-

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00 -

×

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00 -

×

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

To Hell & Back with Ken Stern

1 × $6.00

To Hell & Back with Ken Stern

1 × $6.00 -

×

The Best Way to Trade Fibonacci On Demand

1 × $15.00

The Best Way to Trade Fibonacci On Demand

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00 -

×

Trading the E-Minis Successfully For A Living 3 Day with Chris Curran with Chris Curran's Live Web Seminar

1 × $6.00

Trading the E-Minis Successfully For A Living 3 Day with Chris Curran with Chris Curran's Live Web Seminar

1 × $6.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

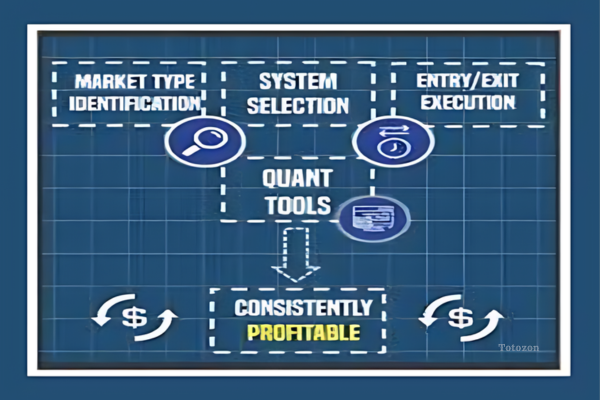

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

What is Strategy with Michael E.Porter

1 × $6.00

What is Strategy with Michael E.Porter

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Time, Price & Pattern with John Crane

1 × $6.00

Time, Price & Pattern with John Crane

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00 -

×

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Learn to Make Money Trading Options

1 × $6.00

Learn to Make Money Trading Options

1 × $6.00 -

×

Day Trading Futures, Stocks, and Crypto

1 × $5.00

Day Trading Futures, Stocks, and Crypto

1 × $5.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Play to Win with David La Piana & Michaela Hayes

1 × $6.00

Play to Win with David La Piana & Michaela Hayes

1 × $6.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

The Stock Rocket Trading System with Dave Wooding

1 × $6.00

The Stock Rocket Trading System with Dave Wooding

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

The Art of Trading Covered Writes [1 video (AVI)]

$15.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Master the Art of Trading Covered Writes

Introduction

Welcome to our comprehensive guide on The Art of Trading Covered Writes [1 video (AVI)]. This article delves into the intricate strategy of covered writes, a popular options trading technique that can enhance your investment portfolio. Whether you’re a novice trader or an experienced investor, understanding covered writes can help you generate consistent income and manage risk effectively.

What are Covered Writes?

Definition

Covered writes, also known as covered calls, involve owning the underlying stock and selling call options against it. This strategy allows you to earn premium income from the options sold while holding the stock.

Importance

- Income Generation: Provides a steady income stream from option premiums.

- Risk Management: Offers downside protection by offsetting some losses with the premium received.

- Flexibility: Can be used in various market conditions to enhance returns.

Core Concepts of Covered Writes

1. Understanding Options

Call Options

A call option gives the holder the right, but not the obligation, to buy the underlying stock at a specified price before the option expires.

Put Options

A put option gives the holder the right to sell the underlying stock at a specified price before the option expires.

2. The Mechanics of Covered Writes

Owning the Stock

To implement a covered write, you must own the underlying stock. This ownership is “covered” by the stock you hold.

Selling Call Options

Sell call options against the stock you own. The premium received from selling the call options is your income.

3. Setting Up a Covered Write

Choosing the Stock

Select a stock that you believe will remain stable or slightly increase in value.

Selecting the Strike Price

Choose a strike price that is slightly above the current market price of the stock.

Determining the Expiration Date

Pick an expiration date that aligns with your investment horizon and market outlook.

Benefits of Covered Writes

Income Generation

Covered writes provide a consistent income stream from the premiums received from selling call options.

Risk Reduction

The premium income received helps to offset any potential losses in the underlying stock, offering a buffer against market volatility.

Market Neutral Strategy

This strategy can be effective in neutral to mildly bullish market conditions, where significant stock price movements are not expected.

Implementing Covered Writes

Step-by-Step Guide

- Select the Stock: Choose a stock that you own or plan to buy.

- Determine the Number of Contracts: Each options contract typically represents 100 shares.

- Choose the Strike Price and Expiration: Decide on a strike price slightly above the current stock price and an appropriate expiration date.

- Sell the Call Options: Execute the trade through your brokerage account.

- Monitor the Position: Keep track of the stock and option prices to make necessary adjustments.

Example Strategy

Bullish Outlook

- Stock Price: $50

- Strike Price: $55

- Premium Received: $2 per share

- Outcome: If the stock price remains below $55, you keep the premium. If it rises above $55, your stock may be called away, but you still keep the premium and profit from the stock appreciation.

Risks and Considerations

Limited Upside Potential

If the stock price rises significantly, your gains are capped at the strike price, plus the premium received.

Downside Risk

While the premium offers some protection, you are still exposed to significant declines in the stock price.

Assignment Risk

There is a risk of being assigned, which means you must sell your stock at the strike price if the option is exercised.

Tools and Resources for Covered Writes

Trading Platforms

Choose a platform that supports options trading and provides robust tools for analyzing and executing covered writes.

Educational Resources

Leverage books, webinars, and online courses to deepen your understanding of covered writes and options trading.

Common Mistakes to Avoid

Ignoring Market Conditions

Avoid implementing covered writes in highly volatile markets without proper risk management strategies.

Overlooking Commissions and Fees

Consider the impact of trading fees on your overall returns.

Failing to Monitor Positions

Regularly monitor your positions to make necessary adjustments and avoid unexpected assignments.

Success Stories

Trader A’s Journey

Trader A used covered writes to generate consistent income and reduce portfolio volatility, achieving a balanced investment strategy.

Trader B’s Experience

Trader B found success by combining covered writes with other options strategies, enhancing overall portfolio performance.

Conclusion

The Art of Trading Covered Writes offers a strategic approach to generating income and managing risk in your investment portfolio. By understanding the mechanics, benefits, and risks of covered writes, you can effectively integrate this strategy into your trading routine. Remember to stay disciplined, continuously educate yourself, and adapt to changing market conditions for consistent success.

![The Art of Trading Covered Writes [1 video (AVI)] Trader analyzing charts and options for covered writes strategy](https://www.totozon.com/wp-content/uploads/2024/07/Students-engaged-in-a-dynamic-options-trading-class-with-charts-and-financial-data-displayed.png)

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “The Art of Trading Covered Writes [1 video (AVI)]” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.