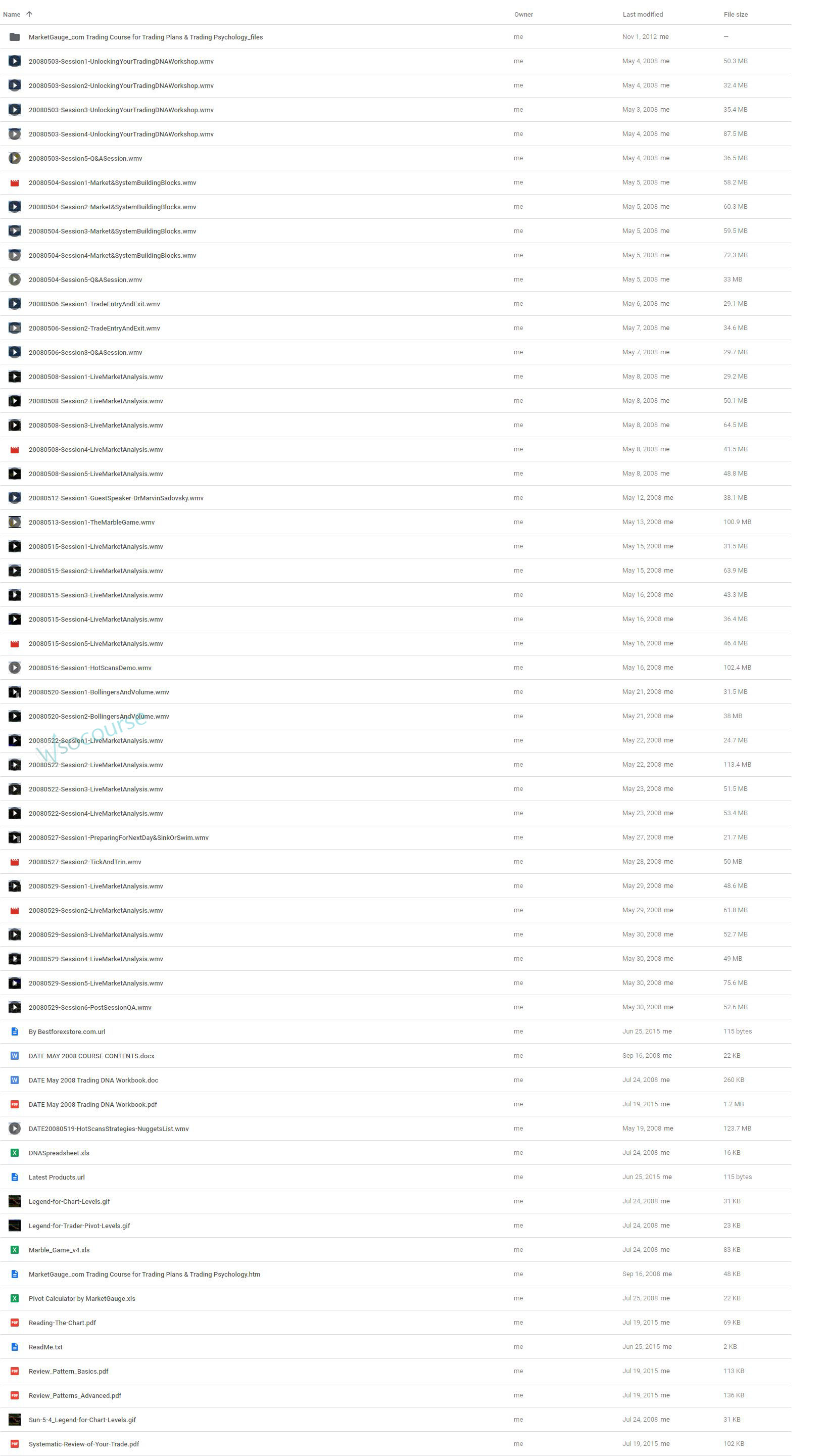

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe” below:

D.A.T.E. Unlock Your Trading DNA Workshop with Geoff Bysshe

Trading can be a complex and challenging endeavor, but with the right tools and insights, it can also be immensely rewarding. Geoff Bysshe’s D.A.T.E. Unlock Your Trading DNA Workshop offers a comprehensive approach to mastering the art of trading. This workshop is designed to help traders understand their unique trading styles and develop strategies that align with their personal strengths. In this article, we’ll delve into the key components of the D.A.T.E. Workshop and how it can transform your trading experience.

Introduction to the D.A.T.E. Workshop

Who is Geoff Bysshe?

Geoff Bysshe is a seasoned trader and co-founder of MarketGauge, a leading provider of financial tools and education. With decades of experience, Bysshe has helped countless traders achieve success through innovative strategies and practical insights.

Purpose of the Workshop

The D.A.T.E. (Discover, Align, Trade, Execute) Workshop aims to help traders unlock their “trading DNA” by discovering their unique strengths and aligning their strategies accordingly. The workshop provides practical tools and techniques to enhance trading performance and achieve consistent results.

Key Components of the D.A.T.E. Workshop

1. Discover

Understanding Your Trading Personality

The first step in the workshop is to discover your trading personality. This involves identifying your strengths, weaknesses, and preferences.

Self-Assessment Tools

Participants use self-assessment tools to gain insights into their trading styles and how they react to different market conditions.

2. Align

Aligning Strategies with Strengths

Once you understand your trading personality, the next step is to align your trading strategies with your strengths.

Customizing Trading Plans

The workshop helps you customize your trading plans to fit your unique style, increasing the likelihood of success.

3. Trade

Implementing Strategies

With a customized plan in place, you’ll learn how to implement your strategies effectively.

Risk Management Techniques

The workshop covers essential risk management techniques to protect your investments and minimize losses.

4. Execute

Consistent Execution

The final step focuses on executing your trades consistently. This involves developing discipline and maintaining focus.

Monitoring and Adjusting

Learn how to monitor your trades and make necessary adjustments to improve performance.

In-Depth Look at Workshop Content

Self-Discovery and Assessment

Personality Tests

Participants take personality tests to identify their natural trading inclinations.

Behavioral Analysis

Analyzing behavior helps in understanding how emotions impact trading decisions.

Strategy Alignment

Strength-Based Strategies

Develop strategies that leverage your strengths for better performance.

Weakness Mitigation

Identify weaknesses and create plans to mitigate their impact on your trading.

Practical Trading Techniques

Technical Analysis

Learn advanced technical analysis techniques to make informed trading decisions.

Fundamental Analysis

Understand the basics of fundamental analysis and how to incorporate it into your trading.

Risk Management and Execution

Setting Stop-Loss Orders

Learn how to set effective stop-loss orders to protect your investments.

Position Sizing

Understand how to size your positions correctly to manage risk effectively.

Continuous Improvement

Performance Reviews

Regularly review your trading performance to identify areas for improvement.

Adaptation and Growth

Stay adaptable and continuously seek growth opportunities to enhance your trading skills.

Benefits of the D.A.T.E. Workshop

Personalized Approach

The workshop’s personalized approach ensures that the strategies you develop are tailored to your unique trading style.

Comprehensive Learning

From self-discovery to strategy implementation, the workshop covers all aspects of trading.

Expert Guidance

Benefit from Geoff Bysshe’s extensive experience and insights.

How to Get the Most Out of the Workshop

Active Participation

Engage actively in all workshop activities and exercises.

Apply Learnings

Implement the strategies and techniques learned in your daily trading activities.

Seek Feedback

Regularly seek feedback to continuously improve your trading performance.

Conclusion

The D.A.T.E. Unlock Your Trading DNA Workshop with Geoff Bysshe offers a transformative approach to trading. By discovering your unique trading personality and aligning your strategies accordingly, you can enhance your trading performance and achieve consistent results. Whether you’re a novice or an experienced trader, this workshop provides valuable insights and practical tools to take your trading to the next level.

FAQs

1. What is the main objective of the D.A.T.E. Workshop?

The main objective is to help traders discover their unique trading personalities and develop strategies that align with their strengths for improved performance.

2. Who can benefit from the D.A.T.E. Workshop?

Both novice and experienced traders can benefit from the workshop, as it offers personalized insights and practical tools for all skill levels.

3. How does the workshop help in risk management?

The workshop covers essential risk management techniques, including setting stop-loss orders and proper position sizing, to protect investments and minimize losses.

4. What makes the D.A.T.E. Workshop unique?

Its personalized approach, comprehensive content, and expert guidance from Geoff Bysshe make it unique and highly effective.

5. How can I apply the learnings from the workshop in my daily trading?

By actively participating in the workshop and applying the strategies and techniques learned, you can improve your trading performance and achieve consistent results.

Be the first to review “D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.